Will Hong Kong’s Starter Homes scheme help young families get on property ladder or fatten the pockets of developers?

In the first of a three-part series on Hong Kong leader Carrie Lam’s much anticipated maiden policy speech due to be delivered next Wednesday, young families and housing experts in the city give their verdict on plans for a new subsidised flats scheme to help middle-income households own a home

Yuen Yuk-ting had her life planned out at 26 years old: she would open a bank account with her boyfriend, spend the next four years saving HK$1 million for a down payment on a 400 sq ft flat in Hong Kong, and then get married at 30.

That dream was thrown off track however when she found out she was pregnant last September.

“Having a baby was of course the greatest thing to happen to us, but at the same time, buying a flat just became a lot harder than it already was,” Yuen, now 28, said.

She rents a 270 sq ft flat in Chai Wan for HK$10,300 a month, living with her husband, her eight-month-old daughter, and her mother-in-law and brother-in-law who sleep on their living room sofa.

The family have a combined household income of more than HK$52,000, which means they do not qualify to buy one of the heavily discounted flats under the government’s existing subsidised housing scheme. But neither do they earn enough to afford a flat in the city’s red-hot private property market.

Yuen’s plight is typical of that seen in middle-class Hong Kong families, many of whom have fallen through the cracks and failed to get on the housing ladder as property prices have spiralled upwards, far outpacing gains in wages in the city.

Watch: can the government work with private developers to ease Hong Kong’s housing crunch?

But a new government-subsidised property scheme to help first-time homebuyers is looking to fill that gaping hole.

The Starter Homes scheme, an election pledge by Hong Kong leader Carrie Lam Cheng Yuet-ngor, will be formally announced in her maiden policy address next week.

Lam has said the scheme will target young families whose income exceeds HK$52,000 and who have not been able to purchase any property before. If single-person households are also eligible, it would presumably mean individuals with incomes exceeding HK$26,000 will be able to apply.

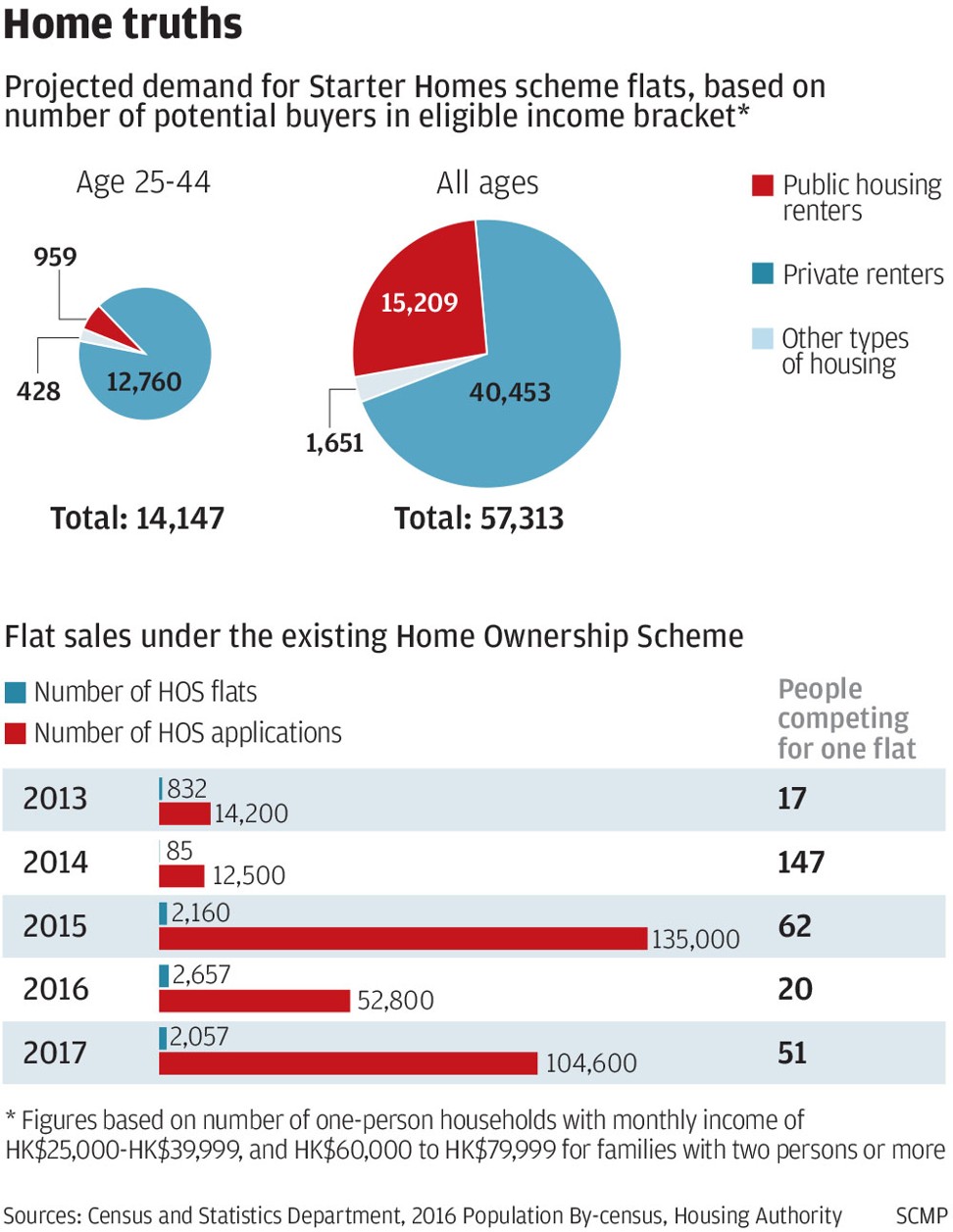

The demand for such flats will most likely far outstrip supply.

