Hong Kong to add 96,000 homes over three years, but will they halt runaway housing prices?

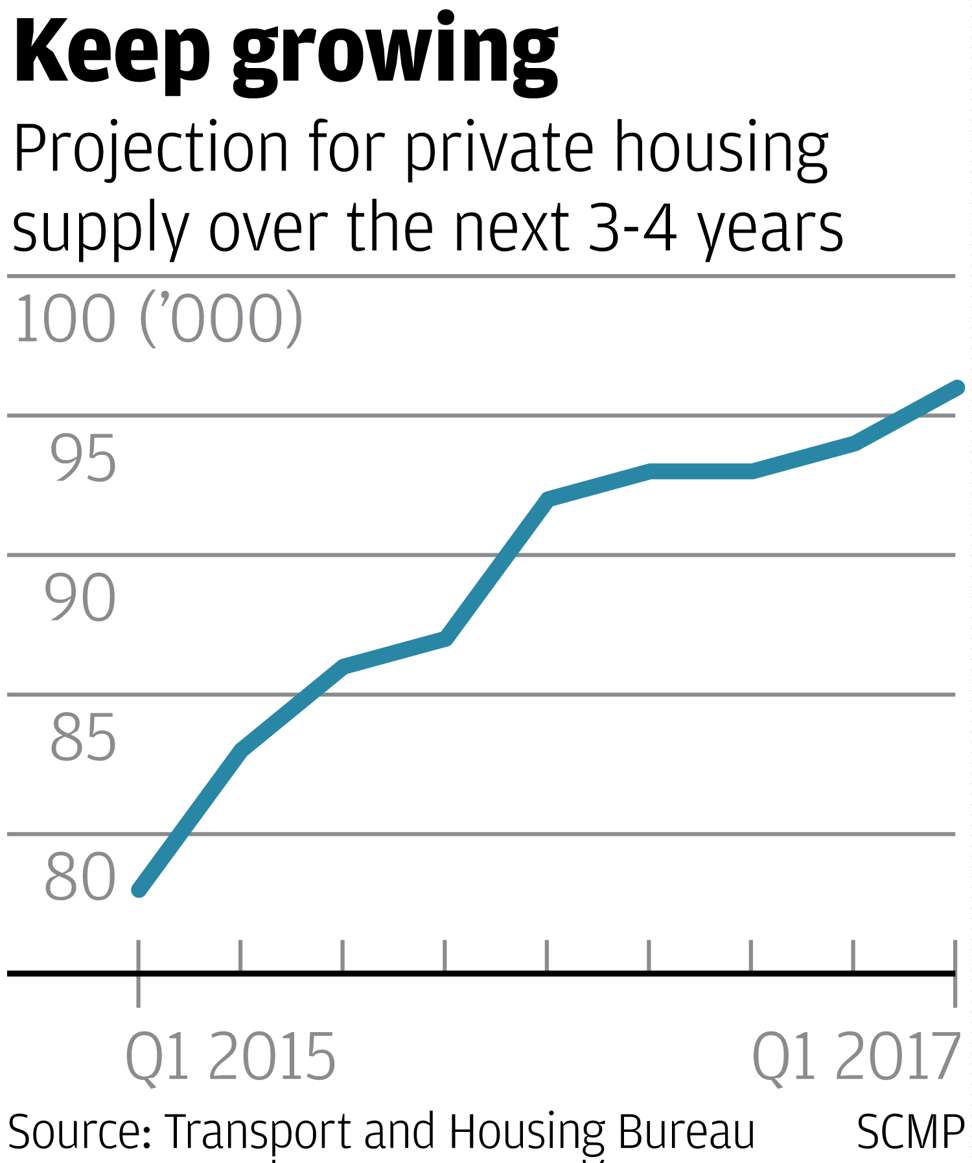

The supply of new private housing will rise by 2 per cent to a record 96,000 units over the next three years, according to government data, but the new properties will do little to dent the record prices of housing in the city.

A record 96,000 units will be added to Hong Kong’s supply of private housing over the next three to four years, according to the Transport & Housing Bureau’s latest quarterly data, an increase of 2 per cent from the previous projection.

The modest increase, which reflects the Hong Kong government’s determination to accelerate land sales to bolster flat supply, will do little to reverse the surge in housing prices that’s made the city the world’s most expensive urban centre, some analysts said.

Hong Kong’s home price index, which tracks prices in the secondary market, rose for the 12th consecutive month in March, advancing 2.2 per cent to a record 319.8, according to data by the Rating & Valuation Department.

“Home prices are unlikely to see a significant drop, unless there are unexpected external factors that adversely affect Hong Kong’s economy,” said Knight Frank’s senior director Thomas Lam. “Prices will be supported by strong demand from end users but growth pace may slow down.”

The price surge and additional supply underscore the challenges facing incoming Chief Executive Carrie Lam Cheng Yuet-ngor in addressing what’s been labelled as the biggest public concern among the electorate. In the last 12 months, median home prices in Hong Kong have surged beyond the affordability of many new wage earners and school leavers, while the sizes of newly launched properties have shrunk.

The average size of newly built apartments has shrunk 40 per cent to 600 square feet in 2016, from 1,000 sq ft in 2013, according to the Building Authority’s data.

“Developers are building smaller flats, because these sizes are more affordable” to new buyers, said JLL’s regional director of valuation Cliff Tse.

As many as 10 groups of buyers are bidding for two units each, with one customer budgeting HK$80 million (US$10.3 million) to buy three units, said Centaline Property Agency’s Asia-Pacific vice-chairman for residential Louis Chan.

As many as 61,000 units of private housing are under construction in Hong Kong, according to government data. Up to 27,000 units have been earmarked on land sites sold by the government where construction work is pending, while 8,000 units remain unsold in completed housing projects around the city.

Property prices, which have risen faster than forecast, will peak in the first half of 2017, according to Nomura’s property analyst Joyce Kwock.

The government’s cooling measures have pushed home seekers flocking to the primary market, where an array of flexible financing schemes, discounts and sweeteners are on offer to entice buyers, said Midland Realty’s chief analyst Buggle Lau.

“The government should unlock the existing flat supply in the secondary market by relaxing the restrictions to cool the red hot market,” he said.