08:55

Huawei's founder on US sanctions, 5G leadership and building trust in Europe

As China’s telecoms champion and 5G powerhouse, Huawei Technologies is used to playing the role of king. Lately though, it is finding itself more like a pawn in the great power game between the world’s two superpowers.

The target of crippling US tech sanctions, the Shenzhen-based company has been on the ropes for some time but was able to fight back, even claiming the No 1 spot in smartphones in the second quarter. But with the latest move by Washington to tighten its grip over Huawei's access to US core tech like semiconductors, the company is literally facing a life or death situation.

“The US right now seems to be looking to kill Huawei [to] teach China a lesson,” said Stewart Randall, head of electronics and embedded software at Shanghai-based consultancy Intralink.

So far Beijing has not retaliated with anything other than fiery rhetoric, despite saying 15 months ago it would create an unreliable entity list of US companies operating in China. In response to the latest US move on Huawei, which effectively cuts off its supply of semiconductors altogether, the Foreign Ministry said Washington was weaponising national security issues and abusing state power.

“Retaliation from China isn’t a scenario we see playing out,” said Kenny Liew, telecoms analyst at Fitch Solutions “China still derives a lot of manufacturing value from US OEMs like Apple, and Chinese action will likely motivate the shift of production and assembly lines out of the country.”

For the next 68 days Beijing is likely to bide its time until the US presidential election, although analysts say a Biden win over Trump will not necessarily provide relief for Huawei.

Regardless of who wins the White House in November, Huawei needs to come up with a viable long term solution to survive without access to US technology.

“Leaner times certainly lie ahead for Huawei, but an enforced rationalisation and refocusing, however, could make Huawei stronger in the long term,” said Liew.

If Huawei survives the crisis, it is likely to look like a very different company.

For starters, it will not be the No 1 global smartphone brand – or maybe not even a premium brand – because that depends on its in-house designed Kirin chipsets, something now even acknowledged by its senior management who have for months downplayed the impact of the US sanctions.

“We are in a difficult situation … Huawei’s smartphones have no chip supply,” Richard Yu Chengdong, chief executive of Huawei's consumer business group, said earlier this month.

Huawei declined to comment on the issues raised in this story.

08:55

Huawei's founder on US sanctions, 5G leadership and building trust in Europe

In the second quarter Huawei managed to overtake Samsung Electronics for the top spot and reported a 13.1 per cent rise in year on year revenue for the first half, but with the company living off stockpiled chips, that cannot last.

Huawei had expected to sell up to 130 million 5G smartphones next year but that target may drop by 75 per cent to 30 to 35 million, according to Taiwan-based semiconductor research firm Isaiah Research.

Huawei’s inventory of 4G/5G smartphone chipsets will drop to around 50 million by the end of this year, including its own Kirin chips and those from Taiwan supplier MediaTek, but that stockpile is likely to run out by the first quarter of next year, said Isaiah chief executive Eric Tseng.

“After that, Huawei’s smartphone business may lose its competitiveness as it cannot order from Qualcomm or MediaTek without US permission,” he said.

Huawei then enters uncharted territory, say analysts. “It will likely have to reorganise, retrench and scale down operations to remain profitable,” said Liew from Fitch Solutions.

The biggest hit will be on its consumer products group which accounts for over 50 per cent of the company’s total revenue. The products in this group, including smartphones, tablets and PCs, all need semiconductors to function.

