British Columbian startup pioneering bank ownership through crowdfunding

Montreal’s Impak Finance is the first Canadian bank to tap Internet to raise equity capital

By Tyler Orton

Much like AirBnB is reinventing the hospitality sector, Paul Allard imagines Canada’s newest bank will reinvent the country’s banking system.

The president and co-founder of Montreal’s Impak Finance is in the midst of raising capital for what he describes as the “first responsible bank in Canada.”

“Responsible,” Allard said, because it will invest only in “companies that want to solve a social and/or environmental issue by using innovation and making money.”

For any Canadian retail investors wanting in, Impak is relying on Vancouver startup FrontFundr to help raise capital using its equity crowdfunding platform.

It’s the first bank in Canada to sell shares directly to investors through a crowdfunding platform.

Traditional crowdfunding allows groups and individuals to solicit donations to raise money for projects like films or devices.

Equity crowdfunding allows startups to sell its shares directly to investors. But regulations differ between provinces, making it difficult to launch a nationwide campaign in Canada.

In September 2015, FrontFundr became the first platform in Canada to help a business raise capital through equity crowdfunding after six provinces, including B.C., adopted new exemptions allowing companies to sell shares through an approved funding portal.

Since then, FrontFundr has worked with regulators to make its platform available in all jurisdictions except Prince Edward Island and the territories.

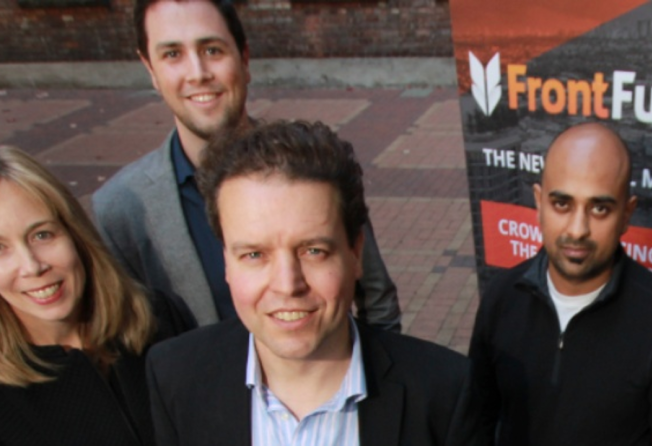

“We’re based in Vancouver, but it’s absolutely key for us to establish and roll out our position as a Canadian platform,” Van Hoeken said FrontFundr CEO Peter-Paul Van Hoeken. “Impak basically put us on the map in Quebec.”

Impak set out to raise C$500,000 (US$376,333) in October by putting up 6.25% equity through FrontFundr.

It raised C$425,000 (US$319,873.60) in 24 hours and that tally has exceeded C$1 million (US$752,669) from 1,500 investors ahead of the December 15 closing of the campaign.

Van Hoeken said the majority of investors are from Quebec, “so it’s totally changed the demographics of our user base.”

Allard said using a crowdfunding platform might seem off the beaten path for a bank, but it’s in line with Impak’s mandate to promote collective governance and ethical investing.

Impak is modelled on the Dutch bank Triodos, which has billed itself as a pioneer in ethical banking since its founding in 1980. It invests members’ money only in businesses it deems to have social benefits, such as solar energy or organic farming.

Allard said Impak will give members seven options ranging from sustainable buildings to aquaculture when deciding where they want their money invested.

“You’ll be able to see exactly where we invest and where we do the loans in each of the companies and trace them [with] 100% transparency,” Allard said.

A single Impak share costs C$1 (US$0.75), but the minimum buy-in for investors is C$100 (US$75).

While credit unions subscribe to the one-member, one-vote principle, Impak investors must agree to give away their voting rights to a foundation.

Investors are permitted to vote for board directors elected to the foundation, which is responsible for ensuring members’ money goes into social impact investments.

B.C. startup pioneering bank ownership through crowdfunding