How Hong Kong’s MTR takes on local rail giants in Europe

Foreign business makes up an increasingly big chunk of the transport giant’s profits, and bosses are looking to expand further. Its work in Hong Kong, where its dominance is unquestioned, provides good groundwork

One morning in London last week, Frederick Ma Si-hang was perplexed. The underground train he was travelling on had hit a series of hiccups.

As chairman of Hong Kong’s railway operator, the MTR Corporation, he is used to trains that run on time, and having access to email while commuting.

First, a silent notice on the platform told him there would be “indefinite delays”. When he finally boarded, his journey was marked by intermittent stops caused by a signalling failure. To top it off, he could not check his email, because there was no mobile or Wi-fi internet connection.

Ma had no complaints about his time on the Tube, but his experience stood in stark contrast to the services in Hong Kong which are cleaner, more efficient and more punctual.

Ma said he hoped MTR Corp, which is building up its interests in the British capital, could give Londoners an experience to which Hongkongers have grown accustomed. But he added that doing so would not be easy.

It is all part of a wider push by the Hong Kong company, so well known in its home town, to build up its already expansive foreign interests.

“We expect the contribution [to company profits] from the European business will grow further,” Ma said. “It is not easy to go global, not to mention successfully. The board has decided to continue pressing ahead with the strategy.”

MTR Corp was founded by a group of British rail experts in Hong Kong in the 1970s as a government-owned utility. It went public in 2000, and turned the tables by getting to work in London about 12 years ago, as the Hong Kong market matured.

The rail firm has since either collaborated with larger rivals in Europe or crossed swords with them when bidding for rail projects. Those rivals include deeply embedded competitors such as Arriva, the international unit of Germany’s Deutsche Bahn, Keolis of France, the British-based Stagecoach Group and FirstGroup and SJ of Sweden.

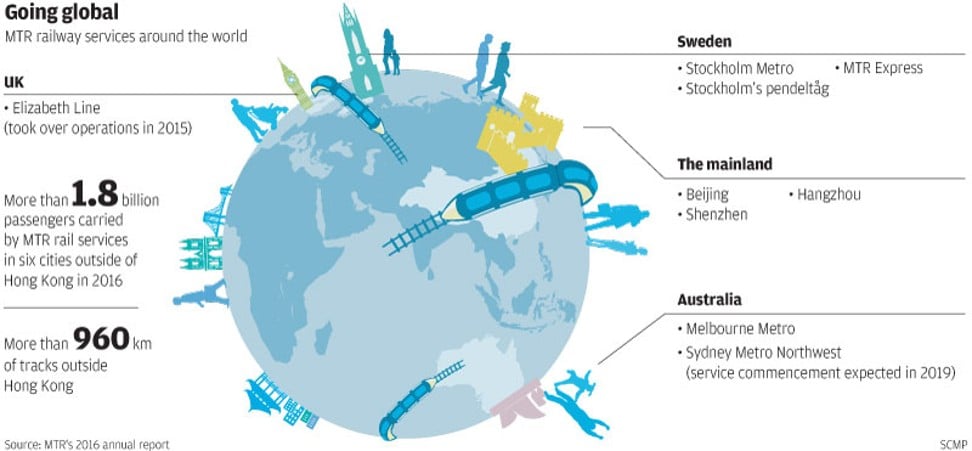

As well as having business in the UK and Sweden, the corporation does work in Australia and mainland China.

