Huawei has a plan to create a telecoms rival in the US, but Washington won’t be buying it

- The offer to license 5G technology to an American company does not address Washington’s concerns, analysts say

- Telecommunications have increasingly been seen as a strategic national security domain and a geopolitical issue

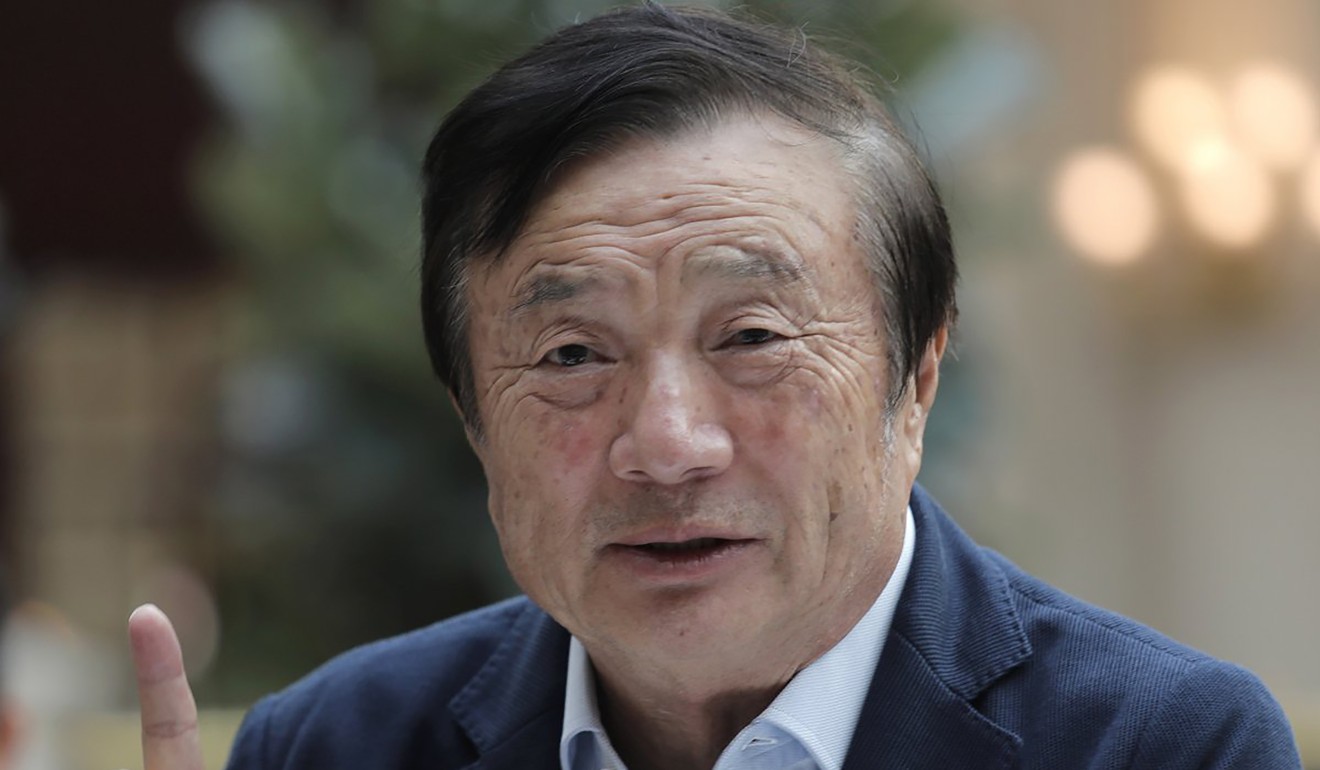

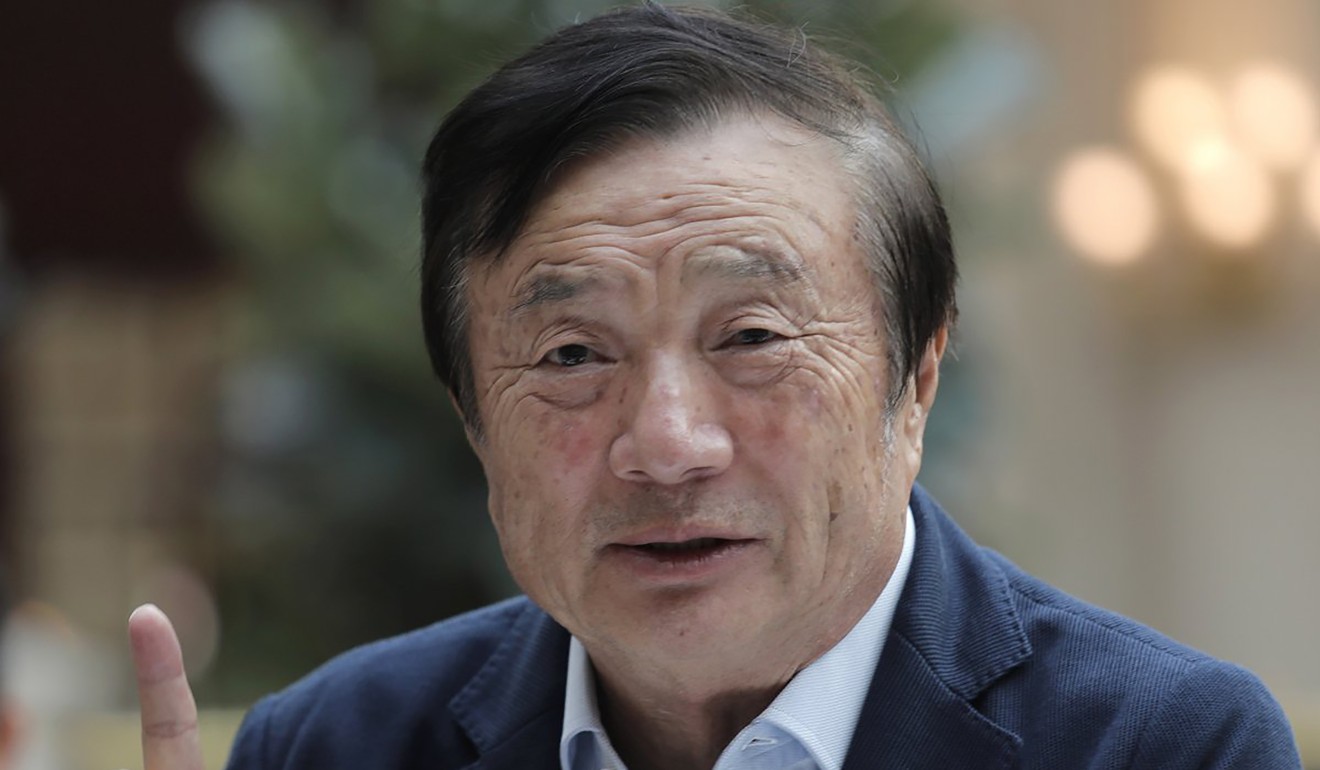

China’s telecommunications giant Huawei Technologies made headlines last week when its founder and chief executive, Ren Zhengfei, offered to help the United States build a competing 5G company – exclusively licensing its entire portfolio of 5G wireless technology, hardware and source code alike – that could develop its own large-scale market.

However, analysts said, Ren apparently overlooked one problem: the lack of US interest.

“It is an interesting proposal, but it doesn’t really address any concerns the US has … especially as Huawei has become synonymous with all the things people distrust about Chinese telecommunications,” said Lorand Laskai, visiting researcher at Georgetown University’s Centre for Security and Emerging Technology.

“Also, it is not a general licensing offer, but an exclusive one, like you transfer everything to one company in a really big deal.

“It is hard to imagine any company would take that risk to deal with Huawei,” added Laskai.

Indeed, the Trump administration has made Huawei a target this year, declaring that the company and its devices constituted a threat to national security while also trying to rein in China’s dominance in next-generation 5G wireless networks – specifically, Huawei’s.

Signing an executive order restricting US technology purchases by “foreign adversaries” that are deemed national security risks, US President Donald Trump put Huawei and 70 of its affiliate companies on a government “entities list” – a blacklist limiting Huawei’s access to critical chips and software from American suppliers.

For Ren, the dispute with the US got personal when his daughter, Meng Wanzhou, Huawei’s chief financial officer, was detained in Canada on a request by the US Department of Justice. Meng is fighting extradition to the US, where she faces charges related to violating sanctions against doing business with Iran.

Ren’s proposal, which came about two weeks before the resumption of US-China trade talks in Washington on October 10, is in sharp contrast to Huawei’s previous stance. In June, Ren told Bloomberg that “even if the US wants to buy our products in the future, I may not sell to them. There’s no need for a negotiation.”

