Hong Kong’s Chan brothers, famed for charity in Canada, fight tax investigation over KPMG offshore firms

- Tax agency wants heirs to Hong Kong’s Crocodile Garments fortune to hand over 1,297 documents about an offshore company structure in Isle of Man

- A lawyer says the offshore firms were only for philanthropy and never distributed gifts or income for the Chan family’s personal use

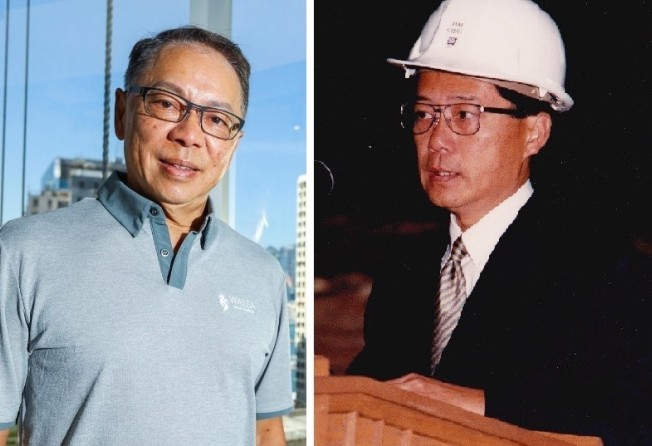

Hong Kong Canadian tycoons Caleb and Tom Chan – whose huge donations have made them two of the biggest names in Vancouver philanthropy – are fighting Canada’s tax collector by refusing to hand over documents about an offshore company structure set up in the Isle of Man with the help of accounting giant KPMG.

The Canada Revenue Agency (CRA) has not accused the Chans of wrongdoing as it audits the brothers and seeks access to the documents.

A lawyer associated with their charitable interests said the offshore structure was only for philanthropic purposes, and no Chan family member ever received income for personal use or gifts from it.

“At the time the Isle of Man Companies were wound up, all of the assets of the Isle of Man Companies were transferred to the Chan Family Charitable Trusts, where these funds continue to be used to facilitate international charitable giving,” Daniel Reid, a lawyer for the trusts, told the South China Morning Post.

The Chan brothers are asserting lawyer-client privilege over the Isle of Man material in their court battle with Canada’s Minister of National Revenue. The CRA wants the material as it audits the brothers.

Details of the Chans’ court battle with Canada’s tax collector were first reported by the Canadian Broadcasting Corporation on Tuesday.

Heirs to Hong Kong’s Crocodile Garments fortune, the Chans tried to conceal their names from Canadian authorities as government auditors pursued users of the KPMG scheme, but they abandoned that effort when their identities were independently confirmed by the auditors, according to the legal action.

The Minister of National Revenue is seeking a federal court order that the Chans and KPMG hand over 1,297 documents related to the offshore arrangement, which was based around companies set up and then liquidated in the Isle of Man, a tax haven.

Neither the Chan brothers nor their lawyer in the case agreed to discuss the matter with the Post.

But Reid said the Isle of Man firms were set up for charitable purposes only, in keeping with the family’s “long history of charitable donations”.

“At no time were any funds from the Isle of Man Companies ever withdrawn or gifted to Chan family members,” Reid said in a statement to the Post.

“Rather, funds held by the Isle of Man Companies were invested and used exclusively for donations to international charitable organisations.”

KPMG’s Isle of Man scheme has been the subject of years of controversy in Canada, after tax collectors struck an amnesty deal with some of its other wealthy users, whose identities remain a public secret.

But the Chans were not part of the deal, and the legal battle over the documents details their involvement with the KPMG product. Only a handful of other users of the scheme have been publicly named; the Chans are by far the most prominent.

According to a statement published by the CBC on Tuesday, Caleb Chan said: “We have a deep love for Canada and the utmost respect for its laws and institutions. Any suggestion that we would deliberately act counter to this goes against everything that we stand for.

