Hong Kong’s success as a financial hub brings new opportunities for fintech firms to up their game

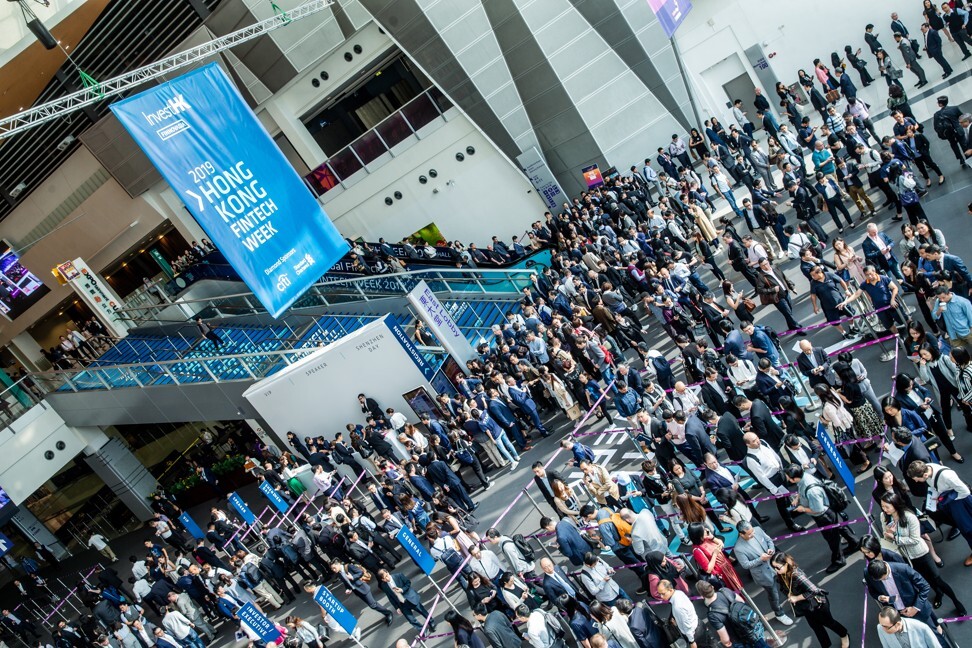

- Hong Kong FinTech Week brings fintech founders and investors together, as well as established financial institutions and regulators

- Event provides networking opportunities for local and global fintech firms seeking funds to scale up, as well as decision makers at financial institutions

Over the past few years, Hong Kong has claimed its place as the world’s pre-eminent fintech hub. The city is now home to more than 600 fintech companies across segments as diverse as personal finance, wealthtech, insurtech, payments and regtech – or audit, risk and regulatory compliance – drawing start-ups and established firms alike.

The return of the annual Hong Kong FinTech Week in November places this success firmly in the spotlight. Already one of the most important events on the global fintech calendar, it is expected to attract more than 17,000 senior executives, including some 250 speakers.

Key to the success of Hong Kong FinTech Week – much like the achievements of Hong Kong itself – is the will and know-how of bringing major financial and technology players together. These include not only fintech innovators, but also established financial institutions, regulators and academics.

“Hong Kong’s fintech success is in large part due to the breadth and depth of our financial services industry and our entrepreneurial culture,” says King Leung, head of fintech at InvestHK. “Together with supportive government policies and regulators, and substantial pools of private investment, our ecosystem has become a magnet for global start-up and scale-up companies.”

Opportunities to scale up

Hong Kong’s reputation as a global financial powerhouse means there are ample opportunities for newer fintech firms to network and secure collaborations and funding.

Some 270,000 financial services professionals work in Hong Kong, which translates into a deep fintech talent pool. But it is not only the volume of talent that counts. The city provides a vast supply of diverse and skilled manpower, particularly when it comes to fintech expertise.

“We are able to access a lot of crypto industry financial talent here … which is why we chose Hong Kong to be one of our frontline offices,” says Toya Zhang, deputy chief operating officer at cryptocurrency exchange AAX. “We want to attract global users on our platform, and Hong Kong’s advantage is the mixed culture of talent – people with backgrounds from across Asia, the US, Europe and Australia, which helps extend our global reach.”

