Easing restrictions at the national level, not city level, will prove effective in boosting China’s property market, say analysts

- Home sale rose marginally in only one of the three cities where property curbs were eased

- CICC and other analysts said credit easing holds the key to boosting property sales, which is not within local governments’ purview

Chinese cities that have eased property curbs have not seen a significant pickup in sales, as analysts believe these measures are not enough on their own to boost the sector given the bearish sentiment hovering over the economy.

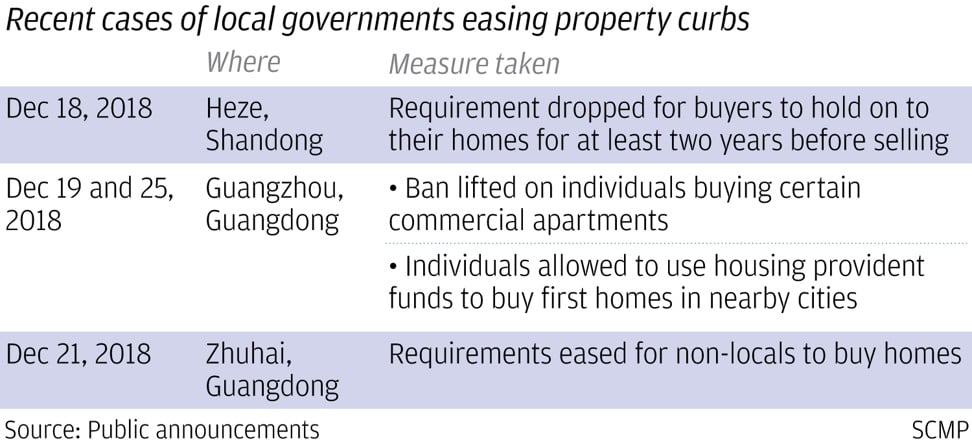

Guangzhou, Zhuhai and Heze loosened property curbs in late Decemberafter a key economic meeting in Beijing adopted a pro-growth policy stance, while granting local governments more power to adjust policies based on their respective situations.

Data from the consultancy China Real Estate Information Corp (CRIC) showed that in Guangzhou, sales of flats targeted at investors inched up 2.6 per cent from December 24 to 30, the first week after the rules were eased, compared to the prior two weeks. In Zhuhai, new home sales dropped 17.3 per cent in December over the previous month. There were no figures available from Heze as it is a small and inconsequential market.

Whether the easing can make a difference remains to be seen as more than 60 Chinese cities have various administrative curbs, ranging from purchase eligibility restrictions, resale ban and price cap, in place.

While there is rising expectation that more cities will be allowed to relax their tight curbs following the three cities’ lead, its success could decide the fate of China’s property market this year – the biggest economic growth driver.

“It is still too early to say whether the three cities’ easing will work or not as it takes at least a quarter’s sale data to make a call,” said Xiao Wenxiao, chief analyst with CRIC’s Guangzhou branch. “Removing buying restrictions in theory could increase demand, but in reality a number of factors are at play.”

For example, in Guangzhou’s case, the sales of flats after the easing was applied, were dominated by investors instead of end users, who usually buy during an upward cycle and stay away when the sentiment sours, he said.

There is a possibility that prospective buyers could get cold feet despite the ban being lifted, he added.

Deng Haozhi, an independent property analyst familiar with Guangdong market, said in Zhuhai the ban was eased only in two districts on the outskirts, which may not provide a lift to the entire city.

The initial data echoed a recent report by the investment bank CICC, which said local governments’ marginal easing of property curbs will not do much to reverse a slowing trend in those markets.

“If history offers any lessons, it is that the market rebound only happens after easing at the central level, while local-level [policy] loosening has very limited impact,” according to a report by CICC property analysts Zhang Yu and Wang Pu.

The research team examined the last three policy easing measures since 2008 and the corresponding market performance, and found that the catalyst for a sales rebound is always central level financial and tax policy easing.

For example, a dozen Chinese cities that had loosened their home purchase restrictions in April 2014, after a sharp drop in sales volume in the first quarter of that year, found that the market continued to slide until October even after the banking regulator had lowered the down payment requirement for first homes and eased the definition of “first home”. The market, however, stabilised and rebounded after April 2015 when Beijing further relaxed down payment requirements, cut interest rates and tax on flat transactions.

CICC said that local governments tend to act quickly after the first signs of a slowdown emerge because the stakes are high for them as it could affect land sales and transaction-related taxes. Beijing, on the other hand, only tends to act when real estate investment, which accounts for a fifth of the total investment, slows down and jeopardises overall growth.

CICC analysts believe that since property investment is still elevated, Beijing will not come to the sector’s rescue until the second half of this year.

“Loosening of administrative curbs by local governments, such as purchase eligibility curbs, is hardly a decisive factor. Overall money supply and minimum payment ratio are,” said David Hong, CRIC’s Hong Kong head of research.

In 2016 when home prices in major cities soared, M2, a gauge of broader money supply, increased 11.3 per cent (it rose 8 per cent in the first 11 months of this year). Fanned by price rise expectations, individuals raced to take advantage of easy credit, driving new mortgages granted by the four biggest banks to over half of their total new loans in that year.

Zhang Dawei, a research head with Centaline Property, said local-level easing at most could stabilise the sentiment, while credit easing holds the key.

Meanwhile, CICC maintained its previous 2019 estimate that national home sales by area would fall 10 per cent from 2018 and selling price would remain flat.