What does Hong Kong’s Anglican church do with money from sale of property? It buys some more

CSI Properties, which bought the Hong Kong Anglican Church’s old staff quarters for HK$400 million, is redeveloping the site along with Richard Li into a HK$2 billion luxury residential project

For five decades, an 11-storey building at 5 Glenealy Road in Mid-Levels served as the staff quarters of the Hong Kong Anglican Church, until it was sold in January to CSI Properties for HK$400 million (US$51 million).

Now, CSI, which also owns the adjacent Yue Lam Mansion at 3 and 4 Glenealy Road, is redeveloping the two buildings, within walking distance of Central station and Lan Kwai Fong, into a HK$2 billion premium luxury residential project along with Richard Li Tzar-kai, the younger son of Hong Kong’s richest man Li Ka-shing.

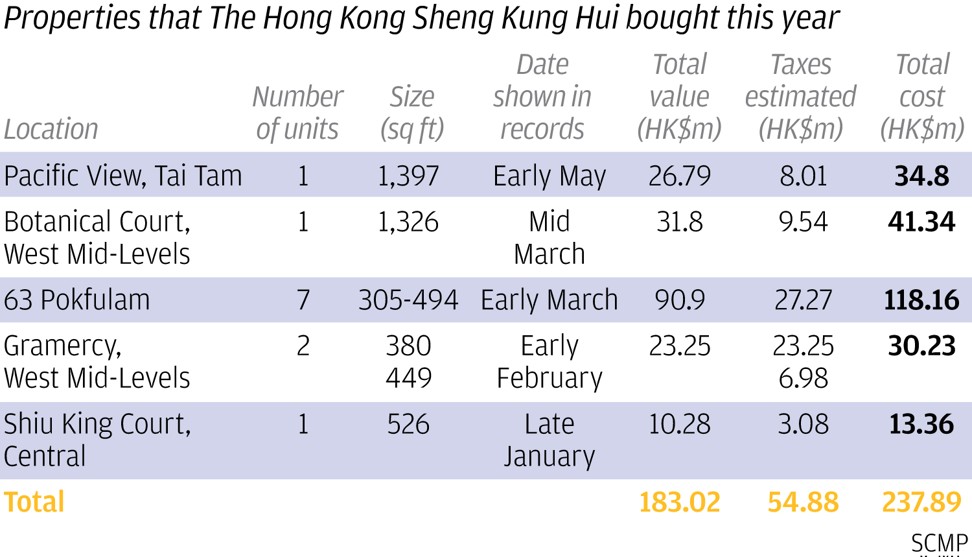

St Paul’s Church, under Hong Kong Sheng Kung Hui, has since spent about HK$240 million, including stamp duty of HK$54.88 million, on 12 luxury flats in Tai Tam, Mid-Levels, Central and Pok Fu Lam for its staff, drawing criticism from local pressure groups.

According to an article published in the local media, the Liber Research Community wanted Sheng Kung Hui to move its staff to Ridley House on Upper Albert Road, another old building in the vicinity, instead of buying expensive properties.

Reverend Peter Douglas Koon Ho-ming, provincial secretary general of the Anglican church, defended the purchases, saying Ridley House was owned by a separate entity.

Ridley House is held by Hong Kong Sheng Kung Hui Foundation, even though all the properties of its various arms are nominally owned by the church.

It is absolutely false to say that we bought the properties for capital gains

Koon also denied Liber Research Community’s allegations of buying property for speculative purposes.

“It is absolutely false to say that we bought the properties for capital gains,” he said, adding that they had to move out within a year as per the terms of the deal, which is less than eight months away.

Among the church’s notable purchases was a 1,326 square feet flat at Botanical Court in West Mid-Levels for HK$31.8 million.

The church, considered as a corporate buyer, is liable to pay 30 per cent buyer’s stamp duty for all residential properties to curb speculative investment. Together with stamp duty of HK$9.54 million, the church paid HK$41.34 million, its most expensive acquisition since January.

Earlier this month, it continued its shopping spree by adding another 1,397 sq ft unit at Pacific View in Tai Tam for HK$34.8 million, including stamp duty of HK$8 million. It also bought seven units, with sizes ranging from 305 sq ft to 494 sq ft, at 63 Pokfulam development for HK$118.16 million, including tax of HK$27.27 million.

“Most properties chosen were around Central, even though they were more expensive, because they were near the churches and in the same neighbourhood,” he said.

Individual Anglican churches are usually financially independent. As they are responsible for the accommodation of their clergy, they may need to buy homes on the private market if they do not have a dormitory.

While some of the purchases are for the domestic use of its staff, others are for investment purposes, to generate rental income for the general working capital of the church.

Meanwhile, Sheng Kung Hui also bought an industrial unit at 1 Hung To Road in Kwun Tong to publish religious books in early January for HK$7.93 million.

Between 2006 to 2017, Sheng Kung Hui bought 13 other properties for HK$245.74 million, excluding taxes.

“Many [properties] are for staff accommodation or church development, but not often for pure investment purposes,” said Vincent Cheung, deputy managing director for Asia valuation and advisory services at Colliers International.