How did 10 investors divvy up a 73-storey office tower? They picked ping pong balls from a hat

With the ink barely dry on the completion of the world’s most expensive real estate deal, some buyers are already putting their shares of the spoil on the market for a premium

This story received the "Journalist of the Year" award in the Investment category of State Street's 2018 Asia-Pacific Institutional Press Awards, which received more than 200 entries for commendations in nine categories

On a sunny afternoon last month, a group of very wealthy men filed into the 28th floor office of Hong Kong’s richest woman at the One International Finance Centre skyscraper overlooking the city’s famed Victoria Harbour.

Among them were Shimao Property Holdings’ founder Hui Wing Mau, the operator of Hong Kong’s biggest fleet of mini buses Ma Ah Mok, and two men who made their fortunes from producing cassette tapes and compact discs.

They had come to the boardroom of Kingston Financial Group’s co-founder Pollyanna Chu Lee Yuet-wah for an unusual ritual: they would pick ping pong balls painted with numbers out of a hat, to decide who among the 10 of them would get the first pick to divvy up the 73 storeys at The Center, the city’s fifth-tallest building.

Six months earlier in November, several members of the group had agreed to pay HK$40.2 billion (US$5.2 billion) to buy The Center from tycoon Li Ka-shing, in a purchase that would top the scales as the world’s most expensive real estate transaction.

It was a sale that had taken more than two years to close. Li’s CK Asset Holdings had initially balked at a lower, HK$35 billion offer, and he only wanted to deal with a single buyer. A sale was only possible after the price was raised by 15 per cent, and the buyers used a consortium called the C.H.M.T Peaceful Development as the signing buyer.

No sooner had the deal been announced than it ran into a snag: China Energy Reserve & Chemicals Group, the 55 per cent stake owner of the buying consortium, could not get its funds past mainland currency regulators, and had to drop out. The remaining investors, with 45 per cent between them, had to scramble to find new investors to make the May 3 deadline to close the deal, and take ownership of 75 per cent of a building with 1.22 million square feet of office space, occupied by such tenants as Goldman Sachs.

Lo Man-tuen, the Fujian-born founder of Wing Li Group and a former delegate to China’s top political advisory body, invited Chu and his fellow Hokkien tycoon Hui to join the group, who picked up part of China Energy’s stake.

Hui agreed to take up 20 per cent, and Chu agreed to buy 17 per cent, while the remaining 18 per cent was divided by existing investors such as Koon Wing Motors’ Ma.

At HK$8 billion, the purchase would be Hui’s biggest property investment in Hong Kong, the tycoon said in a March interview with the South China Morning Post.

“I’m positive about the Hong Kong office market, and the city will benefit from the future development of the Greater Bay Area,” he had said.

Chu was approached by the consortium more than a year ago, she said, but she could not enter into further discussions because she was involved in the annual legislative meetings in Beijing. She provided financing to China Energy last November in view of a positive outlook in the market, she said.

The investors settled on a mezzanine financing deal that bypassed commercial banks’ lending, instead selling two tranches of 18-month bonds to raise the funds to close the transaction.

The financing of the deal, arranged by Morgan Stanley and Hammer Capital Partners, would apportion The Center to the 10 investors, with the provision for them to sell their floors to pay their bond investors.

The 10 investors were divided into five groups. Hui, Chu and Ma would each stand alone because of the size of their stakes.

Lo led the fourth group, while the fifth group comprised Johnny Cheung, whose Man Sun Property in Tuen Mun focuses on retail property investments, and David Chan Ping-chi, chairman of ACME Group, with the moniker “King of Cassettes”.

Whoever picked the ball with the number 1 would get the first pick of the building, according to a person present at the meeting, declining to be named. That turned out to be the property magnate Hui, who eventually chose one high floor for himself, the source said.

The 73-storey building actually doesn’t have the fourth, 13th and 44th floors, as these numbers are considered inauspicious in local Chinese belief.

CK Asset sold 11 floors in 1997 to Malaysian developer Guoco Group. Nine of the 11 floors were resold to Singapore’s DBS Group Holdings a year later, while the 60th and 79th floors were disposed of in 1999, according to The Center’s 2016 sales brochure.

The consortium owns 48 floors of the building, including the five floors above the 70th level – 72, 75, 76, 77 and 78. The deal also includes two floors for display purposes, 402 car parking bays and a shopping podium.

After the lots were drawn, Hui, Chu, Ma, Lo and Chan each were allocated one floor above the 70th level. The remaining 43 floors were split among the entire group of investors proportional to their stakes.

All of us were cooperative and helped to complete the deal within a short period of time

Before the draw, the consortium members had agreed on the prices of each floor, with the higher floors marked at higher values. A consortium member with a 10 per cent stake at HK$4 billion would be eligible to pick either two floors above the 70th level, or four floors on the lower levels, said a person familiar with the rules of the draw.

“Every investor has his own investment strategy,” said Kingston’s Chu, in a telephone interview this week. “I had never met some of the investors before this deal. All of us were cooperative and helped to complete the deal within a short period of time.”

This week, CK Asset confirmed that the transaction had been completed, declining to provide additional details.

At least two buyers had begun to put their shares of the spoil on the market.