But Washington’s take on Huawei over the past four months seems to have shifted, analysts said. More than a possible chip to bargain away in the trade talks with China – as Trump suggested in May – more even than a simple question of technological competition, they said, the US now seems to regard Huawei and its 5G technology as a global geopolitical challenge.

This, and the continued US suspicions about Huawei’s possible threat to national security, are issues, according to experts, that Ren’s offer does not – and cannot – address.

“Ren appears to be getting desperate. I don’t think the US would use Huawei even if offered for free,” said James Lewis, director of the Technology and Public Policy Programme at the Centre for Strategic and International Studies in Washington.

“The US government has been deeply suspicious of Huawei for more than a decade – long before 5G – and the offer doesn’t change that,” he said.

The next-generation mobile networks which are able to stream data about 100 times faster than today’s 4G networks, 5G is what will make driverless cars, smart cities, automation factories and other large-scale applications of connected devices feasible on a commercial scale.

The network that enables new types of machine-to-machine communications is not just a matter of economic and national security but a capability to become the technological and political world power.

As a global leader in 5G, Huawei makes large commercial-scale 5G applications possible at affordable prices. That gives Chinese telecoms companies a leg up on exporting those systems and other technologies to less developed countries as part of the Digital Silk Road Initiative, a foreign policy project Beijing has deemed critical in helping China shape the emerging international order of the 21st century.

Huawei also champions China’s effort in setting the international standard on 5G, an important process because it will determine not just how 5G networks are built, but also where the money flows among participants in the 5G ecosystem. Companies whose technology becomes the 5G industry standard will receive royalty payments from other participants. Those payments, in turn, will help finance future innovation.

“A US company using the same technology and standards provided by Huawei would also have an incentive to promote those very same standards on the world stage,” Lindsay Gorman, a fellow for emerging technologies at the Washington-based Alliance for Securing Democracy.

“There are significant upsides for Huawei in licensing its technology to a US company, especially when the US is not Huawei’s biggest market to begin with. This could actually be an entry plan to the US market,” she said.

Meeting with journalists last week at Huawei’s headquarters in Shenzhen, Ren said he wanted to license his company’s 5G technology to an American company to create a powerful new rival because Europe, South Korea and Japan all have their own 5G technologies.

“We should consider American companies and let them compete with us all over the world,” Ren said, adding that the company would let those companies modify the source code so that neither Huawei nor the Chinese government could have any control over any telecoms infrastructure built using its equipment.

Whether or not Ren expected his offer to be seriously considered, his gesture has been interpreted as an olive branch to the Trump administration and an attempt to soften the US campaign to contain Huawei. But it is not seen as a way to address US concerns over Chinese espionage or intelligence monitoring Huawei might enable.

“It is very, very difficult to go through massive amount of software code to find vulnerabilities and potential exploits,” Gorman said.

“So I am not sure if it is a feasible strategy from the perspective of rooting out espionage risks.”

Huawei has repeatedly denied US allegations that its systems could be used for espionage purposes by Beijing. But the company has so far failed to convince Washington, mainly because of the murky relationship between China’s private sector and its government; a Chinese cybersecurity law essentially requires companies to comply with intelligence requests the government makes.

“In China, every company by law must act in support of national security and the government. No Chinese company is genuinely private,” said US Senator Mark Warner, a Democrat of Virginia who is the ranking member on the Senate’s Intelligence Committee, in a speech late last month at the United States Institute of Peace, a government-financed think tank in Washington.

Warner urged the US to address the vulnerabilities of its telecommunication systems, and the development of 5G networks, by relying on trusted companies for infrastructure and building better cooperation with allies.

Beyond the information security risks Huawei might pose, the bigger question, Gorman said, concerns the values Huawei exports along with its technology.

“What happens if a Chinese-controlled company controls the world’s entire internet? Concentrating power and market share in the hands of an authoritarian-based global behemoth will surrender our future internet backbone to its control, including the ability to shut down parts at will,” she said.

Apart from the security concerns, the considerable investment and the access to qualified engineers also make it improbable that any US company would be willing to take up Ren on his offer, said Paul Triolo, head of Eurasia Group's geo-technology practice.

“It is not likely that Huawei will ever be allowed to become a major player in the US market,” Triolo said.

For more insights into China tech, sign up for our tech newsletters, subscribe to our Inside China Tech podcast, and download the comprehensive 2019 China Internet Report. Also roam China Tech City, an award-winning interactive digital map at our sister site Abacus.