Tencent bolsters lead in China’s video game live-streaming market, fending off rivals ByteDance, Alibaba

- The Shenzhen-based internet giant has paid US$262.6 million to take control of game live-streaming platform Huya

- The firm also has stakes in other major game live-streaming platform operators, including DouYu, Kuaishou and Bilibili

The billion-dollar race to become China’s Twitch and undisputed leader of the country’s fast-growing video game live-streaming market has concluded, according to analysts. And the winner is Tencent Holdings.

That followed Tencent’s move last Friday to pay US$262.6 million in cash to Nasdaq-listed social media company JOYY and take control of Huya, one of China’s largest game live-streaming platform operators. The deal, made through Tencent subsidiary Linen Investment, raised the internet giant’s stake to 36.9 per cent, up from 29.5 per cent, and increased its voting power in New York-listed Huya to 50.1 per cent.

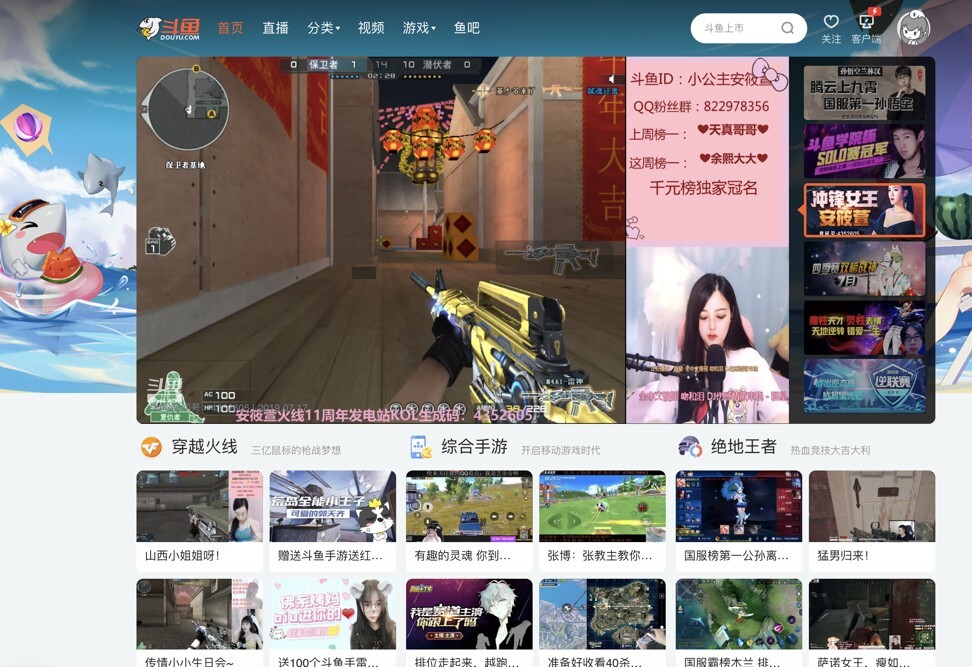

The transaction has enabled Shenzhen-based Tencent, which runs the world’s largest video games business by revenue, to strengthen its lead in China’s game live-streaming market since it already controls Huya’s main rival DouYu, according to Ding Daoshi, director of research at internet consultancy Sootoo in Beijing.

“Tencent has closed the supply chain loop in the gaming industry,” Ding said. “It now controls the development, publishing and broadcasting of gaming content [in China].”

Hong Kong-listed Tencent did not immediately respond to questions sent via email on Tuesday regarding speculation on the potential merger of its game live-streaming platforms.

In its announcement on Friday, Huya said it will continue to operate independently and remain headquartered in Guangzhou, capital of southern Guangdong province.

Before this deal, Tencent had already invested more than US$1 billion in both Huya and Nasdaq-listed DouYu, while backing other companies involved in the game live-streaming market.

