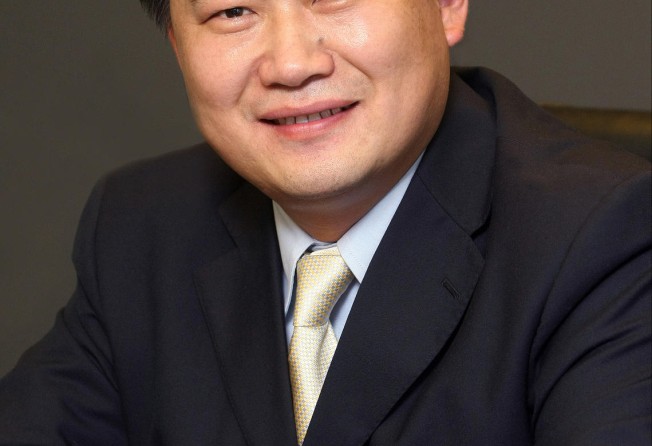

Landsea's Tian Ming leverages green expertise during property downturn

Landsea Group chairman Tian Ming is counting on the company's expertise in green technology and a light-asset business model to ride out the slump, while keeping an eye out for acquisitions

Green-themed developer Landsea Group is keen to acquire a troubled developer with big land reserves, and founder and chairman Tian Ming believes such an opportunity may come over the next year.

Landsea, relying on its expertise in green-building technologies, is also embracing a light-asset business model, which would see it team up with partners in projects in which it may hold minority stakes but would dominate on the development and sales sides. In this case, service charges would become a key revenue stream.

Other developers are also building green homes. Is product differentiation becoming more difficult for Landsea?

Landsea is not the biggest developer but we are the greenest. Unlike other developers which are still testing the concept in a few projects, we are applying green technologies in all the homes we build. Some people talk a lot, but do less. Others fail to generate enough profits to run a sustainable business.

We have devoted ourselves to green property technologies since 2004. We have learned a lot from other countries, including the United States and Europe.

We conduct in-depth research in all our different products. That will help us find a better footing in the market.

You said earlier this year that the correction would last three years. How will green technologies help Landsea survive?

Property transactions will fall and I have said before that this year will be a turning point.

China hit its peak in property sales last year at 1.3 billion sqmetres. Transactions will be on a downward trend. Of course, it will not be a free fall. Under such circumstances, competition between developers will heat up.

Our product prices are higher than others', but we can still sell at a faster pace. Our green homes will enable us to still entice buyers when other developers are struggling and to sell better when others are selling well.

Our main products are not homes for first-time buyers. In recent years, we bought quite a few land parcels targeting first-time home buyers and developed these projects.

There were two reasons for this move: first, before that, all Landsea projects targeted the high-end market. We needed a shift in product mix.

Second, as government intervention became heavier in the past few years, we were vulnerable to purchase restrictions, lending curbs and price caps. So we needed more projects for first-time buyers to generate revenue, while high-end projects were able to protect our profit margin.

I believe restrictive measures will be gradually phased out.

How will you take advantage of the business opportunities in the market downturn?

Under the current market, some small developers do not know how to market their projects. Landsea is willing to buy land from them or develop the projects with them.

Because of our reputation, banks will be willing to help finance the project development. We also have our own fundraising arm.

Do you see any opportunities to buy land now?

We didn't buy much land in the second half of last year as prices were too high. So we have sufficient cash on hand now.

I don't think now is the best time.

The cash strain of the whole industry will probably worsen in the third and fourth quarters. Some small developers, and even some big players, may be in trouble.

We will buy a parcel now if the price is right, but the pace of purchases will not be too fast - just enough to keep our land bank sustainable.

What I am more interested in is an equity stake in developers that have large land reserves. I wish that when such a chance does appear, Landsea has sufficient cash and can team up with good partners such as financial institutions.

So far this year, how is the company's sales performance?

The group's property sales - not the listed firm's (Landsea Green Properties) - grew 35 per cent in the first five months. But we were still affected by the market downturn, as the sales revenue fell 10 per cent short of our target. The cash collection was slower than expected, too. Mortgage loans, released to developers, were slower than last year.

Payment from buyers has remained normal. We often gave some discounts to those who paid full in cash. But we have not resorted to big price cuts.

Are you getting any cash or other incentives from the government?

Many of our projects have been given subsidies by the central government. A project in Wuhan received several million yuan.

But perhaps the government should give direct benefits to the homebuyers.

In our trips to Europe, I found that countries such as Germany and Switzerland have a set of ratings to measure buildings' energy efficiency. These governments are in charge of setting the standards.

Clients buying the most efficient buildings are given benefits including favourable loans and cheaper power bills.