China slowdown spurs purchases of US homes

Mainland buyers, seeking safe haven, snap up US homes as fears of a weaker yuan mount

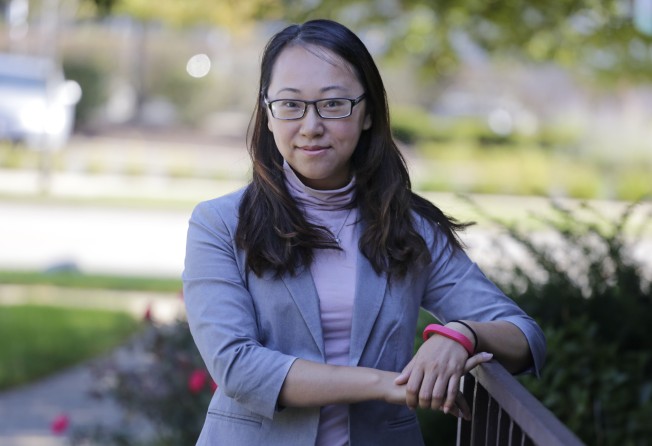

Wu Shanshan already owns three houses in China. But the 36-year-old has spent the past two months in Chicago shopping for a three-bedroom place. She has got cash to spend - up to US$400,000. "The real estate market in China is dropping and I'm planning to sell one of them to maybe buy more houses in the US," said Wu, whose hometown of Yunfu is in the province of Guangdong.

Chinese have been snapping up US real estate of all kinds, looking for a safer place to put their money than their own slowing economy. Investors from China are now second only to Canadians in the number of US homes they buy.

In the past few months, amid signs that China's economy is slowing even more than expected, Chinese investors have stepped up their buying. The government's decision last month to downgrade the country's currency added to their urgency, since a weaker yuan makes buying real estate in dollars more expensive.

"I got a spur of buyers contacting me in the past few days," said Gloria Ma, an agent with Re/Max Action in Lisle, Illinois, who is working with several Chinese homebuyers. "Some of the people are selling part of their holdings over there and come here and buy."

While purchases by foreigners represent just a sliver of overall US home sales, they have impacted markets significantly in certain cities such as New York, San Francisco, Seattle and Irvine, California. Buyers are also showing up in more affordable Midwestern areas like Chicago.

In the 12 months ended in March, roughly 209,000 US houses were sold to buyers living outside the US or immigrants in the country for less than two years, according to the National Association of Realtors. That represents about 4 per cent of all sales of previously occupied homes in the same period.

Of the US$104 billion in total sales, Chinese buyers accounted for the biggest portion, US$28.6 billion. Half of those sales involved homes in Florida, California, Texas and Arizona.

Overall, US home sales to foreign buyers have been falling - 10 per cent in the 12 months ended in March compared to the same period a year earlier - but the devaluation of the yuan makes a slowdown in Chinese deals unlikely.

That is one reason it is likely that Chinese who are interested in buying real estate won't pull back now, said Lawrence Yun, chief economist for the National Association of Realtors.

So far this year, the yuan has fallen 2.6 per cent versus the dollar. It now takes about 6.37 yuan to buy US$1. That is still better than five years ago, when 6.77 yuan bought US$1.

For now, the change in the currency was likely not enough to dissuade well-heeled homebuyers from China, said Tan Wei Min, a real estate broker who caters to investors looking to buy condominiums in Manhattan.

"My clients may say, 'OK, I'll just negotiate an extra 5 per cent off," said Tan, whose clients tend to buy condos priced between US$1 million and US$5 million.

That price range is typical of Chinese investors buying homes elsewhere in the US. And most of them pay in cash.

"In the last year or two, we've seen more sales pushing US$5 to US$10 million," said Tere Foster, a managing broker for Team Foster at Windemere Real Estate in Seattle.

The segment of homes most in demand by Chinese buyers were those priced about US$1.2 million, she said.

Not all buyers are wealthy investors. Some are middle-income earners with children bound for university in the US. They would typically buy an apartment or small single-family home for their children to live in while they go to college, said Lisa Li, an agent at Re/Max of Naperville, a suburb of Chicago.

Others will use the property for holidays or rent it out.

It is not just the US attracting Chinese real estate investment. Australia, other parts of Asia and Europe have also proved popular.

And since 2010, investors from China have bought roughly 100 vineyards in France's Bordeaux wine-making region, according to a report published earlier this year from Christie's International Real Estate.

The main reason is to protect their money.

"They want a safe place to park their assets," Tan said. "A lot of my clients were not expecting the Chinese economy to be strong indefinitely. A lot of them started moving assets to safer countries a few years ago."

Wu, the chief executive of a countertop maker, is looking to make her move now.

She plans to buy a house in cash and live there for at least three years as she works to gain a foothold for her business in the US. Wu is also eyeing the city's Chinatown neighbourhood as a location where she might buy another home as an investment, and to host out-of-town visitors.

Wu says she is determined to land her first home in the US, despite extra costs from the devaluation of the Chinese currency.

"It affects us a little bit," Wu said. "But not much."