Chinese developers warn more rentals will hammer margins

China’s biggest developers scale up their rental building programmes in a bid to echo President Xi Jinping’s hopes that more homes should be built ‘to be inhabited, and not for speculation’

Thousands of new rental properties are set to be rolled out across China over the next three years, as part of a national effort to keep surging home prices under control.

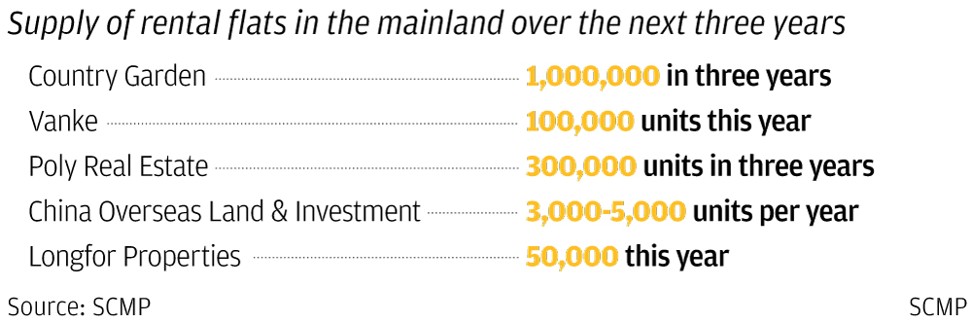

Major mainland Chinese developers including Country Garden, China Vanke, Longfor, Poly Real Estate and China Overseas Land & Investment have all confirmed they are expanding their leasing portfolios in a bid to echo President Xi Jinping’s hopes that more homes should be built “to be inhabited, and not for speculation”.

But already, some are warning they expect margins to remain low for quite some time as a result, with the eventual pay-offs expected to take far longer to filter through than on straight sales.

Shao Mingxiao, Longfor’s chief executive officer, put it bluntly recently while reporting the company’s annual results: to carry such a large rental portfolio, means its leasing business can only hope to “break even, for now”.

It expects to put 50,000 new rental units onto the market over this year, with another 20,000 units expected to come on stream later.

Yu Liang, the chairman of Vanke, has also pledged loyal support to the government-led initiative.

But the country’s second-largest developer by sales has suggested that as pay back, the government should be willing to bend on certain other policies, such as offering developers preferential interest rates and tax policies.

The message is clear, that the government wants to see a healthier property market, in which people can have a decent life without the expense of having to buy a flat

Vanke, in fact, is considered one of the pioneers of the rentals policy, having launched its “Port Apartment” rental complexes in 2016. By the end of 2017 it had offered more than 100,000 units in 29 first- and second-tier cities, with plans for a further 100,000 more units in future.

“The message is clear, that the government wants to see a healthier property market, in which people can have a decent life without the expense of having to buy a flat,” said Joe Zhou, head of research at real estate consultancy JLL in China.

“Currently the biggest developers are scaling up [their rental building programmes] and pouring more money in, although long-term I don’t see a lot of profit being made from receiving rents.

“They are still faced with the main problem affecting the housing market, however: that developers find it hard to make enough rent to balance out the high land prices they are still having to pay.”

Zhou estimated the best margins possible from a long-term rental were 4 per cent to 5 per cent – pretty thin compared to those for sales enjoyed by some firms in 2017. Longfor, for example, reported a net annual profit margin of 18.3 per cent last year, when its operations were heavily skewed towards sales.

Zhou said that while the top management of some developers may have been following the government line, in reality further down the ranks, there were not the detailed policies in place to achieve those goals and still leave a tidy profit.

Mango Chang, director of Colliers International’s east China’s advisory, said flat rental yields could even fall short of those for office space, which in Beijing and Shanghai averaged a relatively low 4-5 per cent. Rentals also cost more to operate and maintain, she added.

China’s first-tier city governments have already said they now require developers to hold back some 15 per cent of their land banks in reserve. In many cases, that land is likely to remain earmarked for investment properties such retail and office space.

