Economy class squeeze: why Cathay Pacific needs to trade in passenger comfort for profits

The premium carrier had a difficult 2016 and has fallen behind its rivals in adding an extra seat

Cathay Pacific economy class passengers have long enjoyed a more spacious ride, but pressure on the loss-making airline’s bottom line has forced it to sacrifice comfort for a much-needed revenue boost.

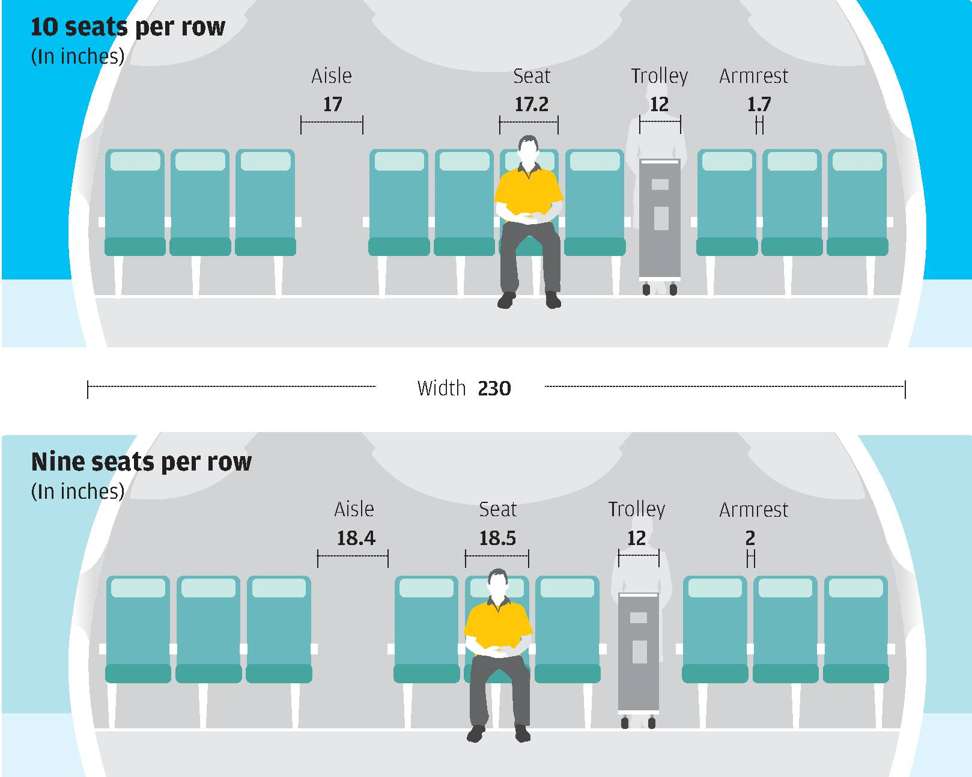

With real estate at 35,000 feet becoming increasingly more expensive, the Hong Kong carrier has found that its roomy nine seats per row arrangement is simply no longer viable.

By no means was Cathay the first the come to such a conclusion. Several years ago, Air Canada faced similar financial hardship and managed to turn itself around by trading comfort for profit. The Canadian carrier increased the number of seats to 10 per row in economy class, cutting costs by 15 per cent in a single stroke.

