Live long and prosper? Hong Kong’s new annuity scheme a ‘step towards universal pensions’

The government’s planned public annuity scheme giving the elderly a fixed monthly income is step towards universal pension, but not yet the full deal

Universal retirement protection could be a step closer to reality, according to a leading economist and a social welfare academic, following the introduction of a HK$10 billion public annuity scheme that provides an option for retirees to invest a lump sum in exchange for a guaranteed monthly income for the rest of their lives.

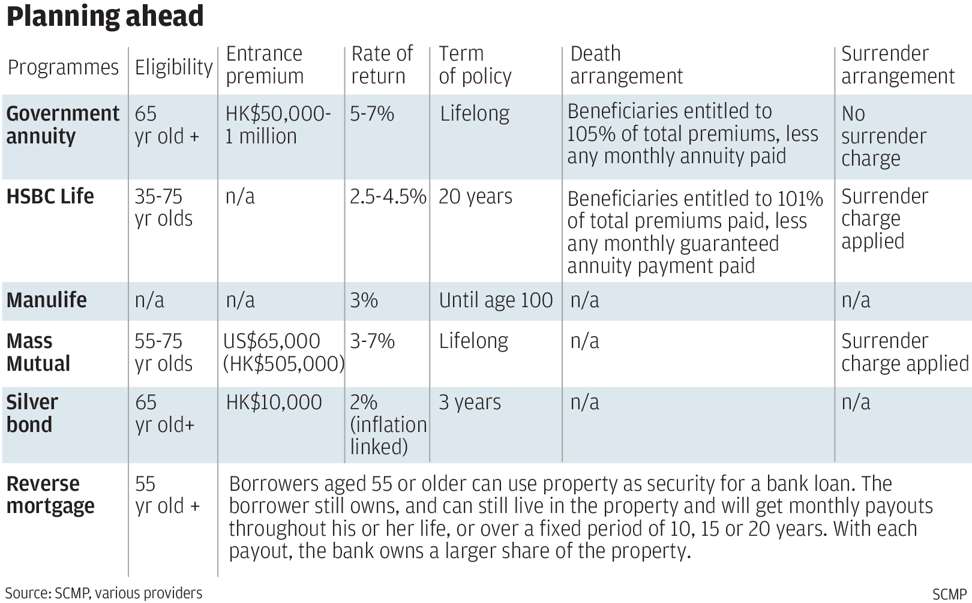

People aged 65 and above will be able to invest between HK$50,000 and HK$1 million under a life annuity scheme to be launched in the middle of next year by the government-owned Hong Kong Mortgage Corporation (HKMC).

Economist Andy Kwan Cheuk-chiu, director of ACE Centre for Business and Economic Research, said the public annuity scheme could be seen as another social welfare programme designed to cater for the elderly.

“It could be part of a comprehensive plan to provide universal retirement protection for Hongkongers,” he added.

With an investment of HK$1 million, a male at age 65 would get a guaranteed monthly return of about HK$5,800 per month until death. This represents a return of up to 7 per cent.

Men who paid the minimum HK$50,000 would receive HK$290 per month while women would get HK$265.

Kwan said that the planned payout ratio would be higher than most low-risk fixed income investments, citing returns on US Treasuries of about 3 per cent a year.

“But with an investment capped at HK$1 million under the scheme, one could hardly scrape a living from the payout [alone],” he said.

Retired professor Nelson Chow Wing-sun, an expert on pensions, echoed Kwan’s views.

“I think the government has almost reached the goal of a universal pension, if the definition of universal pension is that people will receive a stable and reliable source of income when they reach age 65,” Chow said.

He said the introduction of the annuity programme could provide retirement protection for the middle class or more wealthy, while an enhanced old age allowance introduced earlier this year had provided protection for low-income retirees.

Under that enhanced old age allowance programme, those with assets lower than HK$329,000 will receive HK$2,565 per month, while those who have less than HK$144,000 in total assets will be eligible for a higher monthly allowance of HK$3,435. This is expected to benefit some 500,000 elderly people.

For those aged 70 or older, there is an additional non-means-tested allowance of HK$1,325 a month.

With a total size of HK$10 billion, the proposed annuity scheme could accept 10,000 retirees who each put in HK$1 million or up to 200,000 who pay in the minimum HK$50,000 each.

It remained to be seen if the government would expand it as the demand for this relatively safe investment option was likely to surge, given that Hong Kong has more than a million people age 65 or above – almost 14 per cent of the total population, Kwan said.

Chow added that the advantage of the government-sponsored annuity programme is that there would be no management charge or surrender charges, no need to pay for private companies’ profit and no additional risks occasioned by sudden closures of private schemes.

Henry Shin, chief executive officer of Convoy Financial Services, said the introduction of the life annuity scheme could give a boost to the market as a whole and benefit the sale of similar annuity investment products offered by the private sector.

“[The overall market]’s total value must exceed HK$10 billion in the future,” he said.

But he took note of the lack of details about the proposed plan, announced on Monday.

There could be certain built-in service charges and fees relating to the withdrawal from a scheme, which were often found in annuity plans developed by the private sector, despite the authorities’ assertion that management fee would be waived, he said.

“We are expecting more details from the government,” Shin said.

Dr Chung Kim-wah, a political scientist at Hong Kong Polytechnic University, said the government annuity plan’s entrance payment – HK$50,000 – was much lower than that of similar private plans.

Those normally required a minimum of about HK$300,000.

He added that the plan ensured a fixed return, which so far was higher than inflation, and would be suitable for long-term investment.

But Chung said he believed the plan would be attractive to those elderly people who had saved at least HK$1 million.

“[The plan] can absolutely not be confused with a universal pension and would not reduce society’s demand for universal pension,” Chung said.

Before attending the Executive Council meeting on Tuesday morning, Chief Executive Leung Chun-ying said: “The initial response to the scheme was positive, according to our assessment.”