China to keep opening up, leaders tell multinational executives at Fortune Global Forum

Globalisation has been most important driver for global economic growth, vice-premier says

Chinese leaders have sought to reassure the international community that China is opening its economy to overseas investors as the country grapples with accusations of forced technology transfers and limited market access.

The assurances also come as global investors are watching how China handles slowing growth and the challenges raised by interest rate rises and potential tax cuts in the United States.

Addressing the Fortune Global Forum in Guangzhou on Wednesday, Vice-Premier Wang Yang said rising protectionism and unilateralism were posing challenges to globalisation but “we should continue pushing for convenient and free trade”.

“The revolution in the tech and industry fields, the digital and shared economy, is reshaping the global economy … China’s future will be innovation driven,” Wang said at the forum attended by executives from 152 of the world’s biggest multinational companies. “As long as we break the barriers in the system, we will unlock enormous potential.”

He said China was working on a timetable to further open up key industries, including financial services and electric cars.

Chinese President Xi Jinping sent a letter of greeting to the forum in which he stressed China would keep its door open and welcome foreign investment.

“The door of opening up for China will not be shut. It will be further opened up. And the business environment will become more inclusive, transparent, and regulated,” Xi said in the letter.

“China will continue to develop global partnerships, expand common interests with other countries, and make trade and investment free and convenient, pushing economic globalisation to be more open, tolerant, inclusive, balanced, and mutually beneficial.”

But in a panel discussion on Wednesday afternoon, former US Treasury secretary Henry Paulson said China needed to take bolder steps to achieve real openness.

“China said it would open up, but I would say it is still [in] its early days,” he said.

Paulson said one example was the financial sector, where foreign players were still only allowed to own 51 per cent of Chinese securities firms, fund managers and futures companies, caps that will be scrapped in three years’ time.

He also questioned why China would try to establish “world-class capital markets” when it was not attracting world-class investors and bankers.

In terms of the Sino-US relationship, he said he was concerned that the two countries had not found a common goal. China and the US “need to gather more momentum to work together, particularly on the economic field”, he said.

The assurances from the Chinese leadership come after sources said last month that talks over an investment treaty between China and the European Union were being hampered because Beijing wanted many sectors to be exempt from the pact. The EU was disappointed at the slow pace that the financial services sector was being opened up, sources said.

The US is also investigating Chinese regulations that force US companies operating in China to transfer technology to local business partners.

On top of that, China is grappling with the challenges of a growing debt pile, unsustainable infrastructure investment and overcapacity.

Nevertheless, China’s economic growth has been resilient, easily hitting the 6.5 per cent target so far this year. But a US Senate vote for tax cuts on the weekend has raised concerns of a new round of capital outflows from China.

AXA Investment Managers senior economist Aidan Yao said that if the tax package was rolled out and rejuvenated the reflationary trade of the US dollar, “then we could see capital exit from the emerging markets, including China, back to the US – making it more difficult for China to carry out internal reform”.

Yao said that some industries were not fully liberalised for foreign investors, “while some foreign firms are directly competing with state enterprises that enjoy preferred policy and resources”. “The advantage, however, is the still fast growth, huge market and rising middle class,” he said.

