Small Hong Kong developer CSI Properties has lofty ambitions

Rapidly expanding company aims to boost its annual sales to HK$10 billion in five years

With a market capitalisation of HK$3.3 billion, CSI Properties is definitely a small developer. But it has lofty ambitions.

The company aims to achieve annual sales of HK$8 billion to HK$10 billion in five years, or about three times this year's projected sales of HK$3 billion.

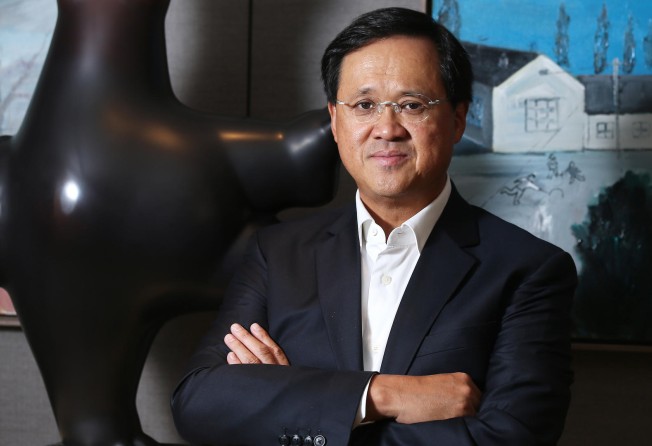

"With property sales of HK$8 billion, it will be quite a scale [for a] property company in Hong Kong," said chairman Mico Chung Cho-yee, who founded CSI in 2003. "We have five projects now on hand and then we will have another five. We are on the way to expansion."

CSI has been expanding rapidly.

On May 13, the company won a commercial site in Kowloon Bay for HK$3.04 billion in a joint venture with Sino Land and Billion Development.

Total investment of the project, in which CSI has a 30 per cent stake, was estimated at HK$4.5 billion to HK$5 billion.

Last month, it won a residential site in Sheung Shui through a government tender for HK$302 million. The site will be developed into six big houses to target affluent individuals or families from Hong Kong and mainland China.

CSI started as a commercial property investor. It diversified into upmarket residential properties under a division called Couture Homes six years ago.

"Profit margins of investing in commercial properties are higher, but supply of attractive properties is limited," Chung said. "However, the government will continue to provide stable supply of residential sites. Diversifying into residential development will make our profits sustainable."

Chung aims to maintain the portfolio of residential and commercial investments at a 50-50 ratio.

CSI plans next month to sell its luxury property, Kau To Highland, located at the luxury residential district in Kau To Shan. With a development area of 50,376 sq ft, the site provides about 20 luxury houses.

The developer is also planning to sell its luxury residential project in Shanghai's Qingpu district.

Last month, the company issued a profit warning, announcing that the group's unaudited consolidated net profit for the financial year to March would reflect a significant decrease compared with the previous year.

"It all depends on when the development earnings [are] to be booked into the profit and loss account," said Chung. "We are not as big as Sun Hung Kai Properties. They have many property projects scheduled to be booked every year, and that maintains profit sustainability. For a small company like us, they should look at our net assets, which keep growing."

In C-Suite, Chung shares his view on how a small developer survives in Hong Kong