Hong Kong government’s problem is not deficits but structural surplus, say economists

Annual surplus likely to be just shy of HK$160 billion by the end of financial year, source suggests, as pressure mounts on financial chief for budget giveaways

Hong Kong is set to reap a bumper budget surplus this year as experts warn of a structural surplus problem, with HK$120 billion already in the bag and the final figure likely to be just shy of HK$160 billion by the end of March, according to figures obtained by the Post.

The massive projected surplus, at least seven times the original estimate of HK$16.3 billion for 2017-18, has reignited criticism of officials’ conservative calculations, and the resultant failure to invest in things like public hospitals and helping the elderly and the young.

Experts chastised officials for taking what they called a doom-and-gloom outlook and forecasting a fiscal structural deficit by 2021. One economist said the problem was the exact opposite, with the city facing a structural surplus.

With such resources at his disposal, pressure is piling on Financial Secretary Paul Chan Mo-po to give one-off relief measures when he delivers his annual budget on February 28.

While big accounting firms had predicted that the surplus – that is, a positive difference between the government’s income and its outgoings – this year might be between HK$160 billion and HK$180 billion by the end of March 2018, a source familiar with the fiscal position predicted a final figure just below that range.

This year’s projection would smash a record set in the last financial year, when the city reeled in a surplus of HK$92.8 billion, eight times the original estimate of HK$11.4 billion.

As of November last year, the city had a cumulative surplus for the year of HK$57.2 billion, four times the original estimate of HK$16.3 billion for the whole of 2017-18.

The city’s fiscal reserves exceeded HK$1.7 trillion by December 31 last year.

But these surpluses all wash in against a backdrop of looming deficit, which will almost certainly come about as a result of the city’s ageing population. As the share of the population aged over 65 – and therefore not working and paying income tax – grows, the government’s revenue is likely to shrink. At the same time, the cost of caring for this growing elderly population will hit the public coffers, making surpluses a thing of the past.

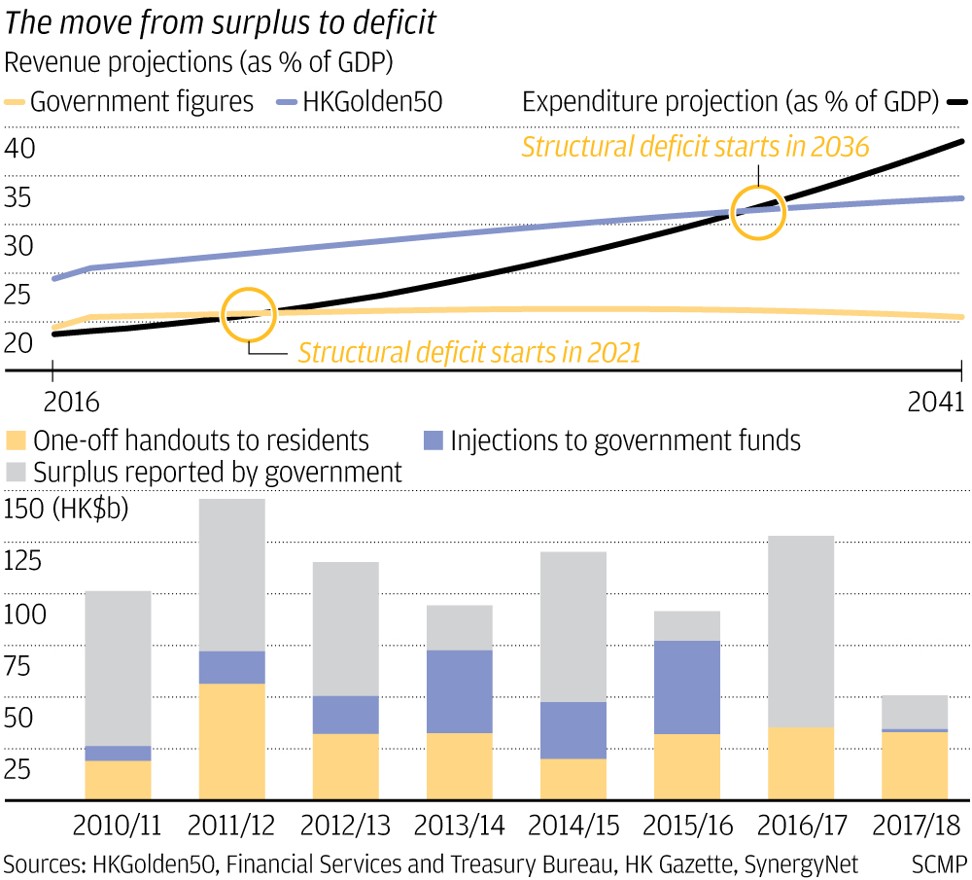

Two veteran economists invited by the Post to revisit the projections made by the government’s long-term fiscal planning panel four years ago said the government’s supercharged income could delay that structural deficit for 15 years or even stop it ever becoming a problem.

Both said the government’s study failed to work in the “China factor”, which has fuelled huge rises on the Hong Kong stock market and record-high land prices in recent years.