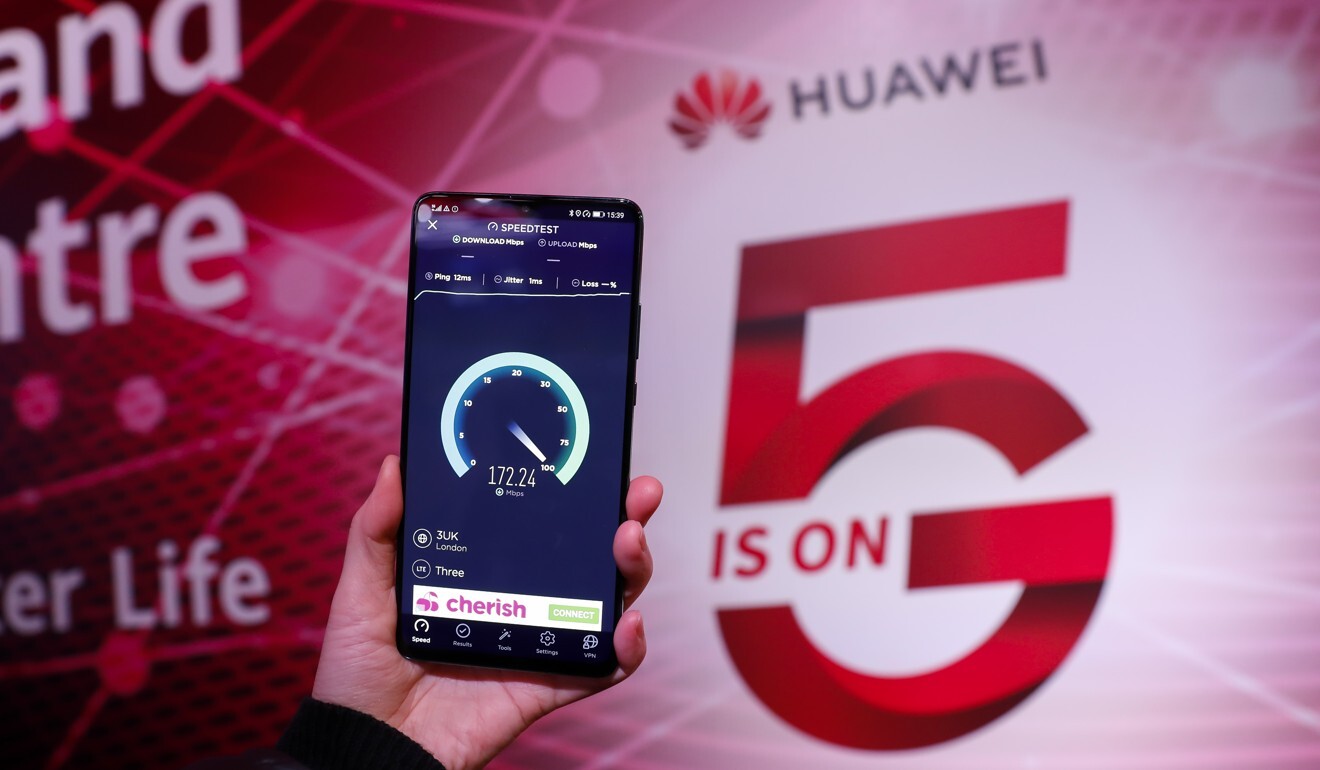

As for Huawei’s prized 5G business, that is also facing a dire situation because the base stations rely on semiconductors made by Taiwan wafer foundry TSMC, which was banned from supplying Huawei in a separate order issued by Washington in May. As well as being cut off from chip supply, Huawei’s 5G business is being shut out of more countries, including the UK, France, Japan and Australia – and now India is following suit.

But at home Huawei is doing well in the 5G infrastructure build up, using stockpiled chips for the critical base stations. By April, it had secured more than half of the 5G contracts awarded by China’s three largest carriers, beating out competitors like Sweden’s Ericsson and crosstown rival ZTE.

The fact that the Chinese government is not helping in the company’s fight with the US must be a bitter pill for Huawei, which got into trouble with Washington in the first place because of its perceived ties to Beijing, an allegation it has always denied.

A Shanghai-based investor compared Huawei’s situation to that of a pawn in a larger fight between the world's largest economies.

“To solve the problem China has to compromise because now it cannot defeat the US in the chip industry,” said the investor, who spoke on the condition of anonymity due to the sensitive topic. “The semiconductor industrial supply chain cannot be localised in China any time soon.”