Then there’s the access to funding and support that Hong Kong offers. The city has a diverse funding landscape for start-ups, involving both the public and private sectors, with venture funding on offer for scale-ups. Hong Kong has the second-largest private capital pool in the Asia-Pacific region, after mainland China, attracting over HK$170 billion (US$21.85 billion) in funding last year, according to private equity and venture capital firm AVCJ.

Meanwhile, the thriving Greater Bay Area (GBA) offers exciting opportunities for fintech companies looking for new markets. Initiatives such as the cross-border Wealth Management Connect, which launched in September, could be crucial for mainland financial players who wish to gain a foothold in Hong Kong.

“From an HSBC point of view, we see this as a really important trend, given that the Greater Bay Area has 86 million people and is an economic powerhouse,” says Dan Roberts, global head of business banking at HSBC Commercial Banking. “Our research projects that the Greater Bay Area GDP will grow to around US$4.6 trillion by 2030, which Hong Kong is very well positioned to tap into.”

Combining the old and the new

For fintech companies, perhaps the primary advantage of Hong Kong’s status as a financial hub is that it allows them to collaborate with large financial institutions and gain access to their customer base, in turn unlocking new opportunities to scale up.

As one of Hong Kong’s largest banks, HSBC is a good example of how a traditional powerhouse can work with fintech firms to develop mutually beneficial partnerships.

“We are still very much a bank-driven market, so we need banks to participate in fintech,” says Maggie Ng, head of wealth and personal banking at HSBC. “We do have the customer base, we do have the infrastructure, and we do have the talent to make a difference. What is going to move the needle is to have the big banks to lead by example.”

HSBC is already ahead of the curve in this respect. The bank works with fintech firms in three main ways, Roberts says. First, integrating into services and platforms to enable greater efficiencies for HSBC customers. Second, incorporating fintech into its own customer proposition and opening up its huge customer base to fintech firms. And finally, mentoring fintech start-ups and supporting their growth through partnerships with innovation hubs and start-up ecosystems.

A company that has benefited from this approach is FreightAmigo, a Hong Kong-based logistics start-up, which the bank first met at the HSBC-sponsored API EcoBooster programme.

“We were very impressed with the team and their product solutions, so we’ve actually incorporated their product into a platform we call HSBC Smart Solutions. This is an ecosystem of tools and capabilities that we provide to our small and medium-sized business customers in Hong Kong, and increasingly in other markets as well,” Roberts says.

HSBC has joined the Global Fast Track Programme under the Hong Kong FinTech Week umbrella as a Corporate Champion, to explore other solutions offered by global fintech companies.

Networking and more

The five-day event will provide an ideal setting for companies such as HSBC and FreightAmigo to continue exploring these mutually beneficial collaborations.

“Hong Kong FinTech Week is the perfect forum for participants to demonstrate, to accept and embrace fintech,” Ng says. “It is a chance for them to be transparent, to let the audience and the other participants know what areas they care most about, as each bank and each participant will have a different focus, and to share the hurdles they face.

“But it is also a chance for us to show what we have been doing so far, and show why fintech firms would want to partner with HSBC. HSBC is not necessarily participating this year just to showcase our success, but also to share our capabilities and explore how each of us can leverage on each other.”

For Zhang, the attraction of the event is all about AAX’s position as a global-facing company with an office in Hong Kong. “Hong Kong FinTech Week is not just a Hong Kong event,” she says. “It is a global event, which we can leverage to impact a global audience. This year, they have both physical and virtual platforms, which means we can further maximise our reach to these global audiences.”

Join some of the biggest names in global finance and technology at Hong Kong FinTech Week 2021. This year’s event combines a conference in Hong Kong with online access from anywhere in the world, and features a stellar line-up of speakers including People’s Bank of China governor Yi Gang, Alibaba Group co-founder and executive vice-chairman Joe Tsai, BlackRock chairman and CEO Larry Fink, and Citi CEO Jane Fraser. The conference will be held from November 3-4 at the Hong Kong Convention & Exhibition Centre and is open to both in-person and virtual attendees. There will also be an additional online-only conference on November 5, where many sessions from global iconic leaders will be broadcast for the first time during Hong Kong FinTech Week.

Discover more and purchase tickets at www.fintechweek.hk.