‘Nude selfies for loans’ scandal sheds light on China’s rampant underground banking

Scandal highlights murky world of loan sharks, nation’s underdeveloped financial system and absence of proper student loans, say analysts

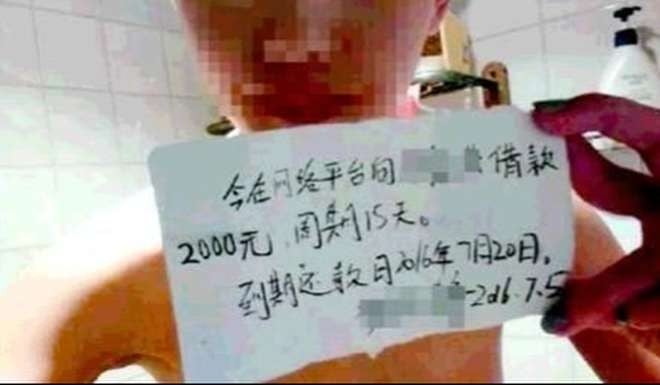

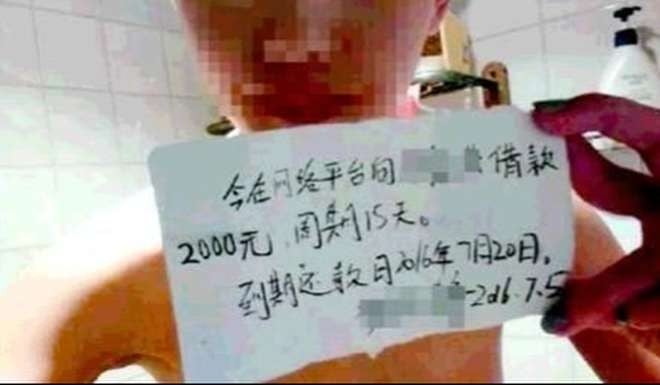

Details have been revealed of more than 100 more cases of young women college students in China who were forced to hand over naked selfies to ensure they would pay money back to loan sharks.

The China Youth Daily said it had found nude pictures and intimate videos of 167 young women, mainly aged 19 to 23 and from across the country.

At least 10 gigabytes of the material has been leaked online to internet users, along with the women’s contact details and relatives’ addresses, according to the newspaper report.

The scandal sheds lights on the widespread use of “underground banking” in Chinese society, increasingly helped by internet technologies.

Students, blue-collar workers and rural residents seldom have credit records in the reference centre of China’s central bank, a system that registers residents’ credit information and can be viewed by the public online, so cannot borrow money from banks or traditional financial institutions. More than 500 million of China’s population is estimated to be in this group.

They become easy targets of peer-to-peer (P2P) lending platforms and online loan sharks, as they usually have low risk awareness, are willing to accept high interest rates can be dealt with outside the law if they default on the loan.

Having long been ignored by banks and traditional financial institutions as not being “good-quality clients”, some are willing to risk much to get quick cash as they have no collateral.

Similar cases have previously made headlines across Chinese media, stirring debate about unscrupulous moneylenders, financial pressures on students and whether the women were right to hand over their pictures. The cases could run into the thousands.

Analysts also said the cases were indicative of China’s rising consumerism, underdeveloped financial system and the absence of a proper student loan system.

Growing demand for loans cannot be satisfied by established banks and credit firms, pushing people needing cash to family and friends for credit or to peer-to-peer loan services and online money lenders, according to analysts.

Zhang Jun, the chief executive of P2P lending platform Pai Pai Dai, said there were almost 500 million people in China without a credit card who were yet to be covered by traditional financial services, the National Business Daily reported.

An executive with another P2P lending firm told the South China Morning Post that young Chinese consumers, who have little real assets to offer as collateral, are the main customers of online credit, which is often granted within a few hours and requires little paperwork.

The students caught up in the scandal were also attracted by the speed of borrowing money if they supplied compromising pictures.

“I got 5,000 yuan [HK$5,550] in loans in less than three minutes after my submission of nude selfies and videos of myself to the lender,” the China Youth Daily quoted one woman as saying.

The interest rate of her loan was 27 per cent a month, according to the newspaper.