Shanghai developers receive pre-sale permits to begin luxury sales, but there’s a catch

Pre-approved government pricing means that Shanghai property developers may see their profit margins sharply constrained

A number of luxury Shanghai residential projects have secured permission from authorities to start sales, even as government curbs on the property market in place since last year could mean developers will have to accept lower prices.

At least seven high-end projects, involving developers Shui On Land, Poly Real Estate Group, China Sunac Holdings and Tahoe Group Company, have won pre-sale permits from Shanghai authorities, according to the website of Shanghai housing authority. The real estate companies can begin accepting orders ahead of a lottery from the middle of April that will determine which applicants are successful.

While the permits are good news for developers who have been waiting for as much as a year for permission to sell, price caps and other government measures imposed to cool the housing market mean that they will not get the prices they had hoped, analysts said.

“These permits are long overdue, and government can’t withhold them indefinitely,” said Lin Bo, research director of Shanghai-based marketing and research company CRIC. “But developers have to compromise on prices.”

“Developers will have to accept prices at least 30 per cent below what they had expected, in some cases even below the prices of nearby secondary homes, because if they do not sell, they’ll be burned by high financial costs and continued cash flow pressure,” said Zhang Zhijie, vice-head of China Index Academy, a property information and research company.

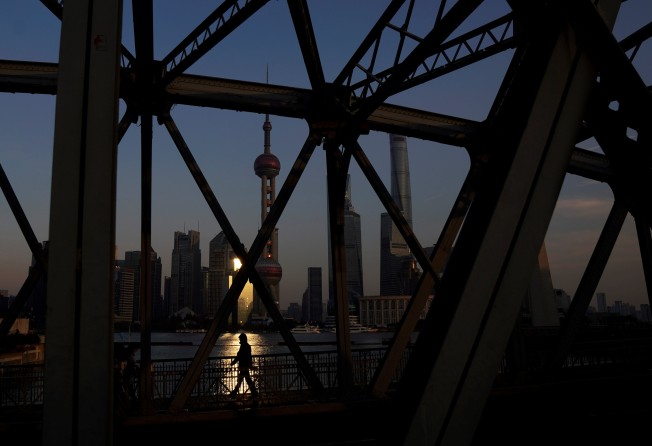

Shanghai has been among the more aggressive of Chinese cities in trying to cool property prices, amid concerns that unaffordable home prices could be a serious stumbling block to its plan to transform into a global financial hub and innovation centre.

To obtain sales permits, developers had to get the government to sign-off on their price lists, a process that allowed authorities an avenue of control over the market.

Analysts said the price-control policy would be a financial burden on developers faced with escalating costs.

“These projects sell at high price is because their cost is high,” said Li Zhanjun, chief analyst with the China Real Estate Association. “Not allowing them to sell at that price would be unreasonable. There have been a logjam of such projects and the Shanghai government can’t allow them to keep accumulating.”

At Shui On’s Lakeville Luxe, a development of stand alone houses in central Shanghai, the approved entry-level price for new homes is 127,000 yuan (US$20,218.61) per square metre, lower than the 130,000 yuan second-hand price of earlier houses in the same development.

The Daning Jinmao Palace project in northern Shanghai, developed by China Jinmao Holdings Group, was allowed to sell at an average price of 93,800 yuan per square metre, a price similar to a year ago when an earlier batch of units in the project were sold.

And at the Shanghai Courtyard, a project jointly developed by Cinda Properties and Tahoe, local media have reported that the approved 90,000 yuan per metre selling price will only allow the developers to earn a margin of less than 10 per cent, compared to the usual 30 per cent or more. Cinda and Tahoe have been waiting for permission to sell since 2016.