“Hong Kong has been experiencing the biggest structural economic growth and it is because of China,” said Franklin Lam Fan-keung, founder of think tank HKGolden50 and a former investment bank analyst who served the government’s Central Policy Unit during the Asian financial crisis of 1997.

“But we did not feed the growth, we did not pour money into social and economic infrastructure ... Offices, hotels and hospitals ended up being very expensive in Hong Kong.”

Official statistics show the average annual growth rate of the government’s revenue from 2009-10 to 2014-15 was estimated at 6.2 per cent in government budgets. Looking back, the actual growth rate was 8.5 per cent, while the corresponding figure for expenditure was 6.8 per cent.

But Lam pointed out that if the revenue growth calculation took into account one-off relief measures and various funds set aside by John Tsang Chun-wah – financial secretary for the whole period – the rate would be as high as 9.9 per cent, 3.7 percentage points higher than the original estimate.

From 2010-11, in response to unexpectedly high revenue from land premiums and stamp duty, Tsang squirrelled away lump sums ranging from HK$26 billion to HK$77 billion each year to bankroll sweeteners or designated funds to address specific public concerns, like drug abuse or housing.

In so doing, he effectively reduced the size of some annual surpluses by almost half and, in some extreme cases, by two-thirds. Including those lump sums, the government’s budget surpluses from 2010-11 to 2016-17 would almost double to at least HK$814.8 billion, from the current recorded total of HK$433.5 billion, in stark contrast with the HK$27.7 billion forecast in the government’s study.

“Yet, with so much money [to hand], the government didn’t build a new hospital or build a land bank, and elderly people’s savings have been eroded by inflation,” Lam said. He said Tsang had taken an overly frugal fiscal approach and failed to invest in opportunities to grow the economy.

Lam said the government’s long-term fiscal study projected future revenue from a starting point in 2014-15 when revenue was estimated at 19.4 per cent of GDP. But in reality, including chunks of surplus set aside deliberately, that figure was more like 24 per cent.

Based on bigger annual revenue growth, Lam’s think tank projected that the structural deficit would only emerge in 2036, even if government spending increases 3 per cent every year.

Chinese University associate professor of economics Terence Chong Tai-leung said the task force should not have predicted government revenue growth based on GDP growth, as the former is set to exceed the latter, thanks to a stamp duty windfall. The annualised growth rate of stamp duty in the past 27 years – from 1989 to 2017 – was 9.4 per cent, while annualised government revenue growth stood at 7.5 per cent.

Chong noted a recent structural change in stamp duty. He said he expected its growth to continue to expand in coming years, making the duty – paid on property and stock purchases – the biggest source of government income and further driving up its total revenue.

“The problem of structural deficit would already be resolved if the additional income from stamp duties would cover the extra expenditure triggered by the ageing issues,” he said, adding that 9.4 per cent growth in stamp duty was a very conservative estimate as policies such as the stock connect and the introduction of dual-class technology stock listings would further fuel its growth.

The city’s windfall from stamp duty is derived almost evenly from its robust property and stock markets. Special Stamp Duty and Buyers’ Stamp Duty were introduced in 2010 and 2012 respectively in a bid to curb the overheated property market.

Launched in 2014, the mainland-Hong Kong stock connect lets international and mainland Chinese investors trade securities on each other’s markets through the trading and clearing facilities of their home exchange. It has also contributed a hefty sum in stamp duty.

Lam said the daily turnover of mainland e-commerce giant Alibaba – which owns the South China Morning Post – last year would account for more than a third of daily turnover on the Hong Kong stock market if it had been allowed to list in the city.

“Had Alibaba been allowed to list in Hong Kong, the amount of stamp duty collected by the government could have been used to waive taxpayers’ salary tax,” he said. “According to our calculations, 90 per cent of Hong Kong taxpayers could enjoy a tax holiday; those earning less than HK$65,000 a month can be exempted from paying salary tax.”

The same amount of money that the government would forfeit under such a holiday could boost recurrent spending on the overloaded local health care system by 60 per cent.

More potential could be realised if other hi-tech mainland companies like phone maker Xiaomi listed in Hong Kong, Lam said.

Professor Liu Pak-wai, a leading economist involved in the government’s long-term fiscal planning, defended the study.

“The study did forecast surpluses in the early years of the long-term projection, although the size of the surpluses in the past few years are unexpectedly massive,” he said.

Liu said it was difficult to make a reliable forecast of land revenues, and that the property cooling measures also boosted stamp duty income.

“Government spending was also smaller than expected because of filibustering and judicial reviews,” he said, referring to delays – in the legislature and the courts – to major construction projects.

“Having said that, the study could have made some policy recommendations on how these fiscal challenges can be coped with. But we were not empowered to do so,” he said, adding that the fiscal study should be reviewed every five years.

A government spokesman said while the administration had noted the recommendations in the working group report, “they have not been and will not be constraints on government spending, which is determined with reference to the needs of Hong Kong for economic and social developments as well as our fiscal strength.”