Cathay Pacific and offshore marine business will test incoming Swire chairman

Analysts say the task has been cut out for Merlin Bingham Swire, who takes over as chairman of the group’s Asian holding unit and property subsidiary on July 1

Turning around the fortunes of Swire Pacific’s aviation and offshore marine services divisions will be the two biggest challenges facing incoming chairman Merlin Bingham Swire, according to analysts.

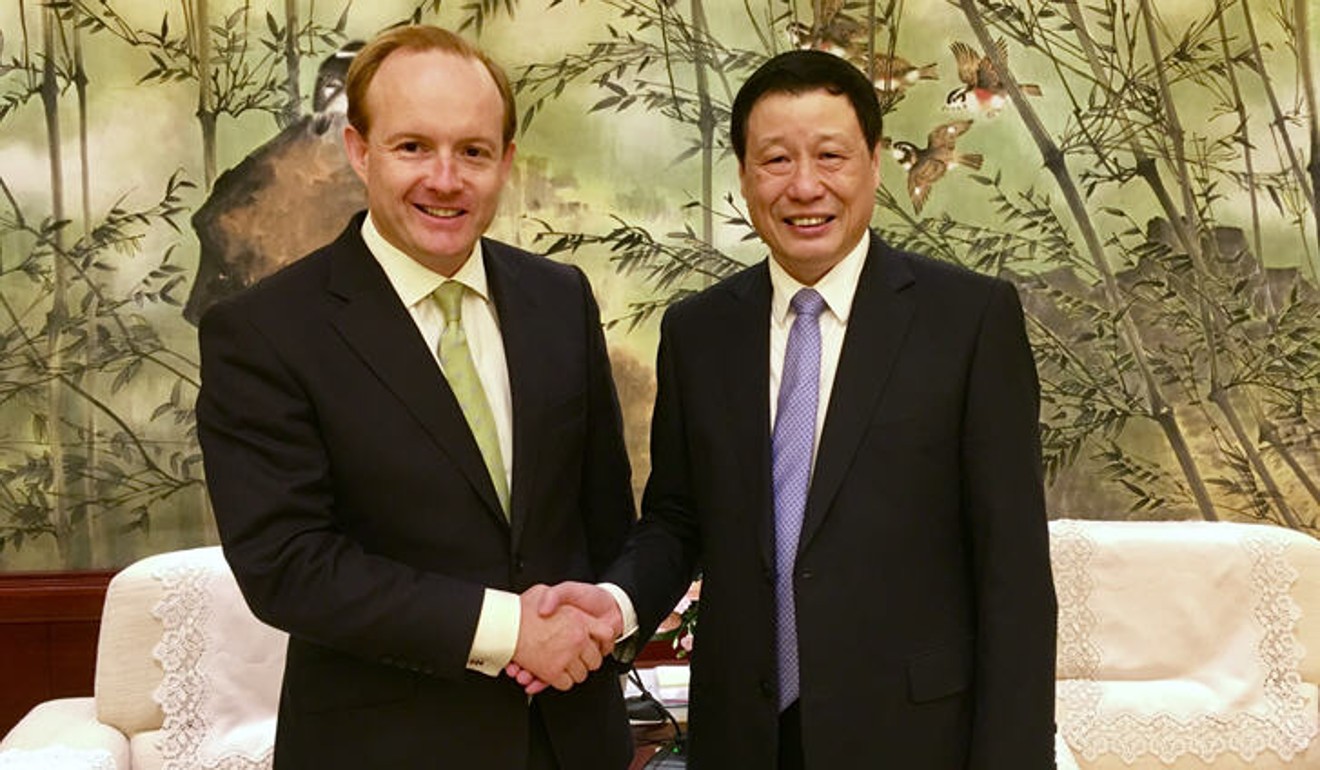

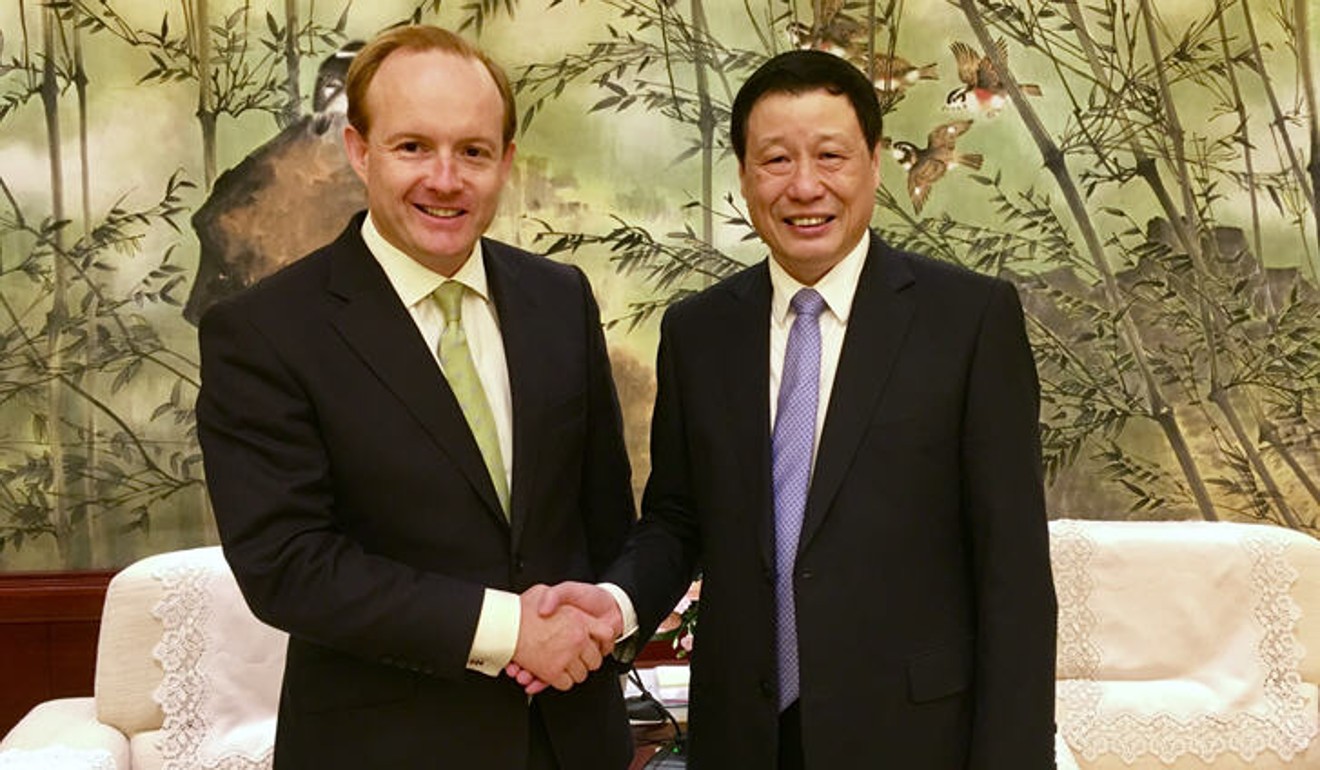

Merlin Swire, 44, chief executive of John Swire & Sons, is a sixth-generation descendant of its 19th-century founder, and takes over as chairman of Swire Pacific, Swire Properties and Hong Kong Aircraft Engineering on July 1.

Jonathan Galligan, head of Asia gaming and conglomerates at CLSA, singled out Cathay Pacific Airways, in which Swire Group owns a 45 per cent stake, and Swire Pacific Offshore (SPO) as two underperforming units that will require a lot of time and effort to turn around.

“Cathay Pacific continues to face structural challenges as competitive pressures increase, which the group will need to continue to address.”

Cathay Pacific reported its worst half-year results in at least two decades, a loss of HK$2.05 billion (US$262 million), almost double the estimated HK$1.2 billion forecast by analysts. The company blamed the result for the six months ended June 2017 on fierce competition and higher jet fuel costs, including losses from fuel hedging.

Besides Cathay, Merlin Swire will also need to deal with SPO’s operations as the market condition has been deteriorating. Because of the falling of oil prices, fewer companies are actively involved in oil exploration thus affecting its rental charges.

“While oil prices have picked up recently, they remain well off their highs of a few years ago which in turn has weighed heavily on their offshore marine business as charter rates remain low,” he said.

Swire Pacific issued a rare profit warning in November, citing a difficult operating environment in the airline industry and the grim market outlook for the offshore support services market.