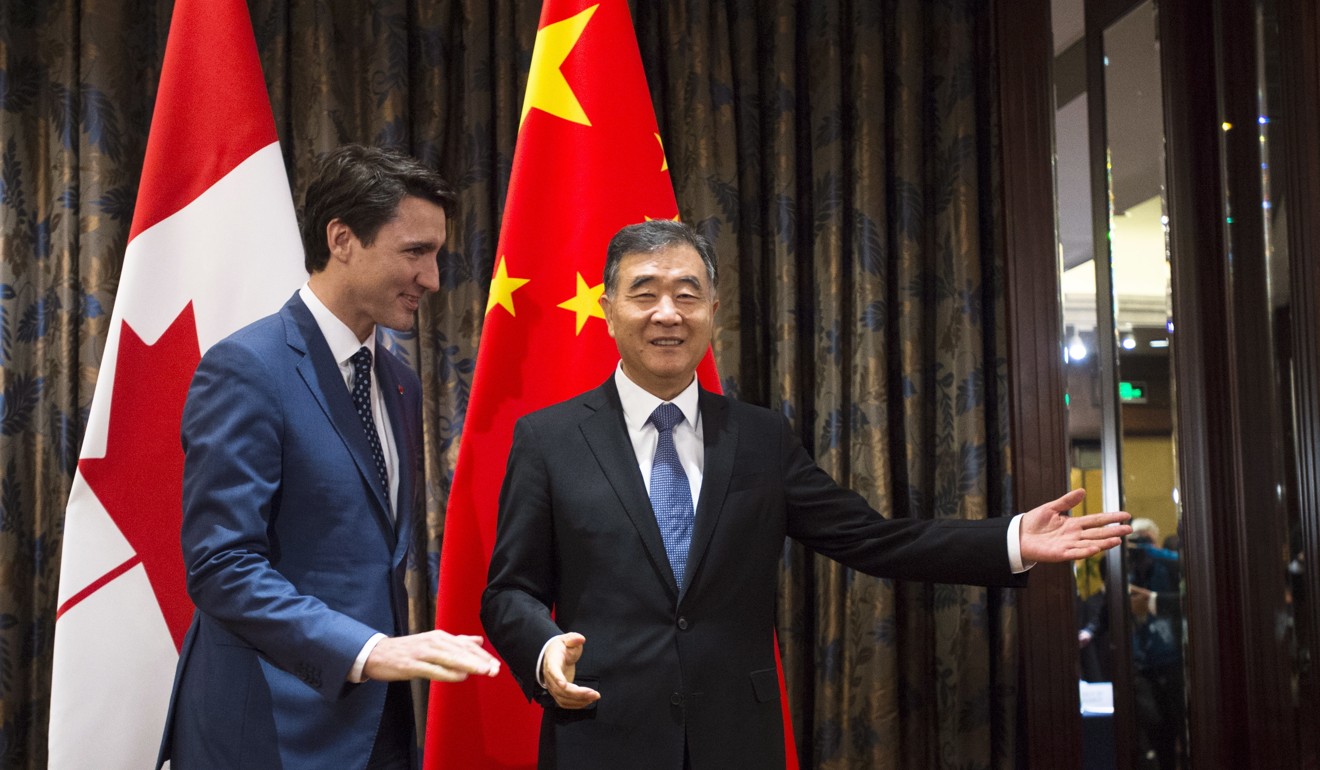

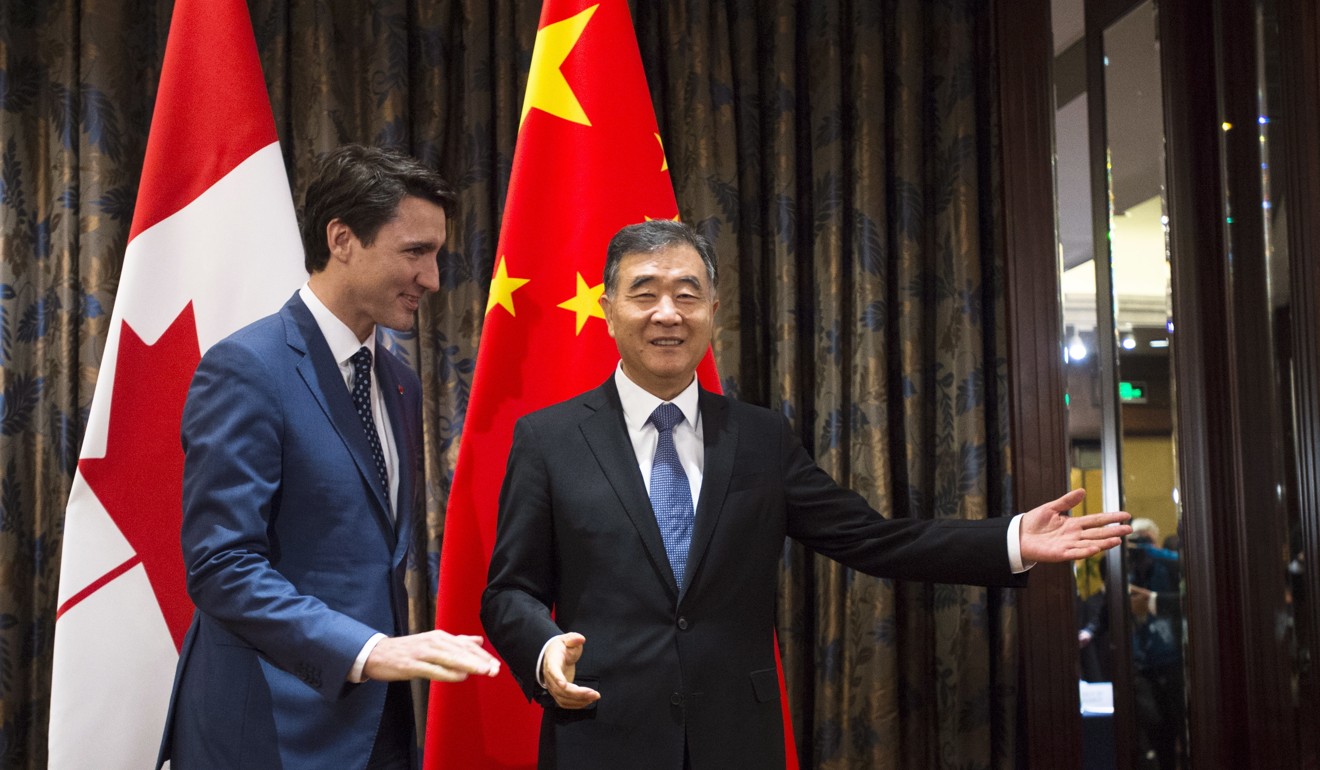

Also attending the forum, Canadian Prime Minister Justin Trudeau said China was the future, blessed with a rapidly rising middle class as it transformed itself into an innovation powerhouse.

“China and Canada share the belief that opening and collaboration will be the right, and only way [ahead],” Trudeau said.

Alibaba executive chairman Jack Ma said several factors gave him strong confidence in the Chinese economy: the stability of the political system – secured by China’s single-party rule, a safe society, a wide and deepening market, and a commitment to opening up and innovation.

Alibaba owns the South China Morning Post.