Behind US private-equity investors’ growing appetite for Chinese start-ups

Buyout firms are shifting into venture-type investing to capture the wave of Chinese high-growth start-ups as finding domestic targets gets tougher

When Apax Partners’ billion-dollar Apax Digital fund last month led the US$60 million latest round of venture funding for five-year-old SoYoung Technology Co, a Beijing-based plastic surgery social network, it was the latest example of US private-equity investors’ voracious appetite for early-stage Chinese companies.

Investment in China’s fast-growing technology sector is at its highest level in years. Buyout funds that typically take publicly listed companies private, are looking to invest billions in young start-ups such as SoYoung.

Apax, a private-equity giant with offices in New York and London, was known over the past 40 years for buying out listed companies in tech and health care. It is now expanding into new territory, betting on edgy fledgling Chinese businesses looking for investors.

Another investor in SoYoung’s latest financing, CDH Investments, also started as a private-equity firm in 2002. The firm branched out into venture investing in 2015.

Both Apax and CDH have joined SoYoung’s other backers – MatrixPartners China and Trustbridge Partners – veteran venture-capital funds that have extensive experience in investing in Chinese start-ups.

These buyout firms are dipping their toes into venture-type investing to capture the wave of Chinese high-growth start-ups as finding domestic buyout targets becomes more challenging. A near doubling in the value of highly esteemed stock markets such as the S&P 500 in the past five years has made investment expensive.

“China has the capacity to absorb innovations from VC-funded companies,” said Erik Gordon, professor at the Ross School of Business at the University of Michigan, focusing on private equity and venture capital investing. “Innovators that face powerful and entrenched incumbents in the US and Europe may have an open field in China.”

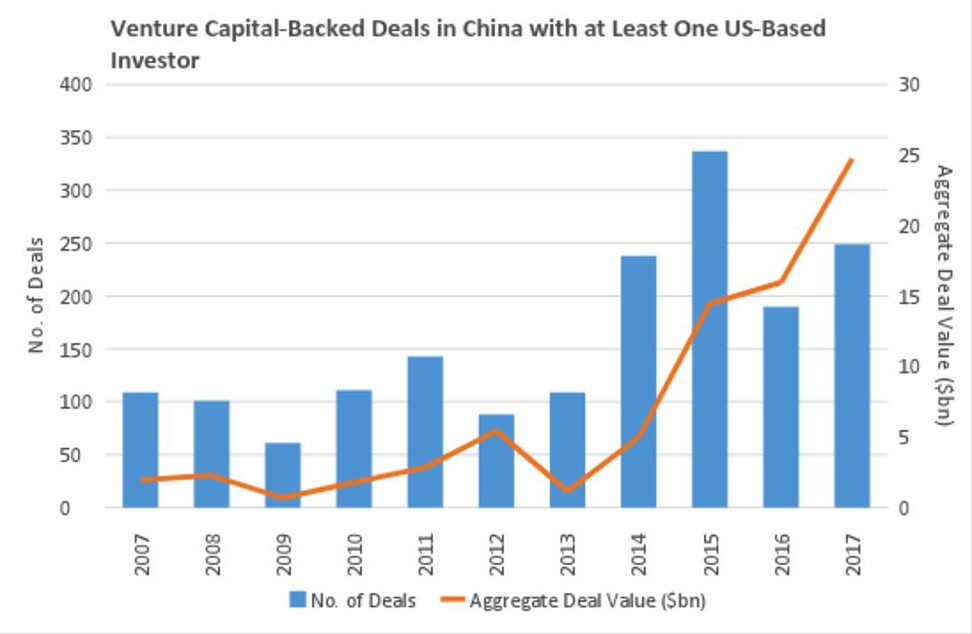

Venture-capital investment into Chinese companies with at least one US investor reached a decade high last year at US$24.7 billion, up from US$1.9 billion in 2007, according to Preqin, a London-based research firm that globally tracks private-equity and venture-capital investment.

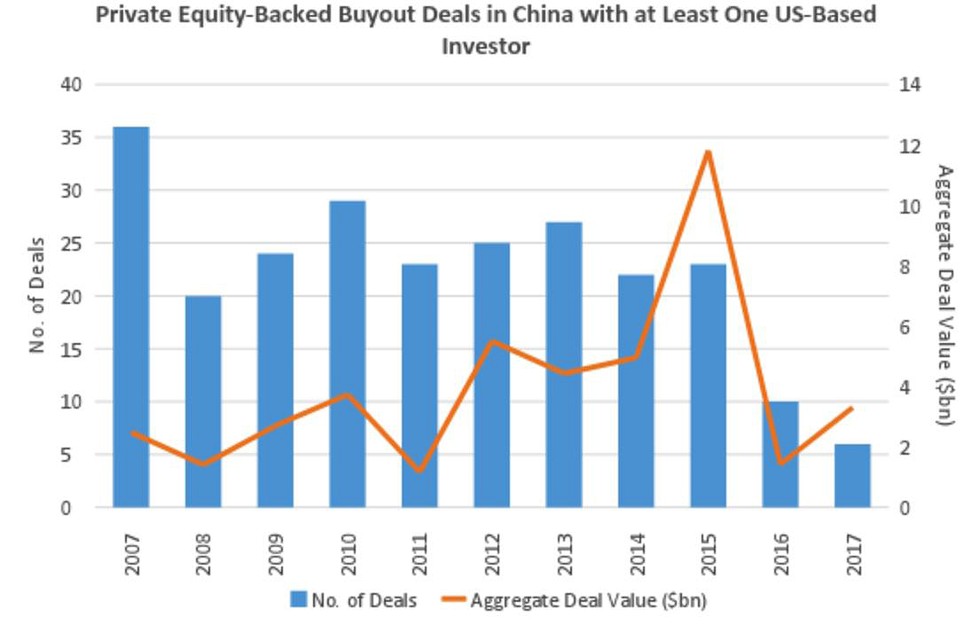

In comparison, buyout deals for more mature Chinese companies that also included at least one US investor were at US$3.3 billion last year, dropping from a 10-year peak of US$11.8 billion in 2015, Preqin data show.

The bifurcation marks a shift among US funds that are increasingly drawn to more early-stage investments.

Gordon cautions funds that are investing in start-ups “will need people located in China who can bridge the US venture capital and the Chinese entrepreneurial cultures.”

That gives a leg up to firms that have invested globally over the years.

Apax, as a private-equity investor, has a long history in China.

Back in 2010, Apax made a high-profile bet on China’s largest real-estate web portal, Fang Holdings Limited, formerly SouFun Holdings Limited. Apax bought a 19 per cent stake in the company, alongside private-equity firm General Atlantic. By then, SouFun was already an 11-year-old company listed on the New York Stock Exchange.

Its other investments, in financial services provider Guotai Junan Securities Co Limited and buffet restaurant chain Golden Jaguar, both followed its flagship buyout strategy in mature industries.

In 2017 alone, Apax invested US$400 million in Chinese companies, including its latest capital infusion in SoYoung.

SoYoung CEO Jin Xing on Wednesday called Apax “the ideal partner” for the plastic surgery social network’s move into its next phase of growth. After three previous rounds of funding, SoYoung is seeking more capital to increase its user base and expand geographically.

Jin highlighted the investor’s “extensive track record in digital marketplaces, experience in health care investment” and its “leading Chinese market presence”.

“China has plenty of capital. US investors aren’t necessarily filling the need for capital,” Gordon said. “The advantage is more on the expertise side.”

As start-ups mature, investors with a global private-equity background may also have the upper hand because they know how to continue to develop businesses, he said.