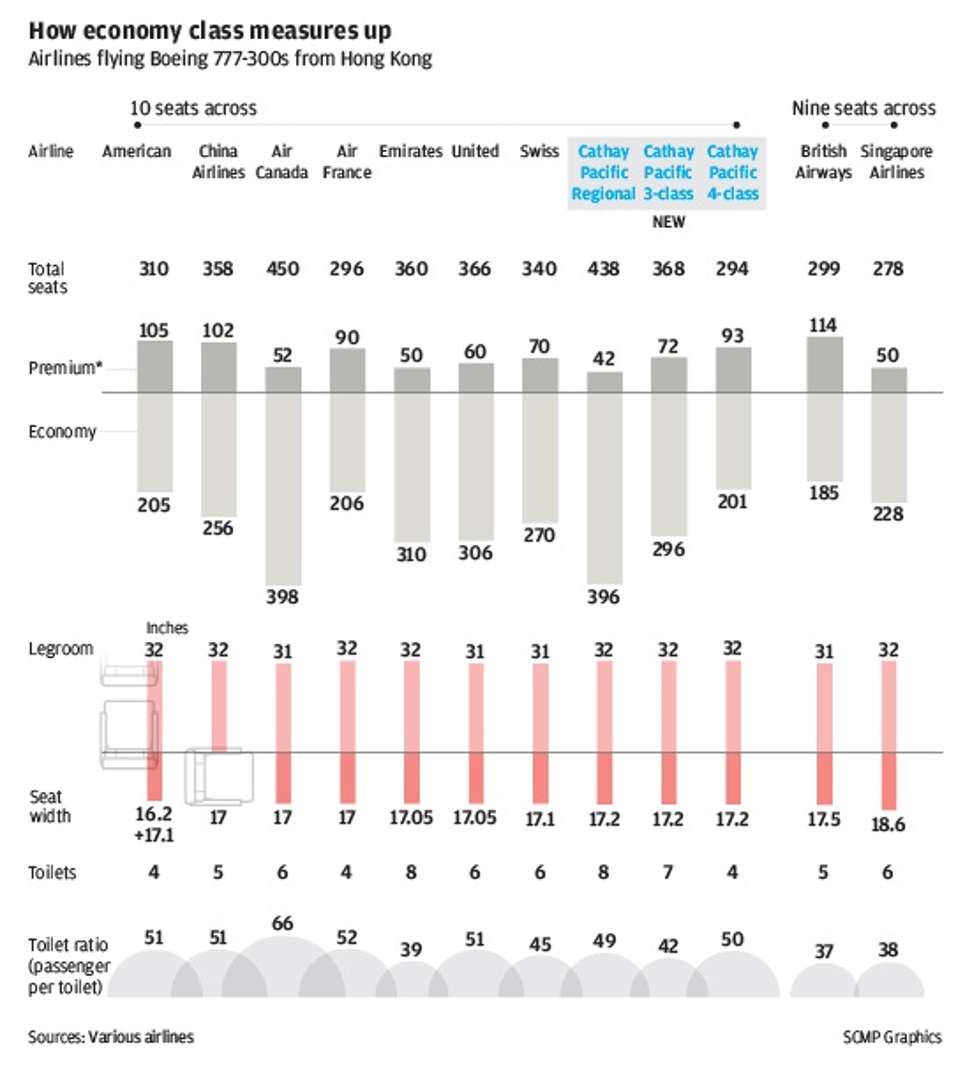

On its Hong Kong-Vancouver route, Cathay’s Boeing 777 can carry up to 275 passengers, however, far more of the plane is taken up by spacious premium economy, business and first class seating.

Meanwhile, Air Canada can fit 450 passengers onto the same aircraft and with more lower-priced tickets available, finds it easier to fill the flights.

“Their average cost per seat mile is lowered today by going to a higher density configuration. For [airlines], it’s one of the few ways to compete,” Raymond Kollau, founder of aviation consultancy Airline Trends, said. “Ten seats is the standard.

“These carriers have had no other choice but to compete with passengers in economy, and now Asia is following. It is either fierce competition or trouble at home... now they have no other choice to densify economy.”

Almost all major airlines have beaten Cathay to increasing density in economy class, albeit at the discomfort of passengers. Emirates Airlines was the first to bring the squeeze, and others soon followed: Air France, American Airlines, Air Canada and China Airlines. Taiwan’s Eva Air opted for the tighter layout halfway through its latest delivery of new Boeing 777s.

Singapore Airlines, like Cathay, is the exception to the rule and has so far not added the extra seat. But the strategy has found the airline in a similar financial predicament as the Hong Kong carrier.

“If you can’t beat them, join them,” Kollau said.

Being behind on economy class density has undermined and eroded Cathay’s dominant position at Hong Kong International Airport, where it controls almost 50 per cent of take-off and landing slots.

Will Horton from the Centre for Aviation (CAPA) said Cathay’s competitors could fly more passengers on the same plane, yet do so at a lower cost and make more money. Now, the beleaguered Hong Kong airline has been left at a “competitive disadvantage”.