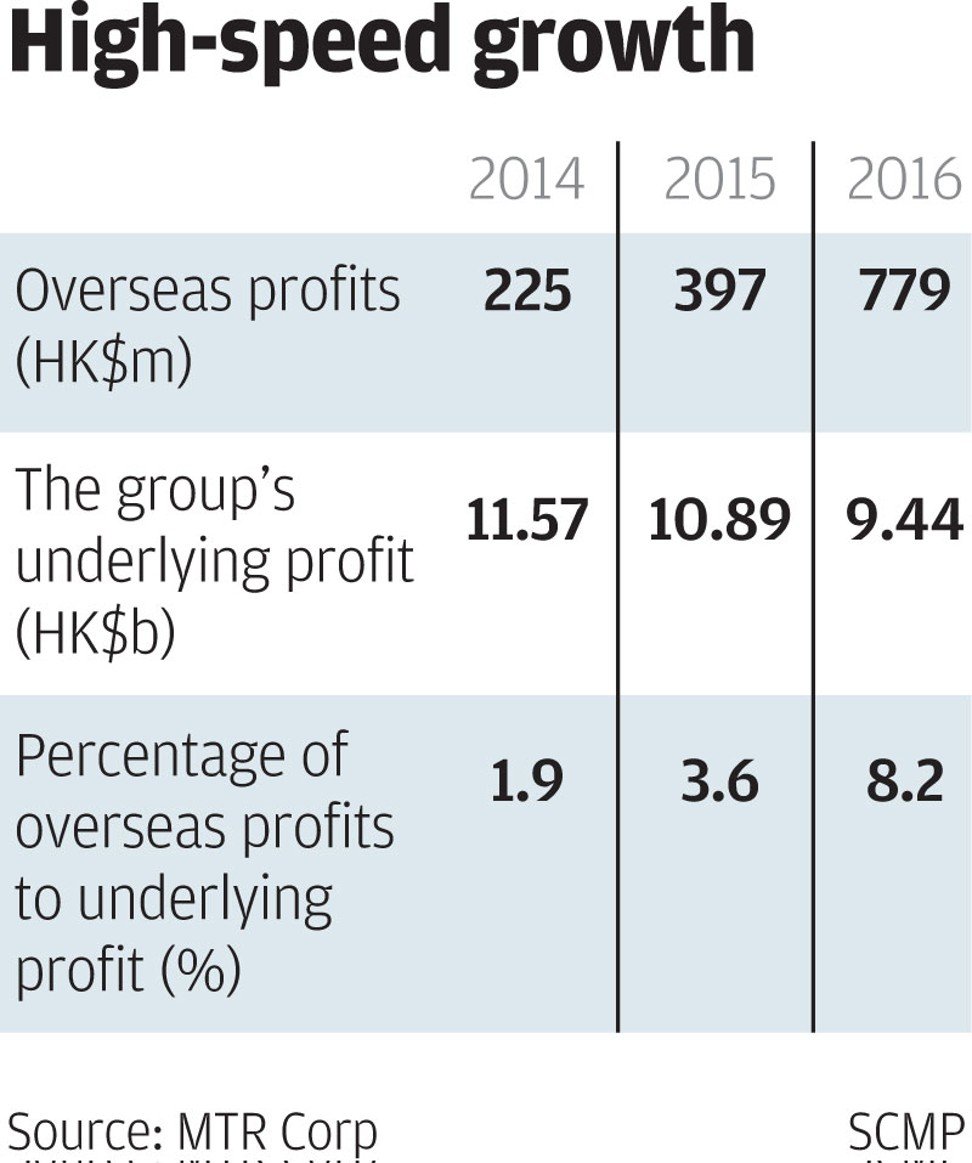

The profit from overseas business last year, standing at HK$779 million, almost doubled from HK$397 million in 2015, and made up 8.2 per cent of MTR Corp’s underlying profit of HK$9.44 billion.

And the company’s Hong Kong travellers – 4.6 million on the average weekday – only account for 38 per cent of the 12.1 million it carries on the average weekday worldwide.

But the global expansion has not been without caution. And Ma said MTR Corp would not compromise on some investment criteria when bidding for a project, with priority on balancing risk and keeping to its own benchmark for rates of return.

In one of its biggest overseas setbacks, MTR Corp last year lost its bid to run London’s overground services, to Arriva. That was because MTR Corp refused to match its competitor’s price, which Jeremy Long, chief executive of MTR’s European business said the company “was not comfortable with”.

MTR Corp missed out on that contract despite ranking higher on service quality, Long said, with disappointment. MTR Corp had operated the overground lines with a partner for the nine years to last year, its first project in the UK.

But as that door closed, another opened.

Last month, MTR Corp and its bigger partner, FirstGroup, took over the running of South Western Railway, one of the UK’s largest franchises. The 998km network runs from London Waterloo to an array of towns and cities in the country’s south, and yields £1.2 billion revenue annually.

And the corporation is working closely with Transport for London (TfL), the city’s transport authority, on the completion of the £15 billion Crossrail project, a 118km network linking the capital’s east and west across the middle by the end of 2019.

MTR has been operating part of the Crossrail services running east from central London since 2015 and will run the train services of the core part of the project – a tunnel section in central London – when it is finished in 2018. By then, the whole line will have been christened the Elizabeth Line, after the country’s current monarch.

“This project is very significant to us,” Ma said. “We will bring in innovation and experience and know-how from Hong Kong.”

Long said a key reason why MTR Corp could carve out a niche in such a competitive market was its business model, which is unique to Hong Kong in that the corporation develops property above train stations, using the profits to subsidise the construction of new rail lines.

This means the company has experience in designing, building, operating and managing all rail lines solely on home turf, as opposed to the more complicated London market, where different aspects of the networks are managed by a number of parties.

Long said MTR is more customer-oriented, and better at using new technology in training and operations, than its competitors.

We are thinking of bringing back the virtual reality programmes to Hong Kong

Among recent technological innovations the company has deployed in London are virtual reality programmes used to train station managers to handle unexpected incidents on platforms; giving frontline staff electronic tablets to deal with incidents and collect evidence of problems more quickly; and training drivers in a simulator.

“We are thinking of bringing back the virtual reality programmes to Hong Kong,” Ma said. “So, the flow of internal information and expertise is both ways between Hong Kong and overseas.”

Another case in point is MTR’s regional train services in the two largest cities in Sweden, Gothenburg and Stockholm. There, it competes with SJ by offering lower fares, Swiss-made trains and an on-board menu created by a celebrity chef. MTR, which runs metro and commuter services in Stockholm, is the biggest rail operator in Sweden by passenger volume.

A former transport policy adviser in Brussels and Sweden and a senior researcher with Stockholm School of Economics Institute for Research, Gunnar Alexandersson, said MTR’s presence in Sweden had already made the rail market, formerly dominated by SJ, more competitive.

“MTR is the first railway undertaking that has entered the Swedish open-access market with brand-new vehicles and a timetable with frequent daily departures. Previous new entrants have generally entered with second-hand vehicles and much more limited services,” Alexandersson said.

“It is clear that MTR has entered the Swedish market with a long-term perspective. The company may start operating traffic on more lines in the future.”

Long said the company would push further into the UK market and capitalise on the liberalisation of the rail industry in France and northern Europe.

“The opportunities are not just operating railways, but infrastructure maintenance, even building railways,” he said.

Denise Tsang reported from London and Stockholm.