Hong Kong’s stamp duties have worked to stabilise the housing market, shielding us from speculative excess

Without administrative controls in the form of stamp duties, debt levels would be sky high, financing ineligibility would be rife and affordability would be worse than it is now

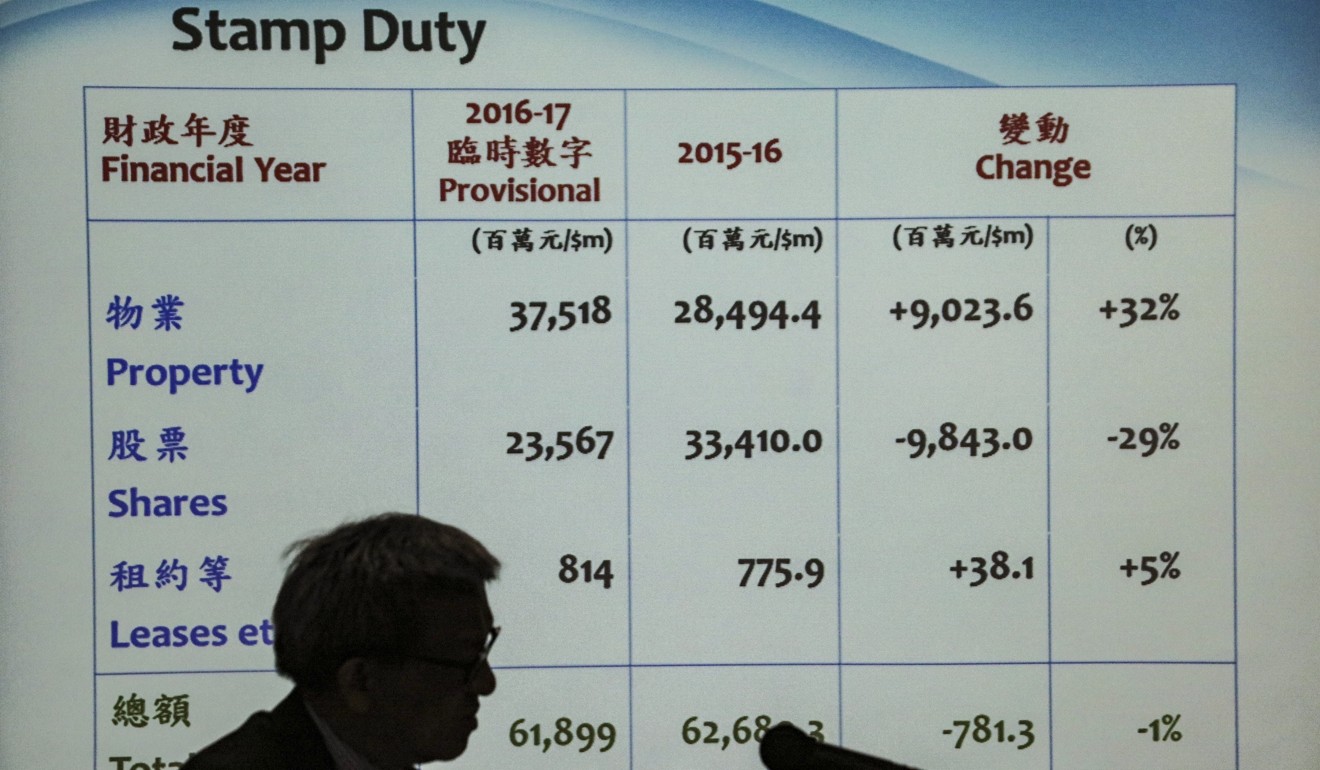

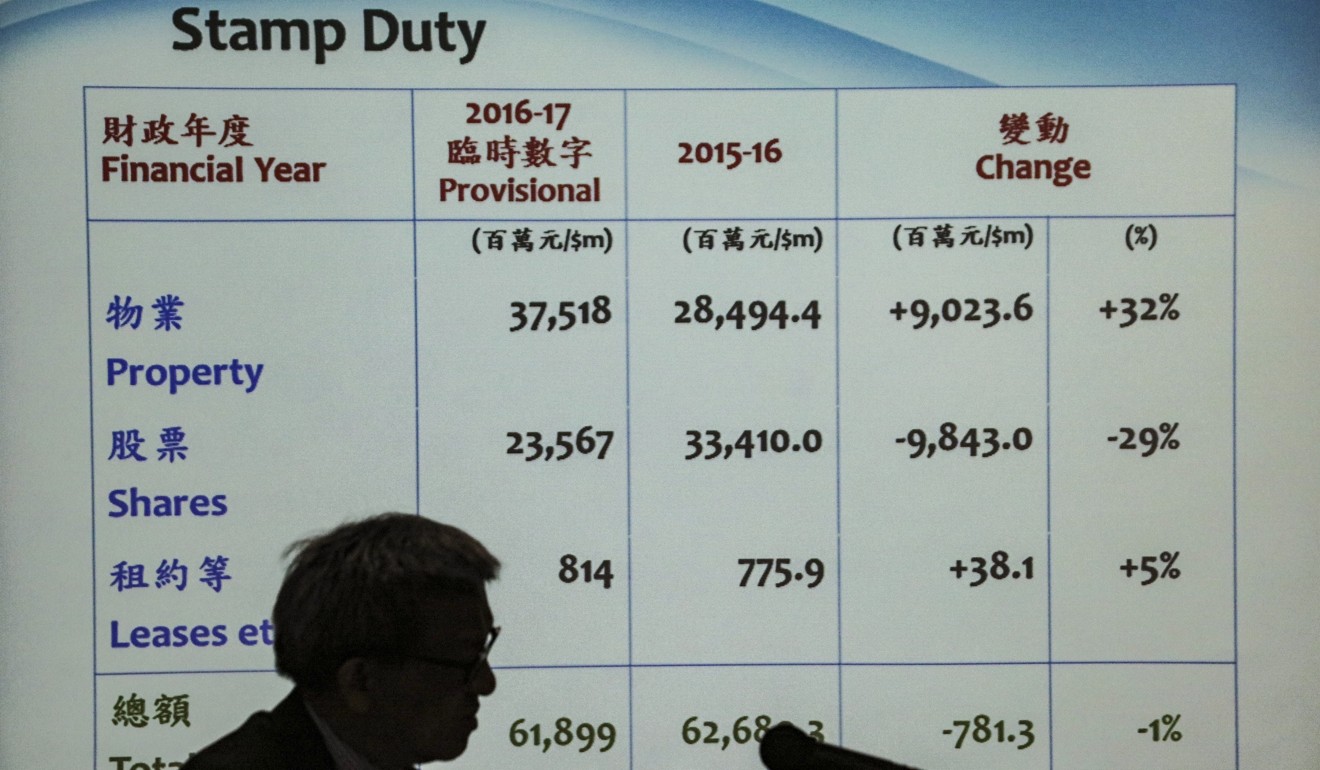

It’s been said there are only two sure things in life: death and taxes. Since November 2010, the Hong Kong government has implemented roughly half a dozen new or amended property stamp duties, and on top of that the Hong Kong Monetary Authority raised the loan-to-value (LTV) ratios three times. Anyone purchasing a second property is required to come up with 60 per cent of its sticker price (based on bank valuation). And then even permanent residents can expect to be slapped with up to an additional 15 per cent stamp duty, while a 30 per cent tax is to be levied on non-permanent residents.

On a HK$30 million (US$3.82 million) property, a permanent resident pays a whopping HK$4.5 million or 15 per cent stamp duty if it's a second home, the amount enough to buy a parking space.

For non-permanent residents, an additional HK$9 million is added, equivalent to what a new flat cost in Yoho Town.

This in addition to HK$15 million to HK$18 million as a down payment.

According to standard mortgage rules, flats costing more than HK$10 million will receive a loan-to-value ratio of just 50 per cent, while 40 per cent is added for non-permanent residents. But it is only for applicants without the outstanding mortgage.

Hong Kong is indeed a tough property town.

But stamp duties and down payment levels are just a part of the bigger picture. As challenging as the cooling measures have made buying a flat for many people, the rules have contributed – significantly – to controlling prices and keeping the market stable. Suggesting Hong Kong is less than outrageously expensive is ludicrous; denying that prices have skyrocketed in the last decade is delusional. But there is a host of factors lurking that could negatively impact both current and potential homeowners.

It is unlikely Hong Kong is heading for a correction, but rising interest rates can influence affordability even more than prices. There’s little worse for a property market or owner than excessive, unmanageable debt. Rates in Hong Kong have been low for so long, well below spots like Australia, Canada or the UK where 5 per cent is a bargain, that a few basis points that bring financing rates up to 3 or 4 per cent is still reasonable, better still when owners have low debt because of those low LTV ratios. The cocktail of low rates, high stamp duties and fat down payments ensure anyone in the market can actually afford to be there. No one’s carrying a cumbersome mortgage.

