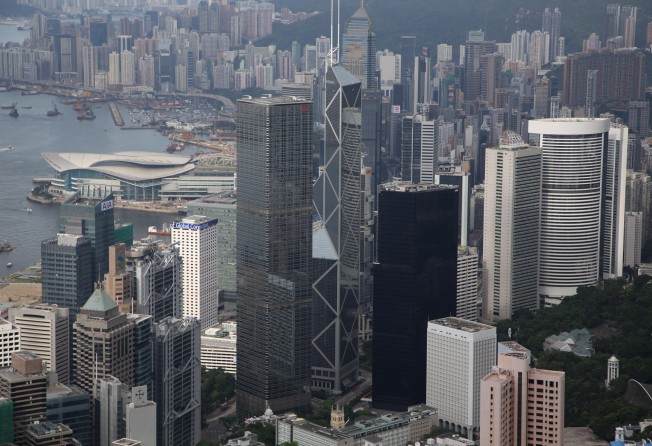

Commercial property deals in Hong Kong expected to decline this month

Commercial property activity is likely to be limited this month compared with August when Cheung Sha Wan sales boosted transactions

Commercial property deals are expected to fall away this month after a jump last month that was driven by the phase two release of Billion Plaza in Cheung Sha Wan.

More than 70 of the deals were at Billion Plaza, said Patrick Chow, Ricacorp head of research.

"Since there is no new project on sale this month, the total number of commercial property deals will return to the levels of July. There are only a few buyers in the commercial property secondary sales market at the moment," said Chow.

If the Legislative Council passes the Stamp Duty (Amendment) Bill, stamp duty will double for property sales exceeding HK$2 million transacted on or after February 23, the day after the anti-speculation measure was announced. Apart from the doubling of stamp duty on the purchase of non-residential properties, concerns that rentals had peaked and could now start falling had also dampened investor interest, Chow said.

International property consultancy DTZ said demand for business space was sluggish in the third quarter so far, with overall "negative absorption" of 191,928 sq ft in the period, against net absorption of 114,296 sq ft in the second quarter.

Negative absorption is the amount of space left when tenants move out of office space and it is not taken up by new tenants moving in; net absorption is the amount of space taken up after accounting for tenants that vacate their offices.

Overall office rents have declined 12 per cent from a peak in the third quarter of 2011.

"The decrease in the number of initial public offerings in Hong Kong this year has been a sign of an underlying lack of business confidence and this has in turn affected demand for business space," said Alva To Yu-hung, managing director for Hong Kong and head of consulting for North Asia at DTZ

So far, Office rents in the third quarter have dropped 0.8 per cent from the second quarter to HK$60.80 per sq ft per month; the average effective rent in Central dropped 1.2 per cent to HK$103 per sq ft per month, compared with HK$104.20 in the second quarter, said DTZ.

Eric Ong, a director of commercial property sales agency Midland IC&I, said he did not expect demand in the office market to improve until the end of this year or early next year. "Despite sales volumes remaining at low levels, owners are not in a panic-selling mood," he said.

Office prices have dropped 5 per cent since the government announced the stamp duty rise.