To that end, China unveiled a major tax incentive policy earlier this month to encourage innovation in the domestic semiconductor industry, offering qualified companies tax free profits for the first two years.

Beijing’s reluctance to retaliate on behalf of Huawei comes amid a shift in strategy from a tit-for-tat confrontation with Washington to an effort to prevent bilateral relations collapsing ahead of the November 3 US election.

“The current problem faced by Huawei cannot be solved by itself as a company,” said Szeho Ng, managing director of research at China Renaissance Securities. “It depends on diplomatic policies between the US and China.”

At Huawei’s Shenzhen headquarters, it might seem business as usual but employees are anxious, with some worried about their jobs.

Several Huawei employees interviewed by the Post said they were expecting cuts to their bonus, and even lay-offs in the near future. Some have started looking for jobs elsewhere. All spoke on condition of anonymity as the subject is sensitive.

“I am preparing for a tough time ahead,” said a salesman from the marketing department, who has already cut back on unnecessary daily expenses. “No matter how big Huawei is, as a commercial company it cannot contend against the US.”

A graduate engineer in Huawei’s research and development (R&D) department is considering leaving after less than two years. “The budget for R&D may be cut if total revenue drops. I may leave if that happens,” he said, adding that it was Huawei’s large R&D spend that attracted him in the first place.

Not all are as worried. “My daily work goes on as normal and my paycheck hasn’t been cut,” said another salesperson in marketing. Another Huawei employee said he was confident the company would survive the crisis, while admitting the situation has put pressure on his own work.

01:05

China urges Canada to immediately release Huawei CFO Meng Wanzhou

If Huawei’s senior executives have a rescue plan, they are keeping it from the rank and file.

“I believe Huawei has some backup plans … but the senior management is keeping quiet and will not disclose them because they will be targeted again by the US,” said another Huawei employee.

The clash between Huawei and Washington has parallels to the situation faced by ZTE in 2018, when it was barred from using US technology when it broke a previous agreement and was caught illegally shipping US-origin goods to Iran and North Korea.

Huawei is also being pursued separately by Washington over alleged violations of US sanctions, resulting in the arrest of Huawei CFO Meng Wanzhou, the daughter of Huawei founder Ren Zhengfei, at Vancouver airport in December 2018. She is facing extradition on allegations that she covered up Huawei’s links to an Iranian company.

However, the parallels with ZTE end there. After a personal plea to US President Donald Trump from Chinese president Xi Jinping, the ZTE ban was lifted and the company agreed to pay an additional US$1 billion in fines and let US regulators monitor its operations.

Xi is unlikely to intervene on Huawei’s behalf as such a move now would have broader implications amid worsening Sino-US relations.

Barring any diplomatic breakthrough, Huawei’s options as a commercial company are very limited, according to most analysts interviewed by the Post. The bulletproof solution – building its own semiconductor foundry completely free of US technology in the next 12 months – is a “mission impossible,” they say.

Ironically, Huawei’s best last hope might be pressure from US chip suppliers like Qualcomm, which once counted Huawei as a major customer before the Chinese company began producing its own chips for smartphones. Qualcomm has been lobbying the US government for approval to resume sales to Huawei, according to The Wall Street Journal.

Qualcomm did not respond to a request for comment.

“American tech companies aren’t happy about the sanctions because they’re losing a big customer in Huawei. So I think they will continue to lobby against the sanctions,” said Mike Feibus, a research analyst at Scottsdale, Arizona-based Feibustech.

Whether they can resume selling to Huawei may depend on the outcome of the US election in November. A Biden Administration could opt for a subtle change in tone, focusing more on China’s human rights record, whereas Trump’s attention has been more directed at commerce and trade.

“I don't think Biden will roll everything back [if he wins], it will look bad for him. China isn't popular in the US right now,” said Randall. However, a new administration “could possibly grant more licences to US firms to sell products to Huawei”.