A DIFFICULT 2016

With Cathay recording losses of HK$575 million in 2016, management is bracing for the biggest overhaul of the company in 20 years.

Contributing to the loss was lower than average business class customers, heightened competition from cheaper Chinese carriers and declining visitor numbers in Hong Kong. It also encountered geopolitical and economic headwinds, and is still feeling the pain of its fuel hedging strategy.

Still, passengers continued to flock to the airline. Cathay Pacific recorded a healthy load factor – a measure of how full flights are – of 84.5 per cent in 2016. Despite the good result, Cathay was still short on breaking even.

The airline’s chairman, John Slosar, alluded to the task ahead during the company’s annual results release.

“Mainland Chinese airlines increased their global reach,” he said. “We have to find ways to attract customers to fly with Cathay Pacific. We can operate in lower cost, be more agile and provide better service to our customers.”

Adding 10 per cent more seats to economy class and cutting 30 per cent of the airline’s staff costs at its headquarters are crucial elements of the airline’s three-year restructuring plan.

IN SEARCH OF PROFITS

Cathay Pacific has arrived late to the party and fallen behind its rivals by not yet increasing density in economy class.

In fact, Cathay is feeling the pressure across all sections of the aircraft.

At the front of the plane, fewer Cathay travellers have been willing to fork out the money for a business or first class seat, while its spacious economy class is as full as ever.

Adding extra seats would “definitely help” the airline return to profit at a marginal additional cost, Geoffrey Cheng, head of transportation and industrial research at Bank of Communications International Holdings (BOCOM), said.

His comments reflect a wider belief among aviation industry observers that Cathay Pacific has simply been too slow to make more money from its long-haul travel.

Achim Czerny, an associate professor in aviation management at Hong Kong Polytechnic University, said the airline was playing catch-up.

“By adopting the strategy, you’re not getting ahead, but if you adopt a successful strategy, you are not being left behind,” Czerney said. “In this environment it makes a lot of sense and is a sensible strategy.”

However the airline sincerely believes it can catch up and get ahead of the competition.

“We are not alone. Actually, we are late in the game... But the overall customer experience is a lot more important than whether it’s a 3-4-3 or a 3-3-3 configuration,” Paul Loo, Cathay’s director of corporate development and IT, told analysts during the results release earlier this month.

STILL A “5-STAR” AIRLINE?

