Prime land on top of Hong Kong’s high-speed rail station to be sold to developers as single site potentially worth more than HK$100 billion, land sale list reveals

- 5.88-hectare site at West Kowloon station was one of 22 residential and commercial lots on this year’s official land sale list unveiled on Thursday

- Secretary for Development Michael Wong says government intends to sell site as a whole instead of carving it up

A prime commercial site on top of Hong Kong’s high-speed rail terminus will be sold to developers in the first half of the year, with 2019 expected to see the highest supply of floor space for offices and businesses in two decades.

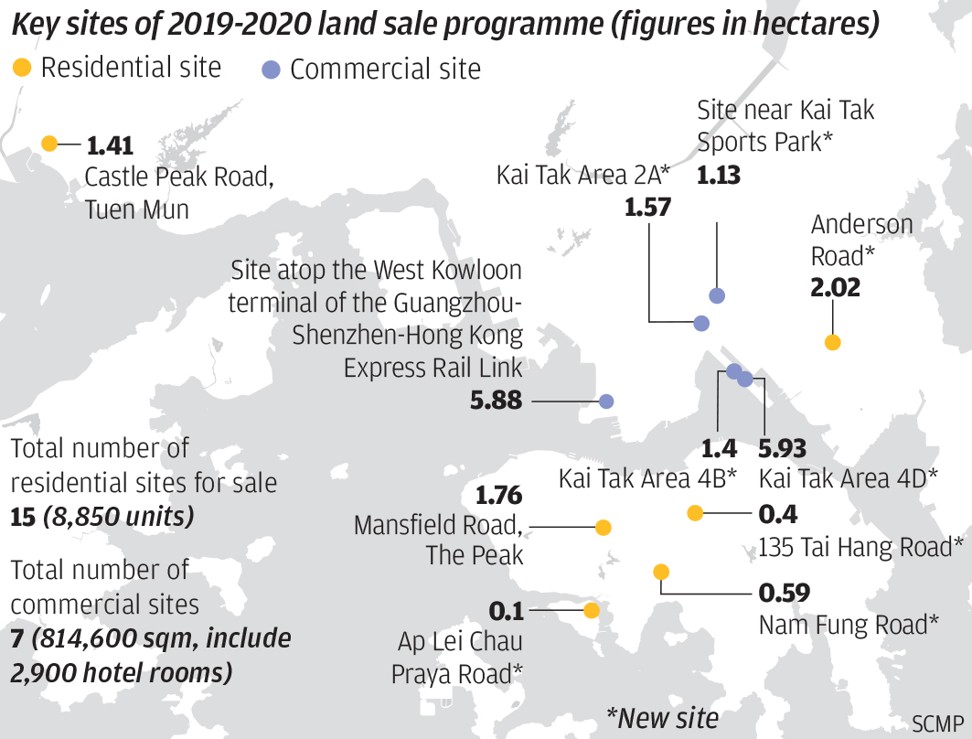

The 5.88-hectare (14.5-acre) site at West Kowloon station was one of 22 residential and commercial lots on this year’s official land sale list, which was unveiled by the government on Thursday.

The expected yield of private flats from this year’s land sales and other projects, however, would be the lowest in almost a decade.

Announcing the land sales programme for 2019-20, Secretary for Development Michael Wong Wai-lun said the government intended to sell the huge West Kowloon site as a whole, instead of carving it up for separate sales, as some market watchers had been speculating.

“In terms of design and management, we believe it is beneficial to sell the site as a whole,” Wong said.

But Thomas Lam, executive director of Knight Frank in Hong Kong, said this might lead to selling difficulties.

“The total value is too large and I’m not very optimistic that it can be sold easily as a whole,” Lam said. “To be sure, developers are interested in the site because of the location, but no single developer now has the ability to put so much money in one site. They have to form a consortium to bid for the project.”

Lam estimated the site could fetch HK$95 billion (US$12 billion) to HK$110.8 billion (US$14 billion) – or HK$30,000 (US$3,800) to HK$35,000 (US$4,500) per square foot.

Hannah Jeong, head of valuation and advisory at Colliers International in Hong Kong, gave a more conservative estimate of HK$63.3 billion to HK$79.1 billion, or HK$20,000 to HK$25,000 per square foot.

“This site is very strategic and many developers will be keen to get in,” Jeong said. “This one is really about the development [of the whole West Kowloon area] in the next five years.”

The 22 lots for sale this year include seven commercial sites that will provide 8.8 million square feet of floor space, the highest annual amount over the past 20 years, according to real estate service firm Jones Lang LaSalle.

The site atop the West Kowloon terminal of the Guangzhou-Shenzhen-Hong Kong Express Rail Link is the second largest on the land sale list. It is also right next to the West Kowloon Cultural District, which is being developed into a prime entertainment, commercial and residential hub.

Turning to land for housing, the minister in charge admitted there would be a shortage of sites for private housing in the short and medium terms, leading to a marked drop in the supply of flats.

“The decrease … reflects the scarcity of land, especially in the short-to-medium term,” Wong said.

Fifteen of the 22 sites on the list – including the high-end Mansfield Road plot on The Peak and another on Nam Fung Road, Southern District – are earmarked for residential development and expected to produce 8,850 flats.

Combined with railway property development, urban redevelopment projects and private projects, the total land supply for this year will provide 15,540 flats, the lowest in nine years.

“That’s the reality … that in the short term there aren’t that many measures that can effectively increase land supply,” Wong said.

He also explained that fewer residential plots were put up for sale because of a new private-public housing mix of 30 to 70 adopted by the government, from the previous 40-to-60 split.

Buggle Lau Ka-fai, chief analyst of Midland Realty, said the drop in supply would not immediately affect the property market, as flats would not be developed until four-to-five years later, and newly finished projects from previous land sales could still keep the supply going.

But if the private residential land supply remained low for the next few years, he warned, the market could face many uncertainties in five to 10 years.

The government has put eight Kai Tak sites on the list, including one commercial lot in the area under redevelopment that once housed the city’s old airport, which failed to sell because developers’ offers did not meet the minimum bidding expectations.

One site on Anderson Road in Kwun Tong, which will provide 1,000 subsidised “starter homes” for first-time upper middle-class buyers, will be put on sale in the second half of the year.

The land sale announcement came a day after the release of the city’s budget, which revealed a 30 per cent drop in land sale revenues last year, partly contributing to a nearly 60 per cent drop in the city’s total fiscal surplus.