“The offshore market in which SPO operates has not picked up or rebounded,” according to the company filing with the Hong Kong stock exchange. “As a result of the review, impairment charges currently estimated at approximately HK$936 million are expected to be made against the consolidated profits of the company for 2017.”

Galligan said the reshuffle – the second major shake up of the board of Swire Pacific over the past seven months – signals the family is taking a more active role in the group.

John Slosar, Swire Pacific’s chairman since March 2014, will retire, although he will remain chairman of Cathay Pacific.

Under Slosar’s leadership, shares of Swire Pacific lost 15 per cent of their value to HK$73.6 as of close of trading in Hong Kong on Friday, while Cathay Pacific shares shed 21 per cent to HK$12.24 in the past four years. But Swire Properties surged 24 per cent to HK$25.9 in the same period.

The benchmark Hang Seng Index has gained 36 per cent in the same period, but have particularly taken a beating this week, losing 9.5 per cent of its value.

Swire Pacific is trading at a 33 per cent discount to its current net asset value against its historical average of 21 per cent, according to CLSA.

Galligan said property remains the group’s strongest division. “Swire Properties has a competitive edge in terms of quality and returns from their property investments.”

Swire Properties, which builds upscale offices and manages shopping centres including Pacific Place in Admiralty, reported a 30 per cent increase in interim underlying profit to HK$4.6 billion for the six months ended June.

He also expects its beverage business to improve this year after consolidation.

Phillip Capital Management fund manager Li Kwok-suen shared Galligan’s views, saying investors preferred Swire Properties to Swire Pacific and Cathay Pacific.

“But compared to other property stocks, Swire Properties’ performance still lags behind as it has limited land bank in Hong Kong,” he said. “It is stable but cannot enjoy the fast growth from property development.”

Li said the reshuffle would hardly turn around the share price performance of Swire Pacific in the short-term.