‘If I kissed that one, would it lead to more?’ US housing chief investigated for sexual harassment

Mel Watt, the regulator of mortgage giants Fannie Mae and Freddie Mac, was accused of asking an employee about a tattoo on her ankle, saying, ‘If I kissed that one would it lead to more?’

This story is being published by the South China Morning Post as part of a content partnership with POLITICO. It was reported by Victoria Guida, Katy O’Donnell and Lorraine Woellert, and originally appeared on politico.com on July 27, 2018.

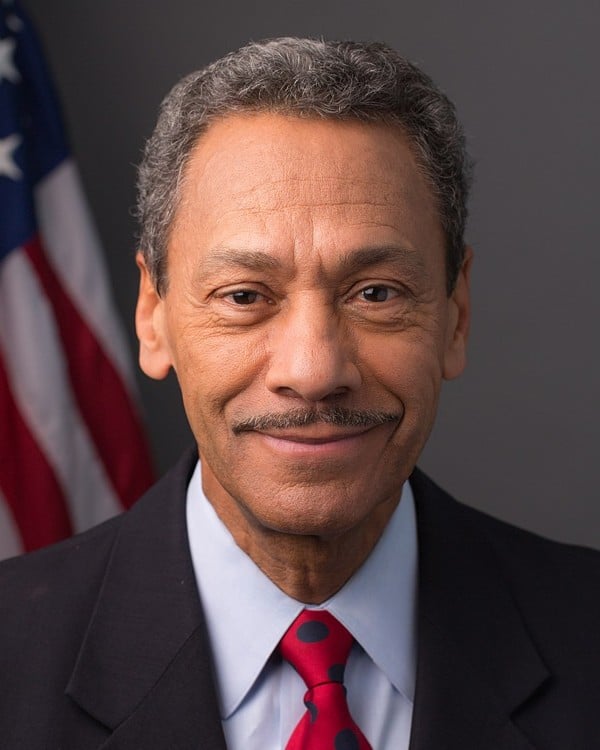

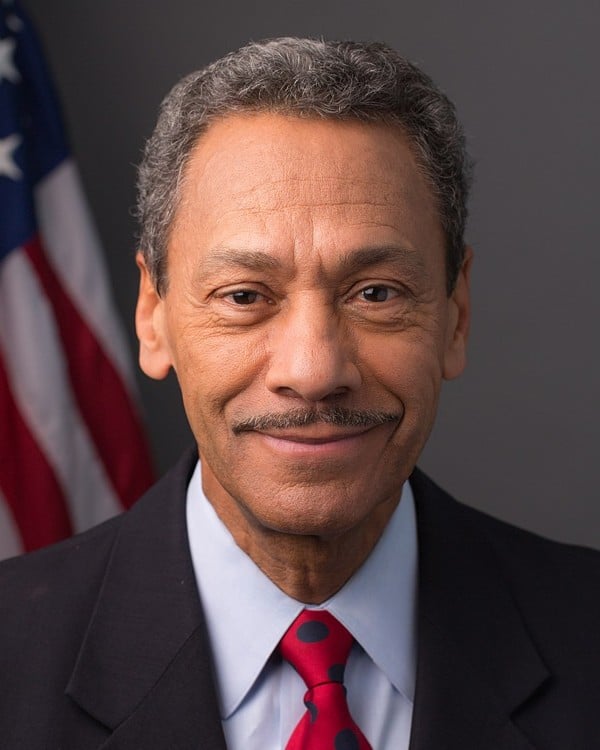

Mel Watt, the powerful regulator of mortgage giants Fannie Mae and Freddie Mac, is under investigation for alleged sexual harassment of an employee.

A Federal Housing Finance Agency staffer accused Watt, the FHFA director, of repeatedly making inappropriate sexual advances when she tried to discuss career and salary concerns.

The conversations included a 2016 meeting during which Watt steered the conversation into a discussion of his feelings for the woman, according to documents and partial transcripts obtained by POLITICO. In a separate encounter, Watt asked about a tattoo on her ankle, saying, “If I kissed that one would it lead to more?”

The employee’s lawyer, Diane Seltzer Torre, confirmed the investigation after POLITICO received copies of the documents related to the case.

The employee has filed an Equal Employment Opportunity (EEO) complaint.

“There is an investigation in progress,” Torre said. “Our preference is to let that investigation proceed.”

POLITICO is not naming the employee, who requested privacy during an ongoing investigation.

Through an FHFA spokeswoman, Watt, 72, released a statement calling the leak of documents political.

“The selective leaks related to this matter are obviously intended to embarrass or to lead to an unfounded or political conclusion,” Watt said in an email.

“However, I am confident that the investigation currently in progress will confirm that I have not done anything contrary to law. I will have no further comment while the investigation is in progress.”

An investigator working for the US Postal Service, which is handling the case, declined to comment. The FHFA inspector general’s office also declined to comment.

Watt, a former Democratic congressman from North Carolina, was appointed by President Barack Obama in 2014 to lead the independent agency and is in the final months of his five-year term.

The FHFA oversees the US$5.4 trillion mortgage portfolio of Fannie and Freddie, the mortgage guarantors that stand behind most of the US housing market. Fannie and Freddie buy mortgages, wrap them into securities stamped with a government-backed guarantee and sell them to investors.

The employee, currently a special adviser at FHFA, has been at the agency since December 2014.

There are four types of attraction: emotional, spiritual, sexual or of friendship. So, the exercise is to find out which one exists here

In a transcript dated April 2016, a person identified as Watt arranged for the two to meet outside the office “because of perceptions.” The conversation took place on the drive from the FHFA office to the Rosa Mexicana restaurant in Washington.

“Well, you probably want to know what I wanted to talk to you about,” Watt said. “I mentioned to you there is an attraction here that I think needs to be explored. In my experience there are four types of attraction: emotional, spiritual, sexual or of friendship. So, the exercise here is to find out which one exists here.”

The woman tried to shut down the conversation.

“If I gave you that impression in any way, that was not intentional,” she said. “My impression was that you wanted to discuss the work-related items I’ve been talking to [a superior] about. But, if that’s not the case, then I think I should take you back to FHFA. Because I don’t want any confusion here.”

Later, in a transcript dated June 17, 2016, Watt asked the employee about a tattoo on her ankle and suggested kissing it.

“Is that what we’re here to talk about?” the employee asked. “Because I already told you I don’t want to have conversations like that with you.”

“No, no,” he said, and then immediately redirected the conversation to “resolv[ing] the pay situation you’ve been bringing up.”

The employee claims that a promotion was withheld from her because she reported the harassment, according to documents.

In a third conversation dated November 11, 2016, Watt asked the woman “why you’ve rejected my advances”.

When she told him she was in a relationship, Watt said: “I love my wife too. Having an attraction for someone else doesn’t have to mean you don’t love them.”

Under EEO guidelines, a federal agency has 180 days to investigate a complaint before the accuser can file a lawsuit. The investigation into Watt has been under way for at least a month, according to the documents.

Fannie Mae and Freddie Mac have been under government conservatorship since 2008, when the Treasury seized control of the companies to prevent their collapse during the housing crisis.

During Watt’s tenure, the companies have been expanding their footprint and developing new mortgage and lending products, raising concerns among Republicans and some Democrats. The FHFA also is facing protracted litigation by hedge funds over the future of the two companies, which remain under government control a decade after the collapse.

Watt came to the job after two decades in Congress, where he was investigated and cleared in 2010 by the Office of Congressional Ethics for fundraising efforts during debate over the Dodd-Frank financial overhaul bill.

A year later, Watt introduced legislation to cut ethics office funding by 40 per cent. That measure failed.