US galleries, Chinese artists share rare trade war ‘win’ after being spared from tariffs

Threatened duty could have destroyed a thriving avenue of cultural exchange between the two countries, while hurting US businesses the most

When Daniel Chen, director of a New York-based gallery of Chinese contemporary art, heard the news that a tariff of between 10 and 25 per cent could be levied on artworks imported to the United States from China, there was one central question on his mind: “How are we going to survive?”

Over in Los Angeles, Kim Martindale, producer of the LA Art Show, thought about what the loss of Chinese art would mean for his global art show, which draws 70,000 visitors from the US and abroad each year.

In Beijing, Chris Reynolds began drawing up contingency plans for pulling his gallery out of art fairs and collaborations already scheduled in the US, in case the threatened tariff was enacted by the US government.

By the end of a public comments period in August, dozens of professionals from throughout the US-China art world had voiced their opposition to the tariffs, which would have affected a wide range of art produced in China including sculptures, paintings, prints and drawings.

Through the public hearing and an online government portal, they pushed back, many saying the artwork tariff would hurt US businesses, not Chinese.

When the latest round of anti-China trade tariffs went into effect on US$200 billion in imports last Monday, artworks were not among the almost 6,000 items hit with a 10 per cent duty, rising to 25 per cent on January 1, 2019.

The omission prevented the US$400 million market for Chinese art in the US coming to a screeching halt.

Paid up front for art entering the country on consignment, the tariffs would have imperilled China-focused US galleries and forced the relocation of auctions of Chinese arts, while probably giving an added boost to China as an ascendant top player in the US$64 billion global art market, according to an Art Basel and UBS report figure.

“We were talking about a possible 25 per cent upfront tariff on artwork made in China – that adds a hefty expense to every single exhibition that we would be doing,” said Chen of Chambers Fine Art in New York, noting that in a global art market, where artists’ work is available in other countries and online, his gallery would not have been able to pass this cost onto buyers, who would simply move to another market. “It just would not work as a business model.”

Chen said the winners and losers were clear in the proposed scenario: “The market would just leave the US. You’re hurting the US-based business and you’re hurting a US customer.”

While the proposed tariffs would have affected different swathes of the art market coming from China, from hand-painted Van Gogh replicas to antiquities, they cast a spotlight on contemporary art, a rare field in which the US$7.1 billion in overall global sales of Chinese art are not dominated by mainland China.

Instead, in this field, American galleries, art fairs and museums play a key role in offering Chinese art an international platform and providing an access point for global and domestic buyers to discover emerging Chinese artists.

The exchange rate

Although it is a niche field, American interest in Chinese contemporary art has been growing in recent years. The trend is seen in greater representation of Chinese artists in galleries not exclusively focused on the field and in collections and exhibitions of American institutions, such as the Guggenheim’s headlining show “Art and China after 1989: Theatre of the World”, which opened last year.

“I’ve seen extraordinary changes in the reception of Chinese contemporary art in the United States,” said Eli Klein, who runs an eponymous gallery of Chinese contemporary art in New York, referring to the past decade. “There have been countless shows at major museums and at university level focused solely on Chinese artists.

“In the past, many themed museum shows were devoid of representation from China.”

Galleries play an important role in how the American art world engages with China’s evolving contemporary art scene.

Klein said his gallery had facilitated loans of artwork to more than 100 institutions worldwide in the past 10 years, and helped arrange numerous connections with Chinese contemporary artists.

These kinds of connections would have suffered under tariffs. Galleries struggling under the burden of paying 10 or 25 per cent upfront on any piece of artwork brought in would have been pressed to sell rather than loan work.

“Some exhibitions wouldn’t happen, on so many levels it would have been detrimental,” said Chen of Chambers Fine Art, noting that the tariffs would also have reduced the ability of galleries like his to find and introduce emerging artists without a proven sales record to the US.

That would run counter to what has been a growing avenue of cultural exchange.

“US audiences are just gaining more knowledge that there are many more artists than they thought,” Chen said. “People want to know what is happening with young artists.”

That interest from the US and overseas is borne out in the data available from auction houses. Contemporary art totalled US$386 million in international auction sales in 2017, around US$130 million more than in mainland China auctions, according to a joint survey by Artnet and the China Association of Auctioneers. That stands in comparison with other fields like antiquities, which are dominated by mainland sales.

Tariff-generated disruption would also have caused a downward push in the US market just as the contemporary art market in mainland China is experiencing rapid growth. Potentially, this could have further shifted the bulk of the market to the East, where a trade in contemporary Chinese art has already long thrived in Hong Kong.

