China’s push for modern warehouses derailed by local government reluctance

The leasing of warehouses generates less tax than house sales or manufacturing

The development of logistics properties in China faces obvious constraints despite the central government’s vow to speed up construction.

The rapid growth of e-commerce has highlighted a bottleneck in the supply of modern warehouses on the mainland.

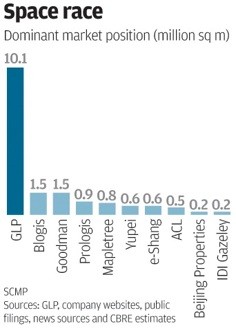

By the end of June, the total area of modern warehouses for nine major logistics operators on the mainland was just 20 million square metres, compared with 370 million square metres in the United States, data from property consultants CBRE shows.

The central government has noticed and has issued a series of guidelines this year to promote the development of a modern logistics sector. However, local governments are less motivated to turn over land for logistics use since the leasing of warehouses generates less tax than house sales or manufacturing.

Meanwhile, major cities are reducing industrial land supply in order to move factories out.

“Beijing’s [city] government has approved nearly zero logistics sites in the past three years, warehouses are in very short supply,” said Michael Siu, executive director of leading Chinese warehouse developer Beijing Properties.

Siu said Beijing Properties’ latest logistics park project in the capital was the city’s last plot of land for logistics. He said local governments preferred to provide land for development by state-backed developers, like Beijing Properties, or foreign developers that had established long-term collaborative relationships with them.

“It is hard for even Cainiao (Alibaba’s logistics arm), to get land,” Siu said.

With no new supply, the vacancy rate of logistics property in Beijing declined to 1.3 per cent in the third quarter of this year, according to CBRE.

Modern warehouses are more efficient and larger, cutting costs for logistics providers compared with smaller, older, unmechanised warehouses. GLP was the first to bring the concept to China 12 years ago.

The industry requires big investments, posing a significant entry barrier for most Chinese developers, which are still comparatively young.

Vanke, one of China’s largest residential developers, announced its entry into logistics property last year but closed its logistics department early this year, and team up with investment firm Blackstone to form a logistics subsidiary.

“Funding is the key for leasing property,” said Vanke’s board secretary Tan Huajie, adding that the central bank’s rate cuts had helped cut funding costs for warehouse investment.

For non-listed logistics property developers, raising money is much harder.

“Some of our competitors hardly survive as their funding costs were up to 17 to 18 per cent,” Siu said. “They are anxious to pursue an IPO.”