8 things to consider when building a sustainable international business

- Survey shows 74 per cent of tech and internet start-ups fail because of premature scaling

- A successful expansion strategy involves an interplay of in-depth market assessment, talent recruitment and seamless scaling of internal processes to cope with the demands of an international business

[Sponsored Article]

The number of start-ups in Hong Kong continues to increase. A report by InvestHK shows that last year, Hong Kong’s start-up ecosystem grew by 18 per cent, generating a 51 per cent surge in jobs created.

Much of the optimism surrounding start-ups in tech hubs such as Singapore and Hong Kong lies in the business-friendly environment and access to a range of global investors and incubator programmes.

However, starting a business is one thing – making sure it grows in a sustainable and competitive manner is another.

According to a survey by research firm Startup Genome, 74 per cent of tech and internet start-ups fail as a result of “premature scaling” – spending money beyond their means before getting the right product and market fit. As more small businesses expand their operations regionally and internationally, it is increasingly important to be aware of the key factors necessary to scale successfully.

Here we look at the top eight things to consider as you chart your business for growth.

1. Adopting a data-driven approach to identify new markets

With cloud-based accounting tools that provide real-time visibility into your financials and performance across different functions, business owners and their advisers are in the perfect position to identify pitfalls and opportunities that would have otherwise been missed.

By leveraging financial data, you will be able to see where your revenue streams are and which geographies give you the highest return on investment (ROI). This is especially so if you run a digital business with a diverse client base.

By assessing demand from each market, you will be able to strategise how to expand your market share in a key market and, likewise, whether it makes sense from the resource perspective to continue your efforts in a market that gives you the lowest returns.

Externally, it is just as important to establish the right connections with in-market advisers who will be able to offer invaluable insights into a region’s readiness for your products and services and even connect you with the right people as you lay your foundations in the new market.

Internal and external data, coupled with the right network, will help you navigate the challenges as you move into uncharted territories.

2. Be prudent with cash flow management and fundraising

Research by Xero, a cloud-based accounting software platform, shows that of the 50,000 businesses that fail each year owing to cash flow issues, 65 per cent of these had problems with access to funding.

Money and time are obviously finite resources, so it’s important to allocate them judiciously and have visibility of your cash flow.

When raising funds from venture capital and private equity, you’ll need to know your financial performance inside out and justify the amount of investment you are seeking.

Cash is the lifeblood of all businesses so it is important to keep the books neat and up-to-date to facilitate loan assessment when the time calls for it.

Having your accounting system based in the cloud will ensure it is easily integrated to have real-time financial data and business performance at your fingertips, and relevant data seamlessly shared with banks and alternative lenders when you apply for loans.

It is important to involve your advisers in the early stage as they have the expertise to identify areas for growth. In the case of the accountants and bookkeepers, they would be able to provide insights on cash flow patterns, pricing and inventory management.

Analytics tools integrated with your accounting software can reveal similar characteristics among customers with a higher average revenue per user (ARPU).

Financial analysis can also determine when it’s time to introduce a new product or service, or when to create membership/subscription tiers to maximise profit.

3. Review pricing model for new markets

When expanding into a new market, it’s important to review your current pricing model, conduct market study and competitor analysis, to derive a suitable pricing strategy.

Arriving at an optimal price point in a new market usually boils down to doing your due diligence, projecting your expenses and targeted revenue to calculate product markup and margins that will allow you to make a profit.

It is also critical to assess the price point based on local market conditions and spending capacity of your local target audience to ensure you are not pricing yourself out of the market entirely.

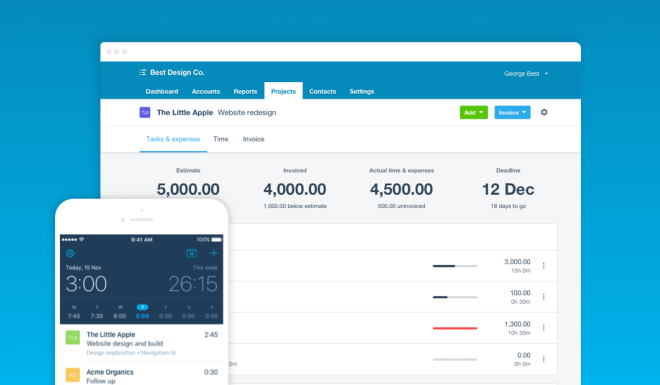

For professional services, including accounting firms and consultancies, they can track the number of hours each employee works using tools such as Xero Projects, and determine the manpower cost of each project.

This allows the business to come up with a cost analysis of how much it will have to spend to complete projects of varying complexity and from there, price the services accordingly.

4. Strengthen talent acquisition and retention strategy

One of the biggest concerns employers have about Hong Kong’s start-up ecosystem is talent.