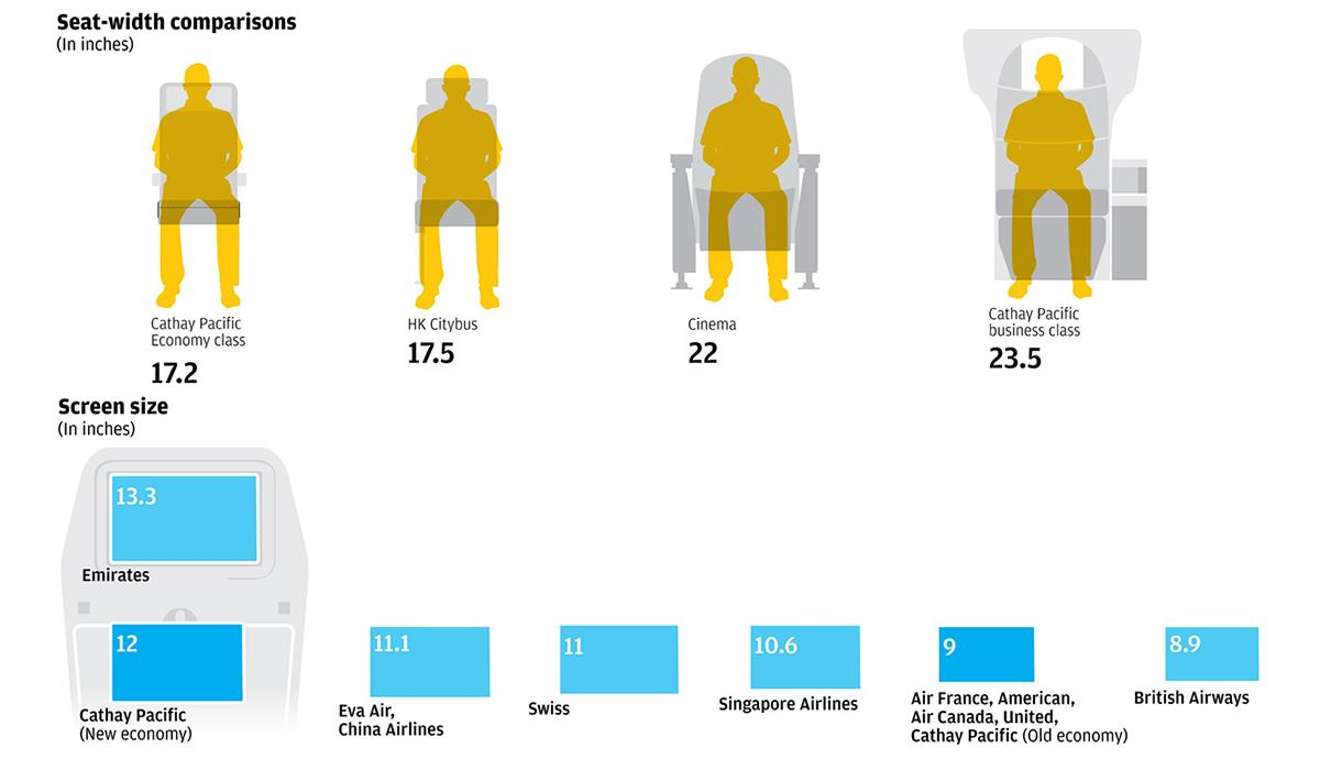

Cathay Pacific has long been known for premium and quality and is one of only nine airlines in the world to be classed as a “five-star airline”.

The elephant in the room, however, is whether an airline can legitimately still be considered “premium” when it has sacrificed passenger comfort for profits by adding the additional seat in its economy class.

“Everyone is hoping Cathay Pacific will maintain its premium status, but the reality is if they really want to compete, adding extra seats will lower its average cost per seat and in the circumstances, it’s a fact of life for competition reasons,” BOCOM’s Cheng said.

Kollau believed Cathay could retain its premium image in economy, and praised the airline for its unique six-way headrest on the Airbus A350 aircraft.

We have to find ways to attract customers to fly with Cathay Pacific. We can operate in lower cost, be more agile and provide better service to our customers

“I think Cathay can still maintain that attractiveness... besides offering a better economy product, they can combine it with data to make a more personalised service or offering. They do have a good selling point to build on, and for now, they are well positioned,” he said.

Fellow “five-star” airlines – Etihad Airways, Qatar Airways and Eva Air – have all made the move to a more cramped cabin.

“Whether we believe in premium or not – yes, we are still in the long-haul network premium model,” Loo said.

Indeed, the airline would hang on to its premium reputation with passengers if it kept the spacious nine-seat arrangement. However, Cathay is stuck between a rock and a hard place, according to Czerney.

The airline is faced with increasing demand and an airport quickly reaching capacity. Hong Kong International Airport hosted 70 million passengers last year alone.

“It’s difficult to add new flights to Hong Kong, but there is a lot of growth. What can you do? You can just squeeze in more passengers into an aircraft,” the PolyU academic said. “Because of the growing demand, they may be able to serve more passengers at an even higher price.”

At the end of the day, the tighter squeeze in the sky may not be so bad for the Hong Kong traveller.

Without more seats in economy class and with all airlines flying out of Hong Kong airport facing the same limitations to growth, pressure would be on carriers to increase airfares.

“In the long run it will be successful,” Czerney said.

“Why? Because passengers care for the price, so if you can offer more seats at a slightly lower price, you will get the passenger and will also earn more money, and be profitable.”

The next challenge on the horizon for Cathay, and other major carriers, is the onslaught of budget airlines offering long-haul flights. And with another runway opening at the Hong Kong airport, Kallau says all carriers would be assessing their position.

“It wouldn’t surprise me since they are all feeling the squeeze from the Gulf carriers and next – from long-haul low cost in future,” he said.