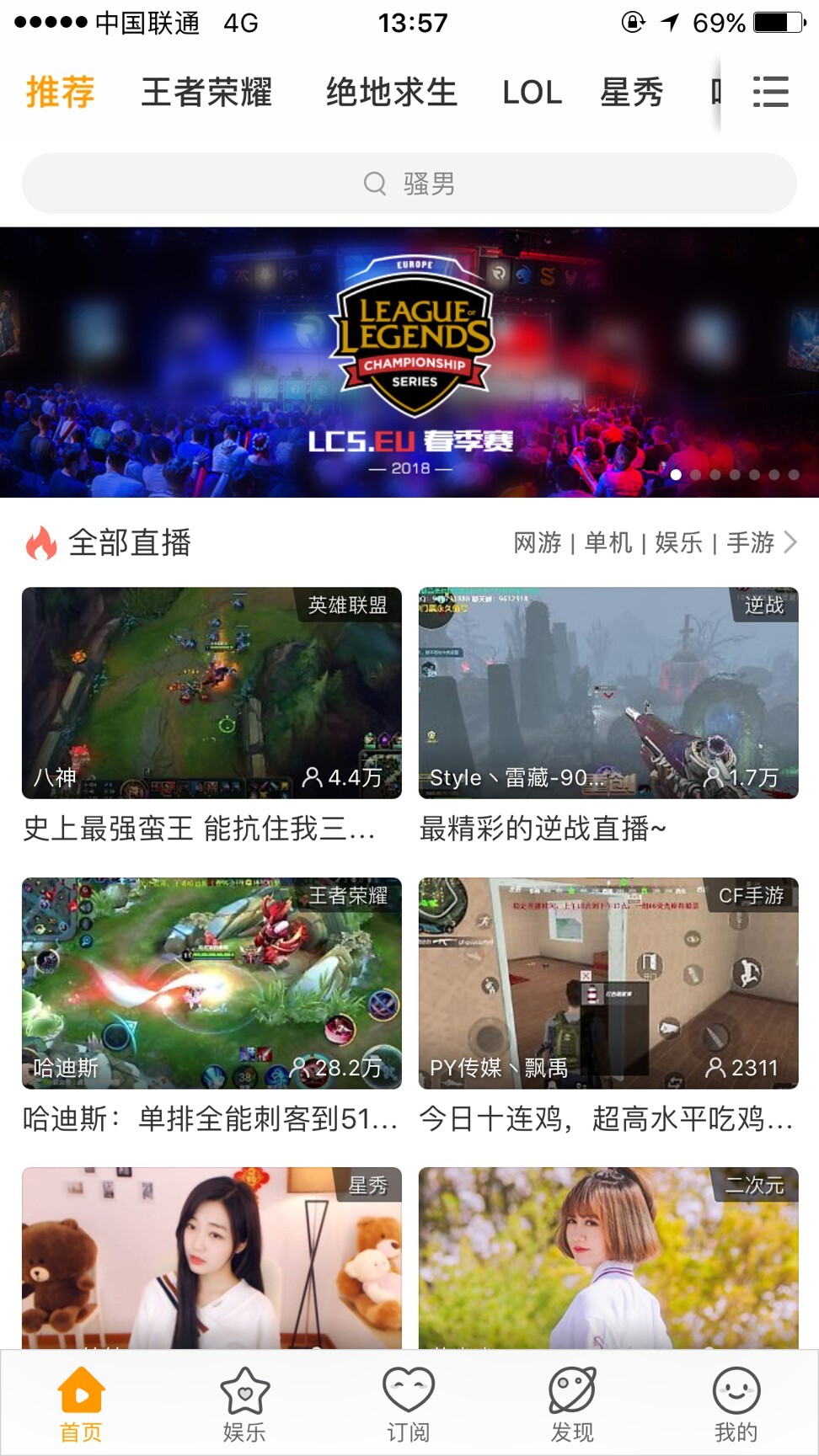

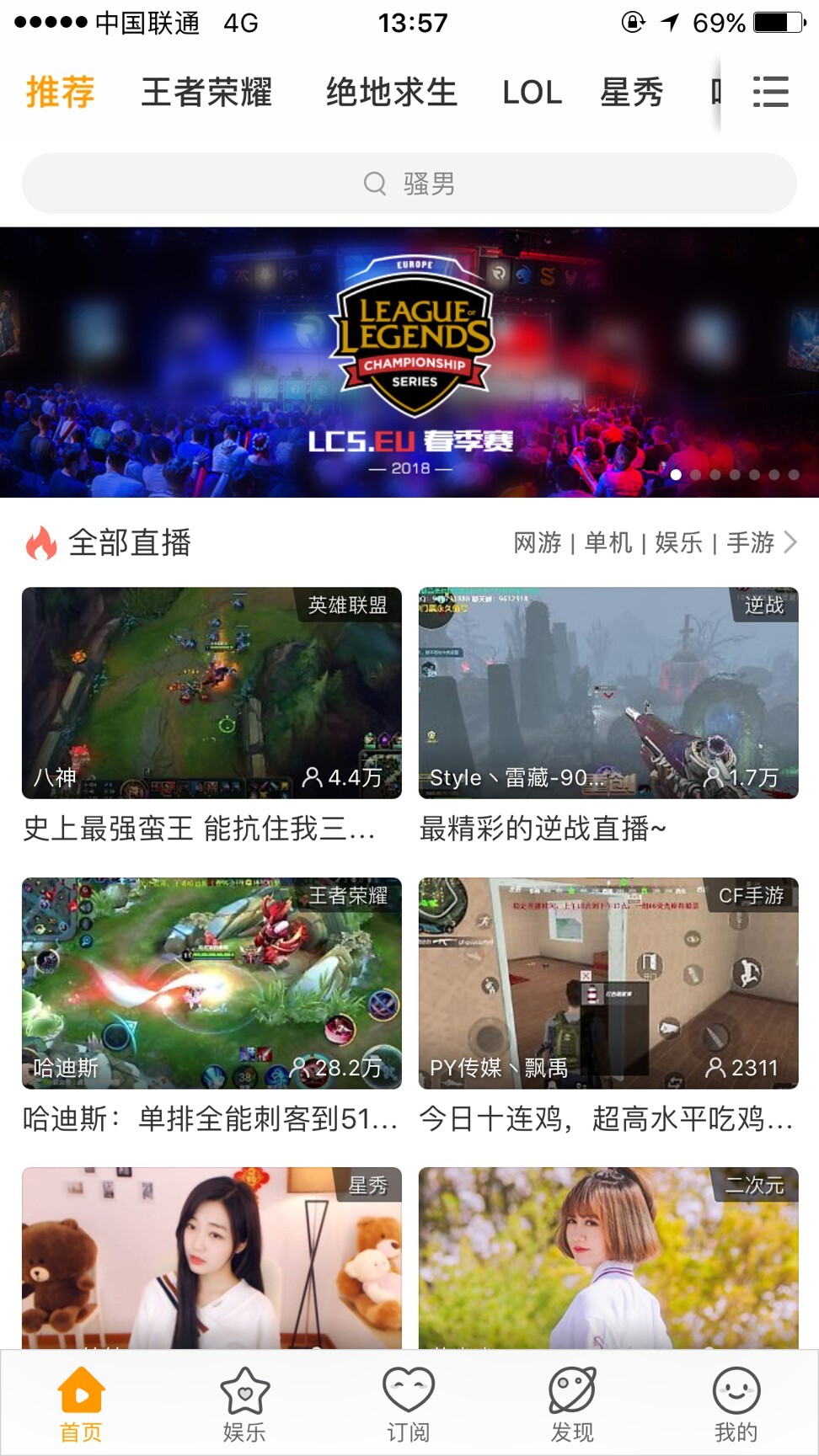

In July last year, Tencent-backed short video app operator Kuaishou announced its support for about 1 million video game broadcasters on its Twitch-like live-streaming service. In December, Shanghai-based streaming video service Bilibili, in which Tencent invested more than US$300 million in 2018, reportedly paid US$113 million to exclusively stream for a three-year period the League of Legends World Championships, the flagship event of Tencent-owned US developer Riot Games.

With its resources behind multiple game streaming platforms, Tencent has created an effective ecosystem to introduce new titles in the world’s largest video games market and launch others into high-profile, spectator-focused e-sports events.

China is the video game industry’s biggest market in Asia and the world, with more than 720 million gamers across mobile, desktop personal computer and console hardware, according to research firm Niko Partners. It projected this market to generate about US$36 billion in revenue this year, up from US$33 billion in 2019.

While Amazon.com-owned Twitch and Google’s YouTube are the dominant game live-streaming platforms globally, these services do not operate in China, enabling Tencent to strengthen its business in the world’s second largest economy.

Tencent’s recent efforts could be in preparation for upcoming competition from other major Chinese internet companies like Alibaba Group Holding and ByteDance, according to TF Securities analyst Wen Hao. “When it comes to live streaming, Alibaba has entered the market through e-commerce,” Wen said. “ByteDance is likely to have a very robust live streaming service going forward.”

Alibaba’s main Chinese internet retail operation, Taobao Marketplace, last year bought an 8 per cent stake in Bilibili, while developing its own live streaming capabilities to help online merchants market their products. Alibaba is the parent company of the South China Morning Post.

TikTok owner ByteDance, the world’s most valuable start-up, has about 800 million monthly active users across its different apps. The company has moved to diversify its operations by forming its own video games business, following its acquisition of a number of local game studios, and has included mini games on its widely popular short video app.

“In the age of cloud gaming, live-streaming platforms are likely to be where users first interface with a new game,” said Zheng Jintiao, co-founder of media outlet Gamer Boom. For live-streamed e-sports, Zheng said Tencent has already made a number of its blockbuster titles, such as Honour of Kings, Game for Peace and PUBG Mobile, well-suited for such events.

Sign up now and get a 10% discount (original price US$400) off the China AI Report 2020 by SCMP Research. Learn about the AI ambitions of Alibaba, Baidu & JD.com through our in-depth case studies, and explore new applications of AI across industries. The report also includes exclusive access to webinars to interact with C-level executives from leading China AI companies (via live Q&A sessions). Offer valid until 31 May 2020.