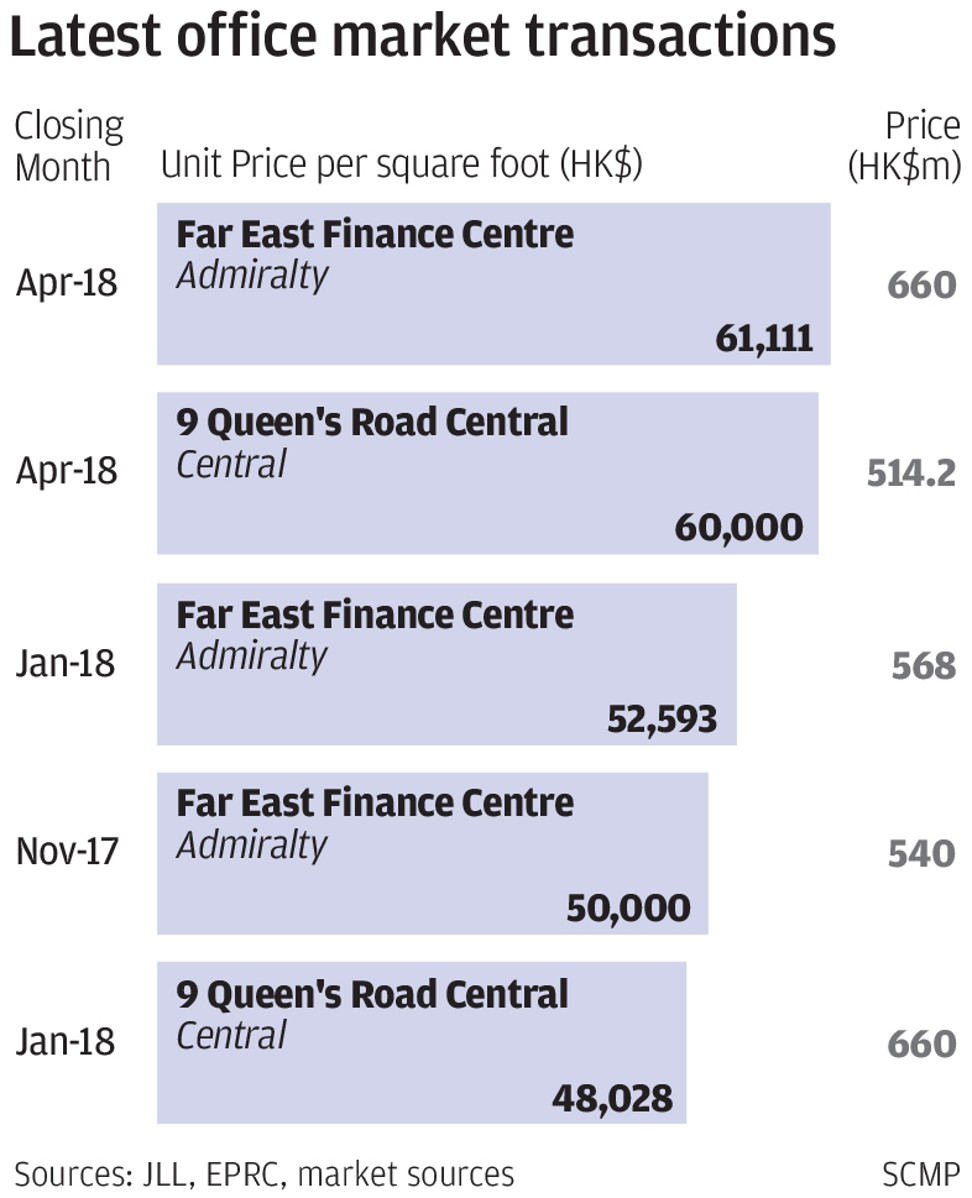

The 38th floor allocated to “Cassette King” Chan, is on the market for HK$1.2 billion, or HK$48,800 per square foot. That asking price would be equivalent to a 45 per cent premium over the average purchase price of HK$33, 000 per sq ft.

Chan, who declined to comment, had received the deposit on the purchase, according to agents familiar with the sale.

Separately, levels 42, 43, 49 and 50 – allocated to retail property investor Cheung – are also on the market, even though two of the four floors may eventually be kept as long-term investments, agents said.

“Office prices in Central, Admiralty and Wan Chai have been surging due to low vacancy of as low as 1.1 per cent, and an increase in demand from mainland companies and Hong Kong property investors,” said Thomas Lam, head of valuation and consultancy at Knight Frank. “Prices have surged 30 per cent to over HK$50,000 per sq ft in the past 12 months.”

According to JLL, an office unit at Far East Finance Centre in Admiralty was sold for HK$61,111 per sq ft last month, which makes the higher price at The Center within reason.

The consortium bought The Center practically for a steal, as the building is currently valued at HK$55 billion, or even more, Lam said.

Tycoon Li, for decades one of Asia’s wealthiest men, had been known as “Superman” for his business acumen and shrewd timing. Now, some property agents are wondering if Superman Li, who turns 90 in July, may have sold the tallest building in his portfolio too soon.

Rental fees for top grade offices in Central are poised to rise even more, as mainland Chinese companies showed no signs of slowing their expansion in Hong Kong, said JLL’s markets head Alex Barnes in a report. As much as 76 per cent of all new office listings in March were driven by rental demands by Chinese banks and financial institutions, he wrote.