According to census figures last year, of those who rent, some 40,717 households earned between HK$60,000 and HK$79,999 a month. There were 16,596 individual tenants who earned between HK$25,000 and HK$39,999.

The actual number of those eligible is likely to be higher. If only including those aged between 25 and 44, just 14,147 are likely to be eligible.

What sets the new scheme apart from current subsidised homes is that it will not build on land earmarked for public housing, a sector already struggling to deal with a backlog of more than 270,000 applicants, Lam said earlier. She did not rule out retracting plots from the government’s land sale programme either.

A number of private developers have already stepped forward saying they are willing to collaborate with the government to help first-time homebuyers.

Sun Hung Kai Properties, Hong Kong’s largest developer by value, said it has identified three possible sites suitable for building affordable housing.

Wheelock Properties said it has submitted applications to Hong Kong’s town planning authority to turn its farmland in Tai Po into a 2,705-flat mixed private-public housing development that will include 1,005 starter homes.

Developers could build “mixed-income” housing projects, where a portion of flats would be reserved as subsidised and the rest sold at market prices on the same plot of land. Such projects would be the first of their kind in Hong Kong. There are a number in New York and London.

Watch: Why is Hong Kong housing so expensive?

The launch of the new scheme is part of a number of policies, including a new task force dedicated to ramping up land supply, that Lam’s government is spearheading to ease the housing crunch.

But there are still a number of uncertainties as to how the scheme will be implemented.

With property prices at historic highs, having increased by 430 per cent since 2003, many have called for the government scheme to be priced according to affordability, instead of following the existing mechanism based on market prices.

Lawrence Poon Wing-cheung, a senior lecturer on housing policies at City University, said that would be the only way for residents to “live in peace” and not “endlessly chase runaway property prices”.

Poon suggested pricing flats according to construction cost or setting a fixed percentage of families’ monthly incomes aside to pay mortgage loans based on what they could afford.

That could slash prices down to levels roughly 50 per cent of current market prices, which would be much cheaper than flats under the existing Home Ownership Scheme which sell at a 30 per cent discount.

“The Starter Homes scheme can at least ensure we will not be kicked out by private landlords,” said Justin Yu Wing-chung, a surveyor in his early 30s who lives with his wife.

Expensive property prices forced the couple to put baby plans on hold and live further outside the city in Tuen Mun, from where it takes them more than an hour and a half to commute to work.

Yu’s worry is that the scheme might set strict limits on reselling flats, only allowing buyers to sell the flats back to the government at their original prices, perhaps plus annual inflation rates.

But Poon doubted the government would depart from a market-based pricing mechanism, given that the HOS scheme, which takes care of families in a lower income bracket, is based on market prices.

“I think the public would find it very hard to accept that the government is giving more assistance to those of a higher income group” by offering large discounts, said Poon, who estimated there would instead be a smaller reduction of about 20 per cent.

Aside from pricing, a number of other contentious factors could make or break the policy.

Only permanent residents of Hong Kong would be eligible for the scheme, in order to make sure property investors are barred, but that includes some 202,000 children born in the city to mainland Chinese parents who would add to the competition for homes.

However, Stanley Wong Yuen-fai, chairman of the subsidised housing committee at the Housing Authority, which is the main provider of public housing in Hong Kong, said it was technically unfeasible to exclude these children from the legal definition of a permanent resident.

And whether the scheme would become just another “big lucky draw”, as the highly sought after HOS has been described, depends on if an age limit will be set on applicants to ensure the scheme targets young families.

“[If no age limit is set] it will defeat the purpose. People beyond the age of 60 who have never bought a home before will also use this as an opportunity,” said Rebecca Chiu Lai-har, a housing scholar at the University of Hong Kong.

Perhaps one of the biggest political hurdles the government will face will be the issue of partnering with private developers, which could give rise to suspicions of collusion between the two, according to urban planning advocacy group researcher Yeung Ha-chi.

Relaxed building density restrictions, infrastructure subsidies and discounts on land premiums could be awarded to developers in exchange for a portion of flats being reserved for affordable housing, experts said.

Such a policy could incentivise developers to release farmland left idle for decades so homes could be built there, Poon said.

For Yuen and her family, who are on the hunt for a bigger flat to fit their family of five, all of those concerns do not matter.

“At the end of the day, we just want a place that we can own and call home,” she said.