Global fixed income repricing creates opportunities for Asian bonds

[Sponsored Article]

Rising interest rates have created challenges for global fixed income markets, but the resiliency and solid fundamentals of Asian bonds still provide investors with long-term opportunities.

US Treasury yields have risen due to a stronger US dollar, increased inflation expectations, and the US Federal Reserve’s interest rate actions. The US 10-year Treasury yield rose above the closely watched 3% threshold in April and May, the first time it has done so in more than four years, and yields have hovered around the 3% level since1. Investor expectations have also evolved from that of quantitative easing to economic normalization, higher inflation, and rising interest rates after a decade of anaemic yields.

Historically, higher interest rates have dampened Asian bonds and a stronger US dollar weighs on Asian currencies. These factors have led to a substantial repricing of risk within the region’s bond markets since early 2018. Spreads have widened and Asian credits have become more differentiated. In other words, the “easy carry trade” has ended and capital outflows have increased. Returns from buying into bond markets for “yield-pick up”, while ignoring economic and credit fundamentals, have dried up.

Asian Bonds Stand Out

However, Asian fixed income still stands out as a compelling option in this complex market environment. The Asian fixed income team at Manulife Asset Management believes higher Asian bond yields and wider Asian credit spreads can still provide investors with attractive investment opportunities. Asian economies display higher rates of growth and stability than many other emerging markets, as well as a better external position. Asia’s higher credit ratings also rank it above other emerging markets.

Indeed, recent market reaction has been less severe when compared to other episodes in recent years as measured by the spread differential with US 10-year Treasuries. This suggests that Asian bonds enjoy better fundamentals in comparison to previous crisis periods.

Analysis of data from 2003 through February 2018 shows that when US 10-year Treasury yields increased by 1% or more, returns for Asian and emerging market bonds have generally been positive. This is in contrast to the mostly-negative performance of US bonds2.

Fundamentally, the region provides a unique array of markets with a stable macroeconomic framework and robust fundamentals. Investment opportunities are expected to remain plentiful over the long-term as Asian governments and companies increasingly seek sources of financing.

Three Sources of Return

Asian bonds provide three attractive sources of return: interest rates, credits and currencies.

The Chinese bond market still offers notable opportunities to investors. Since the onset of global trade tensions, the Chinese government has introduced more accommodative monetary policy and fiscal policy to shore up economic growth. This policy change has improved onshore financing conditions and led to market repricing. In this environment, some state-owned enterprises (SOEs), as well as policy-bank debt offerings, look appealing.

When investors sold off emerging markets in the summer, Indonesia came under pressure with capital outflows placing additional pressure on an already weakened Rupiah. Since then, Bank Indonesia has raised interest rates 125 bps in three months to support the currency.

However, the fixed income team at Manulife Asset Management remains constructive on Indonesia due to its strong economic fundamentals and sound fiscal management policies, as well evident in Fitch’s upgrade of Indonesia’s sovereign credit rating to ‘BBB’ in late 20173. In the longer term, the inclusion of Indonesian bonds in the Bloomberg Global Aggregate Index can also attract additional investment flows. Recent volatility may present buying opportunities.

On the currency front, the stronger US dollar has negatively impacted Asian currencies. If the existing dynamic continues, mean reversion could take place, creating investment opportunities in Asian currencies.

Key Risks to Watch

Global trade friction is on the rise as the US takes a tough stance with key trading partners. These increased trade tensions pose a significant risk to economies around the world going forward. Increased market volatility could negatively impact Asian bonds.

Inflation is becoming a risk with the US economy showing considerable strength. Manulife Asset Management expects US inflation to peak in fall this year, within the Fed’s target rate of 2%, but a significant uptick in inflation may still catch investors off-guard. This could lead to a further repricing with higher-than-expected yields and amplified volatility in the Asian fixed income markets.

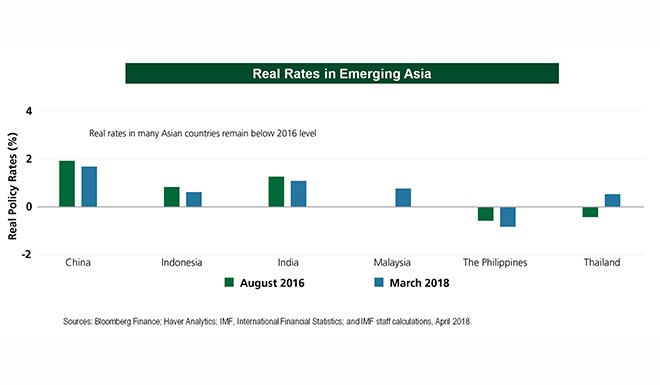

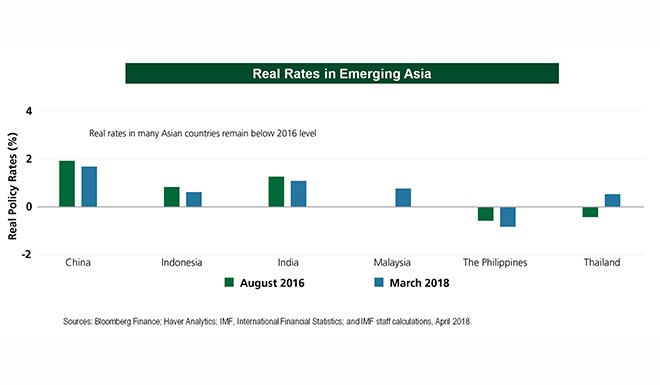

Rising regional interest rates is another key risk. Three Southeast Asian central banks have already hiked rates. Indonesia did so to stabilize the currency and prevent further capital outflows, while India and the Philippines took action to stem rising inflation.

Although nominal rates are rising in Asia, real rates for many countries remain below 2016 levels. This suggests potentially more room to use interest rates as a tool to balance the need for economic growth while managing inflation and stemming capital outflows.

Asia’s Diverse Opportunities

Asian economies continue to display strong growth prospects, fiscal discipline and high levels of foreign reserves. Because Asia is made up of 14 different economies, markets and currencies, each at different stages of economic development, the region’s fixed income asset class brings significant diversification to any portfolio.

Manulife Asset Management believes that Asian fixed income offers investors a compelling and long-term source of income option during this challenging period for global markets.

Click here to get more information on investing in Asian Fixed Income.

Important information: Investment involves risk. Investors should not make investment decisions based on this material alone and should read the offering document for details, including the risk factors, charges and features of the product. This material has not been reviewed by the Securities and Futures Commission. Issued by Manulife Asset Management (Hong Kong) Limited.

1 Bloomberg, Factset, Manulife Asset Management, as of 31 May 2018.

2 Bloomberg, 31 January 2003 to 28 February 2018. Asian bonds represented by JP Morgan JACI index and JP Morgan JADE broad index; emerging market bonds represented JP Morgan Global EMBI Global Composite index and JP Morgan GBI-EM Global Diversified Composite index. US bonds represented by US Aggregate Bond index.

3 Reuters, ‘Fitch Upgrades Indonesia to 'BBB'; Outlook Stable’, 20 December 2017