“Our family has faith that our good and genuine intentions, our values, and our contributions to make Canada and the world a better place will ultimately shine through.”

‘The wifes [sic] are not to know about the assets of the husbands’

Evidence and legal documents filed in the action show the secrecy surrounding the brothers’ use of the arrangement.

An email filed as evidence, sent by a KPMG Hong Kong partner involved in setting up the structure in 2002, suggests that details of the brothers’ assets in the scheme were to be concealed from their wives.

“Do you require professional references for the wifes [sic]?” KPMG’s John Lee asked in his email to Oliver Peck, an executive of the Isle of Man financial services firm that also helped set up the offshore structure for the Chans.

“The concern is that the wifes are not to know about the assets of the husbands, and to require references will alert them to this.”

The Chans are not named in the email exchange, but it includes discussion about naming the Isle of Man firms that the brothers acknowledge were set up for them at KPMG’s recommendation.

The crown has not made any accusations of wrongdoing against the brothers, whose surname is set to adorn Vancouver’s new C$150 million (US$113 million) art gallery, the Chan Centre for the Visual Arts.

But Canada’s government is trying to compel KPMG and the brothers to hand over documents to assist tax auditors.

Funds held by the Isle of Man Companies were invested and used exclusively for donations to international charitable organisations

The brothers argue that the documents are protected by solicitor-client privilege, and that the crown’s action is “overzealous”.

Lee’s question about the wives came in response to a list of conditions provided by Peck to set up the Isle of Man firms.

“Our business implicitly revolves around client confidentiality,” Peck said, adding that he required confirmation that “the clients (or their nominees) will not be signing on bank accounts (for their protection).”

In the email exchange, Peck agreed to fly to Hong Kong to meet Lee at KPMG’s offices.

“I understand your clients’ concerns regarding confidentiality, and am happy to be able to assist you in this way,” Peck wrote. He subsequently assured Lee that references for the wives were not needed.

The Chans are the sons of late Hong Kong clothing tycoon Chan Shun, whose Crocodile Garments brand famously battled French fashion house Lacoste over the use of similar-looking crocodile logos – the Lacoste reptile faced right, while the Hong Kong brand’s faced left.

Chan Shun sold the family’s controlling interest in Crocodile Garments in 1987 to industrialist Lim Por Yen, when it was the biggest clothing chain in Hong Kong. The Chan family moved to Canada in 1989.

Tom and Caleb Chan have since donated tens of millions of dollars to Canadian cultural institutions.

The Chan Centre for the Performing Arts at the University of British Columbia was established in 1997 after a C$10 million gift from the brothers – then the biggest cultural donation ever received in Canada – while the landmark new home for the Vancouver Art Gallery will be named in the brothers’ honour after they donated C$40 million to the project. It is set to open in 2023.

Canadian Business magazine says the brothers were worth C$1.08 billion in 2018, their fortune mostly tied up in real estate and golf courses. Elder brother Tom is closely involved in the family’s charitable endeavours, while Caleb is the face of their business affairs.

What was KPMG’s offshore company structure?

The crown says KPMG’s offshore company structure product was marketed as a tax vehicle for wealthy Canadians, providing “confidentiality”, “investment and accumulation of assets with no tax” and “the ability to receive distributions free of tax”.

“The typical buyer of the product was suggested to be a high net worth client with a minimum of $5 million to $10 million to invest offshore,” the crown says in its memo of fact and law to support its application for a compliance order, submitted on June 28.

CRA first became aware of the scheme in 2010, and it has been under intense public scrutiny since 2015. An out-of-court settlement granted a no-penalty, no-prosecution amnesty to 15 people who identified themselves to CRA as clients in the scheme. Their names remain secret.

The government’s current legal action against the Chan brothers, launched in October 2017, shows they have been under audit since December 2016.

