iPhone sales are down in China as people buy cheaper handsets

Vivo nabs top spot as rivals see sales slump

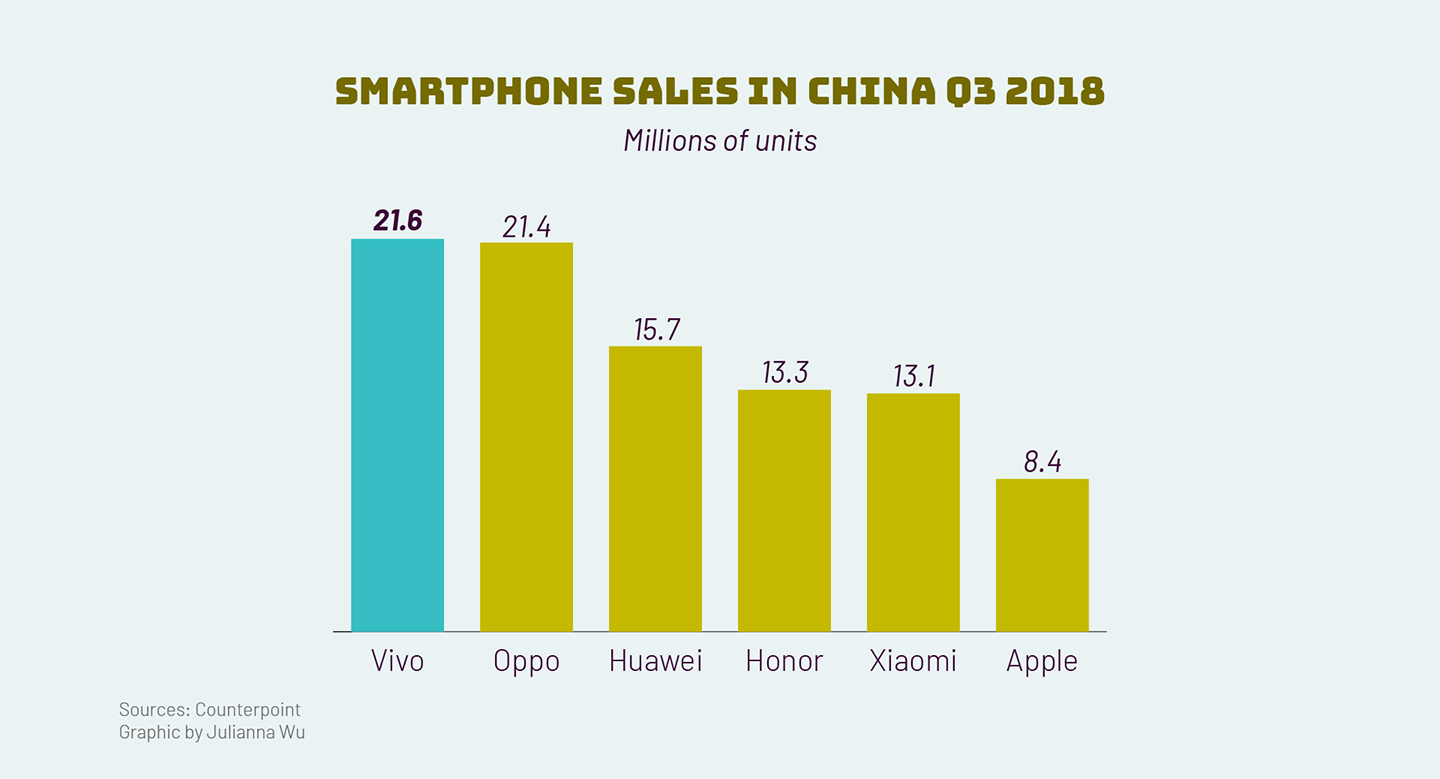

Vivo’s smartphone with a pop-up selfie camera attracted a lot of attention. But it was its budget handsets that saw it snag the top spot in China’s smartphone market in the third quarter of this year.

Right behind Vivo was sister brand Oppo, which sold only marginally fewer handsets -- but that 21.4 million is down 11% from the year before.

The same strategy -- high-end features in cheap handsets -- helped Huawei and Honor (a sub-brand of Huawei) grow rapidly, Counterpoint says. Both of them had a 14% year-on-year growth in Q3, claiming the third and fourth spot and squeezing Xiaomi to the fifth spot, who ranked the third in Q3 last year.

As for Apple, well, it only ranked sixth and took 7.7% of the market share in China last quarter, which Counterpoint says is down to weak demand for the pricey iPhone XS and iPhone XS Max. This period doesn’t include the iPhone XR, which is priced lower, but reports so far suggest demand for that may not change the rankings too much.

But the biggest standout figure here aren’t how the big brands are doing -- it’s how everyone else is doing. Because beyond the big six in this chart, sales for all the other smartphone makers are down a staggering 48% from the same period a year ago.

Why it makes sense for Xiaomi to take on selfie king Meitu’s smartphones

For more insights into China tech, sign up for our tech newsletters, subscribe to our Inside China Tech podcast, and download the comprehensive 2019 China Internet Report. Also roam China Tech City, an award-winning interactive digital map at our sister site Abacus.

For more insights into China tech, sign up for our tech newsletters, subscribe to our Inside China Tech podcast, and download the comprehensive 2019 China Internet Report. Also roam China Tech City, an award-winning interactive digital map at our sister site Abacus.