Investors’ outlook for Asia-Pacific hotels rosier, survey finds

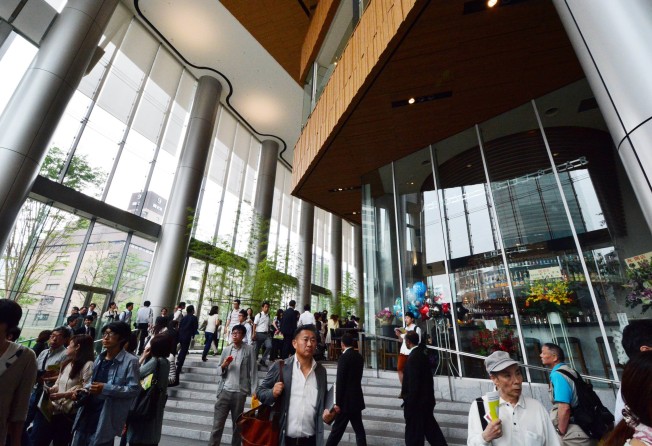

Investors have become more upbeat about the trading performance of Asia-Pacific hotel markets, with expectations for Tokyo the highest in the short term (six months) and Melbourne in the medium term (two years), a survey shows.

The stronger trading sentiment is underpinned by improvements in the global economy, burgeoning travel markets and a moderation in the number of Asian development projects, JLL said in its latest Hotel Investor Sentiment Survey, which covers investors and owners in about 100 hotel and resort markets worldwide.

Sentiment in the short term catapulted 26.3 percentage points from a survey six months earlier to 51.8 per cent, and medium-term sentiment rose 13.7 points to 54.2 per cent.

Each figure is obtained by subtracting the percentage of respondents who responded negatively from the percentage who responded positively.

In JLL's April survey, released on Monday, Tokyo ranks the highest among 24 cities for performance in the short term, at 89.5 per cent, while Melbourne is most favoured over the medium term, at 94.3 per cent.

Beijing ranked the lowest in the short term, at minus 50 per cent, while Shanghai ranked the lowest in the medium term, at about minus 10 per cent.

In China, the announcement of the government's blueprint for reform has improved sentiment, but progress on rebalancing the economy remains tentative, the survey said.

In the face of significant increases in the hotel supply that have come on line over the past few years, time should be allowed for investor demand to catch up, JLL said.

Around the world, investor sentiment has surged over the past six months, with expectations for the short term seeing an increase of 26.4 percentage points to 57.8 per cent and for the medium term up 27.5 points to 66.6 per cent.

Both are at the highest level ever recorded, with trading sentiment positive for all three regions - the Americas, Asia-Pacific and the EMEA (Europe, Middle East and Africa).