“In mainland China we are definitely seeing this mega-trend, this huge wave of new collectors getting into contemporary mainland Chinese art,” said Reynolds, of INK Studio in Beijing.

He believes the value of sales of contemporary Chinese art from private galleries and auction houses in mainland China has already surpassed that of overseas.

A world commodity

Despite the rapidly growing mainland Chinese market for contemporary art, exposure in the US art scene is still a rite of passage for artists looking to build an international reputation. It is another facet of cultural exchange which could have been disrupted by trade.

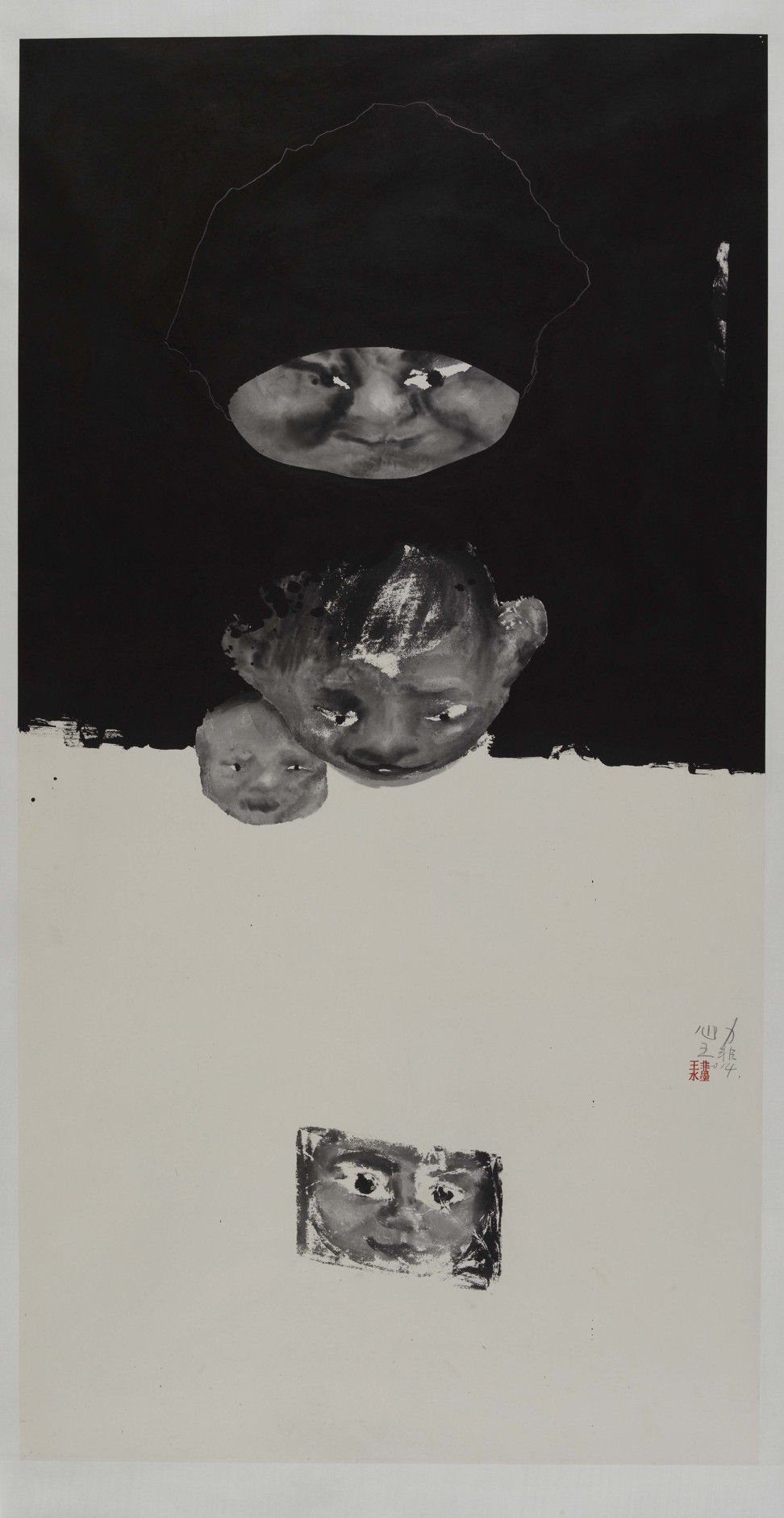

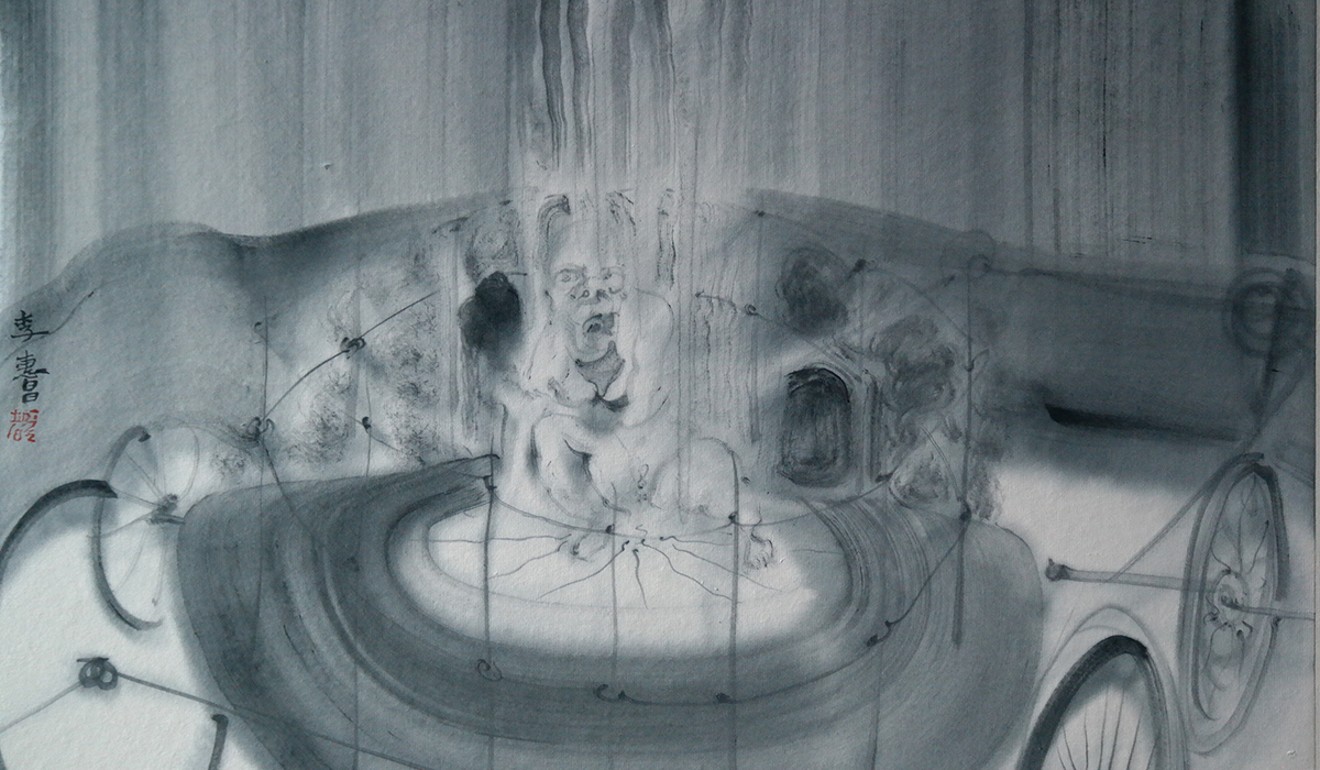

For Beijing-based artist and China’s Central Academy of Fine Arts lecturer Ye Funa, these international experiences in the US and elsewhere are critical.

“Every artist needs to be an international artist, especially in our generation,” the 31-year-old said. “We are all on the same platform and share so much knowledge and resources, so it’s important to show in the US.”

For Ye, who shows her photography at Eli Klein Gallery, trips to the US have not only involved exhibiting. She used one visit to teach a workshop for University of Wisconsin students and was impressed by their knowledge of contemporary Chinese art.

“It all works together; you cannot actually separate artists by nationality,” she said.

That mentality is echoed by Kim Martindale of the LA Art Show.

“Art is something people have been able to develop as a world-based commodity,” he said, noting that cultural exchanges like global art fairs are continuing to grow in number. “There’s never been as much interest around the world in art.”

This global ethos is a key part of the annual LA Art Show. Martindale said he has strived to establish relationships with Chinese galleries to give the shows’ Los Angeles visitors access to that art.

These partnerships would probably have come to an end if artworks had been included in the latest round of tariffs, as a result of Chinese galleries and government-sponsored exhibitions putting their plans to join the January show on hold.

“Many of these [galleries] had been coming to this show for years and slowly building, and we had said, ‘We believe we can help you build a market, so let’s do this together,’” he said. “If you then have a governmental issue disrupt this process, it’s difficult.”

As soon as the news broke last month that the tariffs were not going to be implemented, everything changed, Martindale said.

“Immediately we started to put things back in motion.”