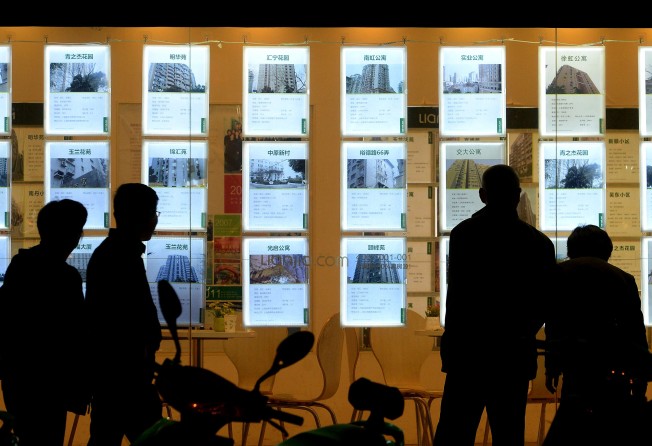

Buyers drawn by China’s US$941.4bn pre-owned homes market

Leading property agents make hay, and attract investors, as frustrated buyers opt for the used option rather than new

China’s 6.5 trillion yuan (US$941.4 billion) pre-owned homes market is attracting growing interest, and rising levels of capital being invested is set to alter the landscape of the business, experts say.

In the latest buyout of a company involved in the sector, in late February Shenzhen-listed Kunming Department Store spent 6.18 billion yuan (US$895 million) on a 94 per cent stake in property agency Weiye 5i5j Group, via a share swap and with cash, with the remaining 6 per cent stake for 378 million yuan in a share transfer deal.

The total 6.56 billion yuan buyout of the country’s second largest property agent valued the company at 32.8 times its 2015 net profit. The deal is still pending due to a securities regulator’s inquiry into whether it’s a back-door listing.

On January 3, Shenzhen-listed Hubei Guochuang Hi-tech Material Co, an asphalt producer, said it planned to buy Qfang.com, an agent in Shenzhen, outright for 3.8 billion yuan.

But the most eye-catching deal came a week later, when Sunac China Holdings – the fast-expanding developer – bought a 6.25 per cent stake in China’s largest home agent Homelink, for 2.6 billion yuan, valuing the online-to-offline agency network at 41.6 billion yuan, or 51.4 times its 2015 net profit.

That purchase came just nine months after Homelink’s series-B fundraising, when a private equity fund owned by China Renaissance, Baidu and Tencent valued the company at just 36.8 billion yuan.

In 2015 its after-tax profit surged nearly ten fold from 2014 to 809 million yuan, while last year amid the red-hot second-hand property market Homelink handled more than 1 trillion yuan worth of transactions, earning an estimated net profit of 1.14 billion yuan.

This compares with 5i5j’s 300 million profit through the first nine months of 2016.

Sun Hongbin, Sunac’s chairman, said he chose to buy into Homelink as he is optimistic about China’s pre-owned home market, and is interested in the company’s financial services platform.

Homelink’s peer-to-peer finance product, Lianjia Licai, has gained massive popularity in the past three years, connecting investors with home sellers who need cash to de-collateralise their homes.

The 1.2 billion yuan worth of sales from the unit accounted for 8 per cent of Homelink’s sales and around a tenth of its profits.

Homelink’s core business remains as a pre-owned property agent, which charges 2.7 per cent of any transaction value as commission – the highest of any mainland agent.

The commission fees are the predominant earners, but there are lots of other value in the sector still largely untapped, especially in the derivatives, data and after-sales service sectors

The company runs some 8,000 outlets across 28 cities with a 130,000-strong army of agents.

In Beijing alone, it claims over 60 per cent of the market. 5i5j runs 2,215 stores in 15 cities, with 45,000 agents.

Centaline Property Agency, another market leader which is equally prominent in Hong Kong, is also thought to have attracted several bids, including from Ping An Insurance.

Centaline chairman Shih Wing Ching, however, now fears the sector faces an oversupply, and says some of the valuations being given are excessive.

But those high values are being driven now by non-property sector buyers, hoping to tap into the sizzling second-hand homes market in top cities, marking for what some are now calling China’s a new era for China’s property sector: buying second-hand rather than new.

Last year around 5 trillion yuan worth of second-hand homes were sold nationally, on top of a rental market worth between 1.1 and 1.5 trillion yuan, according to Homelink’s research academy. This compares with a 10 trillion yuan new homes market.

In Beijing, pre-owned home transactions were 5.67 times that of the new home sales last year, according to Centaline Property, and in Shanghai it was worth four times.

Now experts are predicting the trend will continue to grow in other major cities too, as limited land and new home supply in urban areas frustrates new home hunters.

Yang Xianling, director of Homelink’s research academy, said investors are being lured by the promise of an average 2 per cent service charge of each sale.

The plethora of financial service opportunities that have been created throughout the transaction process is also a huge draw.

“The commission fees are the predominant earners, but there are lots of other value in the sector still largely untapped, especially in the derivatives, data and after-sales service sectors.

“For example, financial capital and agents could help clients to securitise more than 250 trillion yuan,” said Yang.

Experts, however, highlight a couple of inherent risk in the sector: oversupply and poor service.

Shih Wing Ching said the sheer number of operators in the industry means even Homelink, which runs 1,700 stores in Shanghai, for instance, can only make a profit if it secures over half the market. But attaining that share, could then invite the attention of the competition regulator.

While the housing agency industry remains overwhelmed under current market conditions that also adds the added risk of volatility, with investors already talking about the looming prospects of several more cities introducing heavy-handed purchasing controls.

Yang adds that the industry remains inefficient and suffers an image problem, with regular surveys revealing low levels of customer satisfaction.

To continue to succeed, more investment capital is needed to “reshape” the industry’s transaction processes, business model as well as its service levels, he said, something that hard cash often can’t solve.

“In the end the industry is about people – the agents’ service won’t necessarily get any better through new capital injection.”