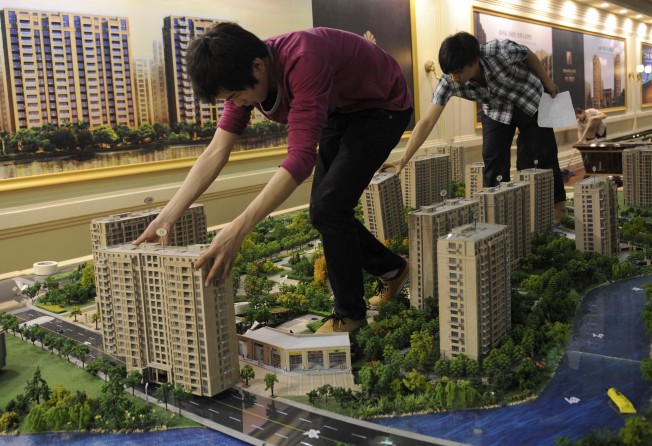

New home market in top mainland China cities softens in April

Market has cooled much faster than expected, with price discounts spreading to more cities

New home prices either rose more slowly or fell more quickly last month from a year earlier in 10 key mainland cities tracked by the SCMP-Creda index, adding to signs the mainland's real estate market is losing steam.

Prices continued to rise in seven cities but fell in three, including Tianjin and Chengdu in Sichuan province.

Beijing led the gainers, with an increase of 18.7 per cent, but the pace was sharply down from March's surge of 34.5 per cent.

The second-tier city of Hangzhou in Zhejiang province suffered the fastest decline of 15 per cent, according to the index, the result of a collaboration between the South China Morning Post and China Real Estate Data Academy, a mainland consultancy.

The index, published each month, covers primary home prices, transactions and affordability in 10 major cities - Beijing, Shanghai, Shenzhen, Guangzhou, Tianjin, Nanjing in Jiangsu province, Hangzhou, Wuhan in Hubei province, Chongqing and Chengdu.

"Project launches will increase, and end-users will remain the main buying force [in the next few months]," said Chen Sheng, Creda's dean and a property industry veteran.

Chen said the mainland property market would probably not recover from the slowdown until the second half of next year.

Creda cooperates extensively with government institutions, academic institutes and financial companies.

The latest data showed new home prices dropped in five of the 10 cities last month from March, with Beijing leading the losers with a drop of 7.83 per cent. Guangzhou followed with a decline of 7.78 per cent.

Prices rose the most from March in Chengdu, by 4.1 per cent, followed by a 3.1 per cent gain in Nanjing.

The frothy real estate market started to crack in February when a couple of developers in Hangzhou first cut prices to speed up sales.

However, the market has since cooled much faster than most developers had expected, and price discounts have spread to a rising number of cities.

Transaction volumes slid during the traditionally busy May 1-3 Labour Day holiday, a negative omen for developers hoping for a market revival, despite new launches of projects to increase supply.

The SCMP-Creda index showed transactions recovered in five cities last month from March, including Hangzhou and Nanjing, but slid further in the other five.

The combined transaction volume in these 10 cities fell to 9.03 million sq metres from 9.5 million sq metres in March.

Home affordability improved in all the 10 cities. But Beijing remained the most unaffordable city, with an average new home price of 26,023 yuan (HK$32,300) per square metre.

That means the average new home will cost 17.2 years of a family's annual income, down from 19.3 years in March.