A report by McKinsey and Company, citing research from Manpower Group and LinkedIn, found that 69 per cent of Hong Kong businesses had problems finding the right talent.

However, another dimension you need to anticipate is how much you can afford to pay new staff in the region. Establishing connections with local advisers, including accountants, bankers and lawyers, will go a long way to making informed financial decisions in this area.

Remember, a remuneration package is not limited to dollars and cents. Businesses offering non-tangible benefits relating to culture and welfare have proven attractive for the modern workforce.

The same McKinsey report shows that young employees in Hong Kong value flexible hours and opportunities to develop their careers. Providing these benefits may allow you to offer a relatively smaller salary and still keep employee satisfaction (and therefore retention) high.

In the technological age, you can also tap into cloud solutions to do away with routine administrative tasks and free up your talent’s time to focus on more strategic, analytical work, thereby creating greater job fulfillment.

5. Scaling internal processes to cope with the demands of running a global business

As your business grows and scales, a common dynamic that slows – or even impairs – its progress is the complexity of internal processes. The larger your business becomes, the more likely your inventory, accounting, human resources, sales and other administrative processes will get more complicated.

One way to get around this problem is with technology such as Software-as-a-Service (SaaS) solutions, which allow you to scale easily as you expand.

A cloud-based solution with built-in systems integration, for example, can streamline and integrate accounting, payroll, expenses, inventory and other related functions onto one platform. This also has the effect of eliminating silos that slow down communication, impair visibility and create management issues as your company scales.

6. Abolish routine work for more effective time management

Another reason to invest in technology is to save time. Data automation and cloud technology streamline routine work, allowing your staff to save time on repetitive administrative processes and focus on tasks that generate revenue and deliver more value to clients.

In fact, firms in Hong Kong spend 80 fewer hours per year on clients that use digital accounting systems compared with those who don’t, according to Xero’s Accounting Industry Report 2019.

Moving your database and processes to the cloud allows you to run your business from virtually anywhere, all while being digitally connected to your team, customers, banks, suppliers and government agencies.

It also allows you to integrate apps such as time-tracking tools and e-commerce portals with your accounting software, thus saving time by automatically syncing and recording data. This levels the playing field with larger enterprises and provides you with insights to make informed decisions faster.

It is also helpful if your accounting software is equipped with the latest technologies to facilitate automation and reduce human error.

For example, Xero’s personalised machine learning systems delivered more than 750 million invoice and bill code recommendations, and more than 250 million bank reconciliation recommendations from March 2017 to May 2018.

These recommendations effectively help to identify errors, suggest corrections and ultimately reduce time spent on administrative tasks.

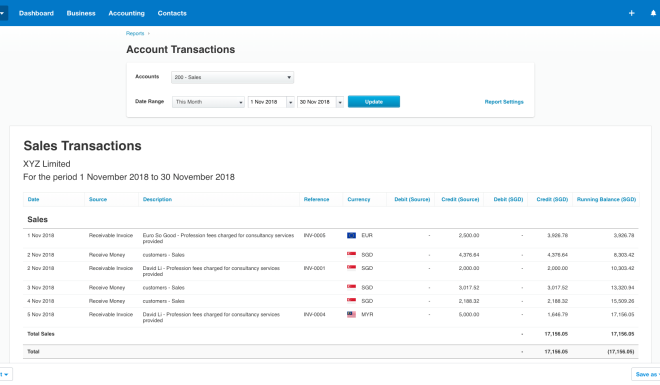

7. Managing multiple currencies

For all the benefits of scaling your business to the global market, there’s also the problem of handling multiple currencies, which comes with its own risks.

While large multinational organisations have entire accounting departments and specialists to handle multiple currencies, small business owners don’t have that luxury, making them susceptible to exorbitant fees associated with taxes, regulation and currency fluctuations.

SME owners can instead turn to accounting platforms that support multi-currency transactions and real-time tracking.

Tools such as Xero are not only integrated with money transfer services like Transferwise, but also they perform automatic currency conversions (based on the latest exchange rates) when carrying out tasks including making payments, receiving bills, or sending invoices and purchase orders.

8. Navigate in-market compliance issues

According to a report by CB Insights, legal or compliance issues are one of the top 20 reasons why start-ups fail.

If you’re scaling your business by moving into a new market, working with a trusted in-market adviser, such as an accountant or lawyer, will help you navigate local regulations and compliance matters.

Hiring a local accountant will take the stress out of complying with legal and government matters, including taxes, business structures, payroll, annual statement of accounts and audits.

Scale smart with proper planning

While scaling a business can be profitable, it also presents several challenges.

Before beginning any business expansion, you will want to create a growth plan that accounts for all the factors mentioned above.

At the same time, consider how accounting and finance strategies can help you scale your business with ease. This will minimise risk and maximise your odds of success, especially if you are expanding into a new regional market.

Learn more on the Xero website