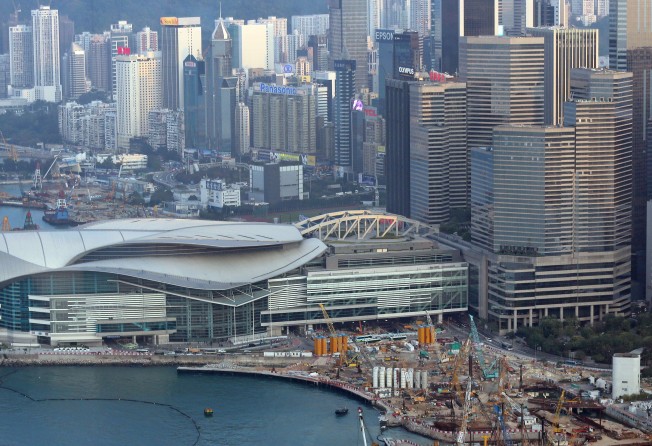

Three levels of Convention Plaza in Wan Chai sell for record price

HK$1.38bn ‘strata-title’ sale will be highest in terms of unit rate for a whole floor in a building, says head of research at JLL

Hong Kong office prices continue to rise, as the latest headline deal saw one mainland company buy three consecutive office floors at Convention Plaza in Wan Chai on Wednesday, for a combined HK$1.38 billion.

CEFC China Energy Company, ranked as one of the mainland’s ten largest private companies by China Daily in 2014, bought floors 21-23 with a combined 49,554 square feet of office space through two separate firms, Tactic Ally Limited and Dunhan Ventures Limited.

The Shanghai-based company, founded by Ye Jianming, focuses on oil and gas and financial services.

The buyers are now required to pay property tax of around HK$118 million, as stamp duties double to 8.5 per cent of the transaction value for commercial buyers.

“Some small units in Convention Plaza sold for close to HK$ 30,000 per square foot last year, but if the latest transaction is completed, it will be the highest in terms of unit rate for a whole floor in a building,” said Denis Ma, head of research at JLL in Hong Kong.

Driven by strong demand from mainland firms, he said office sales have accelerated in recent months.

Ma added strata-title properties – those that are adjoining in some way – were now changing hands at record-high unit rates after a number of non-grade-A office buildings were sold at prices approaching the grade-A office market averages in Central.

The deal translates to HK$28,000 per square foot, which is close to the recent transaction value of a commercial property unit at 9 Queen’s Road Central, a prime location in Hong Kong’s real estate market.

Hong Kong’s residential market, however, showed sights of slowing this week.

By 7pm on Thursday, market sources said it had sold 51 units of the first 135 units released at its joint venture housing project, “93 Pau Chung Street” in Ma Tau Kok, To Kwau Wan.

“Buyers have become cautious after the developer released the project in line with market levels,” said Sammy Po, chief executive of Midland Realty’s residential department.

Average discounted prices for flats in 93 Pau Chung Street were HK$15,000 per square foot, with the units starting at HK$4.64 million for a 316 sq ft studio unit.

● Sun Hung Kai Properties (SHKP) has revealed details of the first phase of its housing project above Nam Cheong Station as Cullinan West.

Phase one will comprise 1,050 units, and is due for completion in August 2018. Victor Lui Ting, the company’s deputy managing director, said the firm has submitted its application for pre-sale consent.