Despite the griping, however, there are signs the government’s favouring of rental development is starting to pay off, certainly in terms of easing affordability.

According to February data from the National Statistics Bureau, home purchase prices in Shenzhen fell 0.6 percentage point from a year ago, while prices in Guangzhou were down 0.4 percentage point, and those in Shanghai and Beijing fell 0.2 from a year earlier.

Shenzhen, which has the largest population growth in China, saw its new home prices little changed in March, which meant an 18th straight month of flat price movements, attributed by commentators to the iron-fisted government clampdown on sales since late 2016.

Shanghai, meanwhile, became the first mainland city to auction land parcels slated only for rental homes.

In the second half of 2017, the authorities there sold 29 plots dedicated to rental, on which a combined 40,000 units can be built on an area of 2.4 million square metres (593 acres).

Currently the biggest developers are scaling up [their rental building programmes] and pouring more money in, although long-term I don’t see a lot of profit being made from receiving rents

“It is a good start to help ease the growing pressure on rental businesses,” said Zhou.

“There are still no set rules in place, however, on who can or cannot apply for this land, and how prices are set,” he said, suggesting the answer could well be the creation of more real estate investment trusts, or Reits, which invest in residential offerings only.

China’s Reit market could potentially be worth more than 12 trillion yuan (US$1.8 trillion), surpassing that of the US, but only if legal and tax barriers were removed, according to a Peking University report published at the end of 2017.

Both real estate funds and Reits can be used when diversifying long-term property investment portfolios.

With a GDP of US$18.6 trillion and property value of US$27 trillion, the publicly floated Reit market in the US had a market capitalisation of US$1.01 trillion by the end of 2016, the largest in the world. China’s GDP by 2016 was US$11.2 trillion while its total existing real estate value was US$44 trillion.

“We believe that estimation is conservative, and that the actual development in coming years could far outstrip this, because China has an additional huge infrastructure market – that could be securitised via Reits – and a still-underdeveloped residential leasing market,” said Zhang Zheng, a professor at the business school and author of the report.

Zhou added that in the US, “Reits are the most active players” in the rental sector, and said the Chinese government should provide “more encouraging measures on this in future”.

In March, China Construction Bank – the country’s second-biggest lender by assets – and China Young Professionals Apartments, teamed up to establish a residential Reit with an initial value of 2 billion yuan, focused on acquiring just residential properties.

The latest market figures just quoted by Xinhua suggest China’s rental business currently still made up just 2 per cent of the property market, compared with 20 to 30 per cent in developed economies.

But it added that demand in the biggest cities for quality rental space was almost as fierce as for the buying market, especially for long-term flats from among young professionals anxious to enjoy a high standard of living, without having to buy.

In the larger population centres, serviced flats have also soared in demand.

One Shanghai-based brand, called Baseliving, a boutique serviced apartment run by local developer Nova, has focused on renovating some of the city’s former factories and schools, renting out spaces for anything between 10,000 and 60,000 yuan per month.

“These kinds of renovated homes, which have great character and attractive older features, are in increasing demand,” said Zhou, adding that Baseliving’s letting levels have quickly reached 80 per cent, soon after being launched.

He Qianru, chief analyst with property brokerage Midland Holdings China, added that even those encouraging signs of price freezes in Shenzhen, “may not signal a concerted drop in home prices due to Chinese people’s mindsets”.

Long-term rental flats can play the role of keeping home prices steady, as people now have one more option

“We still have a belief that rented flats are not our own home,” said He.

“Only purchasing one means we have our names on it. However, long-term rental flats can play the role of keeping home prices steady, as people now have one more option.

“Many will choose these flats first, before they buy their own homes.”

Yang Xianling, a director at Homelink Research Academy, added that for now the number of quality leased flats is still too small.

“The structure is also problematic, especially for lower-end flats for migrant workers,” he said.

“Even if the numbers are sufficient, it is at best only delaying the home-buying age of young people, and not eliminating demand.

“The only hope is that a robust leasing market can provide a transitional period for youngsters.”