New guidelines will smooth path for firms and foreign investors looking to open Hong Kong bank accounts

Monetary Authority intervenes after complaints that tighter regulations were damaging the city’s reputation as a global financial centre

The Hong Kong Monetary Authority will roll out guidelines in the coming weeks to help companies rebuffed while trying to open accounts at banks under pressure from anti-fraud regulations and new compliance requirements.

Many international banks have strengthened internal due diligence requirements in recent years after a number received hefty fines for transgressions such as money laundering and terrorist financing.

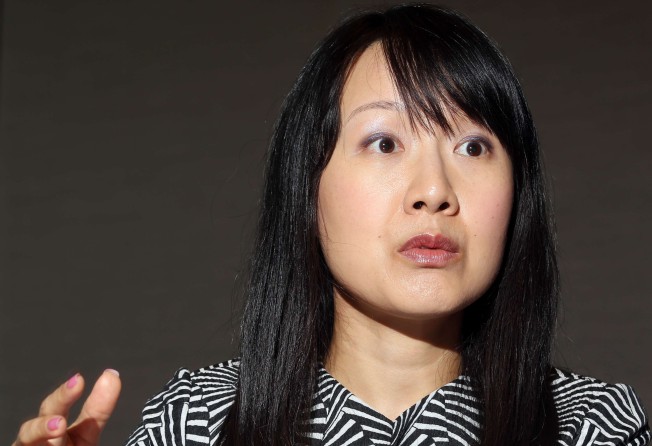

Sarah Kwok, head of the authority’s banking conduct department, said foreign investment had always been welcomed in Hong Kong but the tighter measures could cost the city its reputation as an international financial centre.

A number of lenders in Hong Kong, including HSBC, have made it particularly difficult for foreign small and medium enterprises (SMEs) to open accounts, the Post has learnt.

Kwok told the Post “only one or two international banks” were involved in the recent complaints it had received, without disclosing names. She urged banks to strike a balance between meeting compliance requirements and providing basic services to the public.

She said the authority was ready to negotiate with overseas regulators if the situation worsened to an extent that negatively affected Hong Kong’s business-friendly environment.

“We have noted comments from companies facing difficulties in opening bank accounts recently, especially start-ups and foreign companies.”

Kwok added that it had received nine complaints in the past six months that involved opening bank accounts. The total last year was 59.

But although only “one or two international banks” were involved, these were usually the “first port of call” for overseas companies in Hong Kong.

To tackle the issue, Kwok said the HKMA had talked to the management of the banks in April. They had agreed to review and refine their account-opening process without compromising internal compliance requirements.

The authority would introduce guidelines soon to help the city’s more than 150 banks better conduct the risk-based approach in granting and retaining bank accounts.

“Banks should not adopt a ‘one size fits all’ approach,” Kwok said. The requirements to open a bank account should be proportionate with multiple factors, such as the scale of the firm, she added.

An SME with annual revenue of HK$30,000 should not be asked to answer the same questions or be required to submit the same documentation as a big group worth billions, Kwok said.

The authority would join forces with InvestHK, the government-led business promoter, to help overseas firms gain access to Hong Kong banks.

The president of the American Chamber of Commerce, Richard Vuylsteke, said anti-fraud regulations were like “a sledgehammer pounding a small nail” that put off foreign investors.

HSBC said it was mulling a series of initiatives to streamline and improve the vetting process for companies wanting to open accounts in the city.

Hang Seng Bank said it accepted customers regardless of nationality, country of incorporation or scale of business.

Standard Chartered Bank sought to ensure a balanced, risk-based approach to customer due diligence requirements in relation to the SME sector.

The banks said they were keen to expand their SME business.

Additional reporting by Cannix Yau