Chinese developers, Hong Kong government says xie xie

Mainland Chinese developers have set one record after another at Hong Kong’s land auctions, boosting receipts to a record

Hong Kong’s government revenue from land sales rose to a record HK$71.88 billion in the first nine months of the 2016 fiscal year ending March 31, as HNA Group led mainland Chinese developers in their buying spree in the city.

With the final HK$5.868 billion from a sale at the former Kai Tak airport, land revenue made up 30 per cent of the city government’s income for the first three quarters, surpassing the previous full-year record of HK$66.9 billion in the 2011 fiscal year and beating a government forecast.

Chinese developers, driven away by market-cooling restrictions on the mainland and a desire to get their deteriorating currency out of the country, have outspent Hong Kong developers in three of the 23 land auctions this year, each time setting new records far exceeding market valuation.

“The frenetic buying spree by mainland developers gave us one surprise after another,” said Vincent Cheung Kiu-cho, executive director of valuation and advisory services for Asia at Colliers International. “Their ultra aggressiveness in Hong Kong far exceeded our expectations.”

Kai Tak, site of Hong Kong’s former airfield, is earmarked for residential development, potentially providing housing for as many as 90,000 residents with 83,000 jobs. Planned as Hong Kong’s second business district, the area will have 62.42 million sq ft of office space by 2020, double the space in Central.

The dominance by developers from north of the border is bad news for the city’s home-grown companies, making it harder for them to replenish their land bank to drive their future projects.

Some Chinese developers have been driven southward by restrictive measures imposed across more than 30 mainland cities including Beijing and Shanghai to cool the domestic housing market, amid policymakers’ concerns that runaway prices would lead to widespread public grievance.

The renminbi weakened by 6.6 per cent against the US dollar since January, driving more mainland developers to devise schemes to get their money out of the country before the Chinese currency deteriorates further.

The Hong Kong government’s takings from land sales exceeded the HK$67 billion forecast made in February by former Financial Secretary John Tsang for fiscal 2016.

The trek of Chinese developers will continue in Hong Kong, said Daiwa Capital’s property research head Jonas Kan.

“Only a few Hong Kong developers have the financial muscle to fork out billions of dollars to bid for government land,” Kan said. “On the motherland, there’s no shortage of these buyers, and they all want to extend their reach to Hong Kong.”

Local developers will have to explore alternative options including the conversion and redevelopment of existing buildings, or by paying the government a land premium to convert industrial sites or farmland into residential use, Kan said.

Hong Kong’s profit margin on property developers average between 10 per cent and 20 per cent, making the city a lot more attractive for developers than mainland China, where margins have been compressed to single digits of between 6 per cent and 8 per cent, he said.

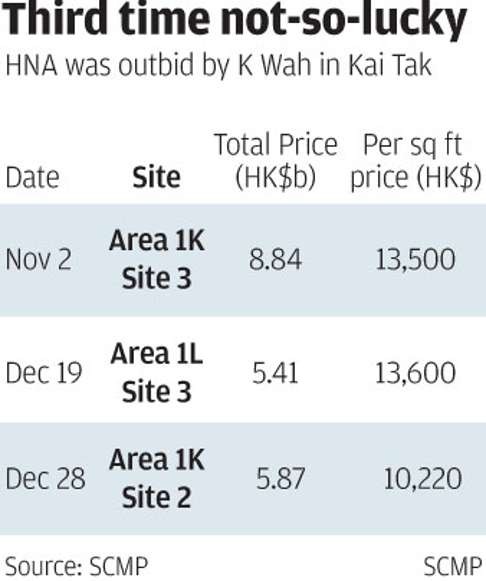

A standout buyer was HNA Group, a hotels-and-golf-course owner and parent of Hainan Airlines Co., which has splurged a total of HK$14.25 billion since November 2 at Kai Tak.

The company on December 19 paid HK$5.41 billion, or a record HK$13,600 per square foot, for its second parcel in Kai Tak, beating out more than a dozen other contenders that included the biggest Hong Kong developers.

The price for Kai Tak Area 1L Site 3, adjacent to the parcel that HNA bought on November 2, was higher than market valuation of between HK$5.74 billion and HK$6.32 billion, or between HK$10,000 and HK$11,000 per sq ft.

The two parcels of land give HNA a residential area with a combined 1.05 million sq ft of gross floor space.

“It may just be the beginning of HNA’s expansion into Hong Kong,” Colliers’ Cheung said.

Among local developers that bought land in 2016, Lifestyle International Holdings -- operator of the Sogo department store -- was this year’s biggest spender, with its HK$7.39 billion winning bid in November in Kai Tak. The parcel, which could be developed into 1.09 million sq ft of gross floor area, translates into HK$6,773 per sq ft, half of what HNA paid.

Kerry Properties ranked second in spending, with its HK$7.26 billion bid for a luxury residential site at Lung Cheung Road at Beacon Hill in Kowloon in October. The price of HK$21,016 per sq ft set a record for the Kowloon Tong area.

Sun Hung Kai Properties, Hong Kong’s largest developer, bought two sites for HK$2.71 billion. It won a business lot in Kwai Chung for HK$350 million in May, and another residential site in Sha Tin for HK$2.36 billion.

Tycoon Li Ka-shing’s Cheung Kong Property bought just a single luxury residential site in Kau To Shan, near Sha Tin, for HK$1.95 billion.

Headline-grabbing prices for land need not guarantee record prices for homes, said Kan, as residential prices are set by market forces.

“The final prices of homes are determined by what the market can bear, so a developer who’ve paid a record land price may not necessarily be able to sell their property at record prices,” he said.

As the year draws to a close, all eyes will be on the next large land parcel up for grabs in Hong Kong.

That’s likely to be a commercial lot on Murray Road in downtown Central, valued at HK$15 billion according to surveyors. The site, currently occupied by a car park next to Chater Garden, will yield a gross floor area of about 450,990 square feet.

.