Admittedly, the way stamp duties locked up the secondary market and essentially removed over one million units of housing stock from the market was unhealthy. They, combined with high LTV, also drove first time buyers to the primary sector, which was a downside to controlling the market over the last two or three years. The duties created a weird situation and skewed the primary market with its 80 per cent or 90 per cent financing incentives. Ironically, in the coming years, when rates creep up, it could be the developers who find themselves saddled with untenable debt if the majority of their buyers are carrying 90 per cent mortgages. How severe that debt “crisis” could be is anyone’s guess, particularly in light of how cash rich and savvy Hong Kong developers are.

Back in the 1970s, seat belts became compulsory around the world. Drivers and passengers whined about infringing on rights, and accused governments of “telling them what to do”. Forty years later, seat belts save lives and latching them is second nature for most of us. Stamp duties in Hong Kong are kind of like seat belts. Like it or not, the time, 2010, was right for rethinking stamp duties. In a city with no capital gains tax – it’s only levied at an effective rate of 15 per cent on properties held less than one year, 0 per cent after three years – it was too easy for hot money to pour into the city and artificially drive the market up. It’s a good thing that the days of flipping a flat within three months on the strength of the old “confirmed sales” agreements, are in the past. The much maligned stamp duties have prevented prices from rising fast enough to compensate for the taxes, and managed to temper prices across the board.

It is unlikely any new duties are in the pipeline, perhaps with the exception of a vacancy tax, which could have the unintended side effect of forcing developers to release more stock, which would be a boon to the mass market. But the duties we do have are probably here to stay. Without the controls for stability that have been put in place, debt levels would be sky high, financing ineligibility would be rife and affordability would be worse than it is now.

Victoria Allan is the founder and managing director of real estate agency Habitat Property