Their CRA auditor, Russell Lyon, said in an affidavit they were confirmed as participants in the KPMG scheme in April 2017.

A KPMG document described by Lyon supposedly explained how the firm’s offshore company structure product worked in general: companies set up in Isle of Man would list “eligible persons” who could receive “gifts” when the companies were liquidated and wound up.

Gifts are not taxable in Canada.

Lyon’s affidavit described three related appeals involving taxpayers from a different family who had used the KPMG product.

“[The] Crown’s position in the appeals is that the taxpayers’ offshore company structure is a sham intended to deceive the Minister,” he said.

Neither Lyon nor the government have accused the Chans of wrongdoing.

Lyon said the “eligible persons lists” were not publicly available from the Isle of Man, but in 2016, the CRA obtained the lists for what he called the “Chan IOM Companies” that were set up with KPMG’s help.

The brothers, their wives and family members were listed as “eligible persons”. The CRA included the lists in exhibits for the legal action.

In his statement to the Post, lawyer Reid representing the Chan family charitable trusts said that “despite Chan Family members being named ‘eligible persons’, the Isle of Man Companies never generated or paid any of their income for personal use of any Chan family member, no Chan family member drew funds or income from the Isle of Man Companies for personal use, and no gifts were made by the Isle of Man Companies to members of the Chan family.

“Any suggestion or implication to the contrary is false and defamatory.”

In the brothers’ response to the Minister’s legal action, issued on April 30, they acknowledge that four Chan IOM firms were registered on December 30, 2002. Lyon said they received gifts of property from “certain trusts” the next day. They were dissolved in March 2013, the crown and the Chans agree.

The Chans acknowledge that all of the assets in four Hong Kong “donor trusts” linked to the family were transferred into the Isle of Man firms, saying that this was on the recommendation of KPMG staff.

Lyon said the trusts date back as far as November 1993, and four British Virgin Islands firms were also connected to the Isle of Man firms.

In March 2017, CRA asked KPMG to turn over documents related to the Chan IOM companies, and sought an explanation for why the firms were wound up.

The Chan brothers’ lawyer in the current case, David Davies, said in his memorandum of fact and law for the court that his clients and KPMG had turned over “innumerable documents” in response.

But the remaining 1,297 documents were subject to the “sacrosanct nature of solicitor-client privilege”, and the minister should not be allowed access to them.

Asked to comment on the case, Davies said he had not been authorised to do so. He said he would pass on the Post’s request for an interview to the Chan brothers.

Kevin Dove, a spokesman for KPMG in Canada, said client confidentiality prevented the firm from commenting.

Lyon said that the Chan brothers were previously audited in 2005, but neither of them disclosed their connection to the Isle of Man companies.

Both Tom and Caleb Chan are routinely hailed on various rich lists as Canadian-dollar billionaires and among Canada’s wealthiest people. But Caleb last filed a Canadian resident tax return in 2013, while Tom last filed in 2009, said Lyon.

Both were Canadian residents when they took part in the offshore company structure, Lyon said.

Caleb Chan is currently believed to live in Hong Kong, where he has recently been active on the charity scene.

In addition to the Chan brothers and KPMG, the crown’s action requests compliance from Hong Kong lawyer Gregory Chan, who acted for the brothers, and his law firm, Lau, Wong and Chan.

Gregory Chan, no relation of the brothers, was their “long time friend and trusted personal adviser”, says the crown, and was the trustee of the Hong Kong trusts that gifted assets to the IOM firms.

His firm acted for the Chan family since the 1970s, but because of his “personal relationship” with Chan Shun, and “the informal nature of Hong Kong legal practice”, there was never a formal retainer agreement, the brothers say.

Davies says in his memorandum of fact and law that “[the] inviolable nature of solicitor-client privilege is well-enshrined in Canadian jurisprudence”.

“The overzealous aspirations of the Applicant to pierce the bona fide legal privilege of the Chan Respondents should be denied,” he said.