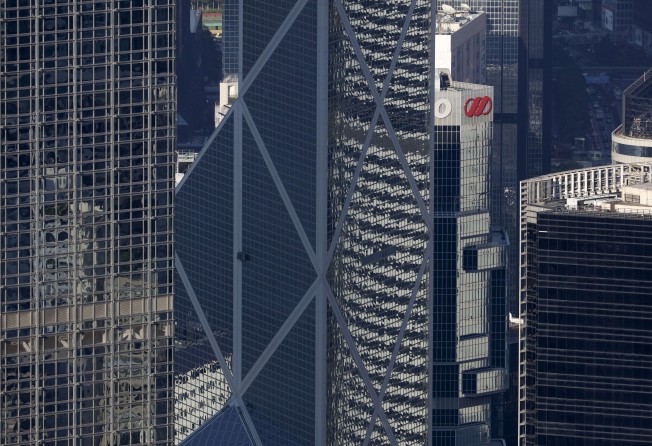

Two thirds of Grade-A offices sold in Hong Kong over past six months snapped up by mainland buyers

Knight Frank says mainland firms paid US$2.9 billion on sites between January and June, 64 per cent of the total office sales transactions value in the city

Two third of Grade-A office properties sold in Hong Kong over the past six months were snapped up by mainland firms, according to new research released on Thursday.

International property consultant Knight Frank said mainland companies paid a total of US$2.9 billion for Grade-A offices from January to June, representing 64 per cent of the total office sales transactions value in the city.

To put that growth in context, over the past decade mainland firms have acquired around US$6.4 billion worth of office properties in Hong Kong. .

The property consultants now predict the buying spree by mainland firms will accelerate in view of the closer integration between Hong Kong and China, expectations of further renminbi depreciation against the US dollar, and the broadening of cross-border investment channels.

“Hong Kong is increasingly being used as the first stop for Chinese outbound capital and a springboard to world markets,” said Thomas Lam, Knight Frank’s head of valuation and consultancy.

“This will be enhanced by factors such as the implementation of the Shenzhen-Hong Kong Stock Connect, the establishment of Asia Infrastructure Investment Bank, and the Belt and Road Initiative.”

Two Grade-A office buildings in Wan Chai were sold in the first half – China Evergrande Group bought MassMutual Tower for HK$12.5 billion and China Everbright bought Dah Sing Finance Centre for HK$10 billion.

Lam said mainland companies, especially financial firms, have become the major demand driver for

prime offices in Hong Kong’s Central Business District.

In the leasing market, around half of new lettings in Central were to mainland tenants, and they have become the main contributors to soaring rents, according to Knight Frank.

Hong Kong is increasingly being used as the first stop for Chinese outbound capital and a springboard to world markets

Hong Kong recently ranked top in a survey of 31 cities around the world, with prime office space leasing for an average of US$278.5 per square foot per annum, according to Knight Frank figures.

Marcos Chan, head of research, Hong Kong, Southern China & Taiwan for CBRE Asia Pacific, said many mainland-backed financial companies such as banks and insurance firms are looking for opportunities to buy headquarters buildings in Hong Kong.

“They are willing to pay a premium, and I will not be surprised if we see more record-breaking deals.

“In the foreseeable future, mainland enterprises will continue to be the dominant buyers,” said Chan.

Mainland firms are also tipped to be the potential buyer of The Center at 99 Queen’s Road in Central, a core asset owned by Li Ka-shing’s Cheung Kong Property (Holdings) with an asking price of HK$35 billion.

“Given the difficulty mainland corporates have faced in acquiring trophy buildings in Central in the past, their attention is likely to turn to the Murray Road Carpark government site which is expected to be made available in the coming six months.

The strong interest from mainland corporates is likely to see the site sold for a record price,” said Denis Ma, head of research, Hong Kong at Jones Lang LaSalle.

The carpark site is the first grade-A office site in Central to be offered for tender in 20 years, with analysts expecting the site to fetch HK$9 billion.