Is the party over for Alibaba? E-commerce king fetes first anniversary of record-breaking IPO in US but faces uncertain future

Chinese e-commerce powerhouse Alibaba Group on Saturday marked the first anniversary of its historic US$25 billion initial public offering, the world’s largest-ever IPO, with a number of questions looming about its future.

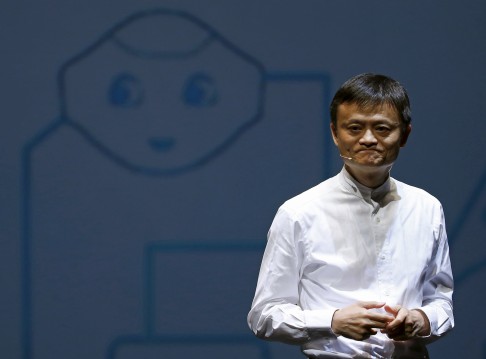

A year ago, New York-traded Alibaba was the toast of the town as its listing in the United States brought a huge windfall to co-founder Jack Ma Yun and the company’s senior management, major shareholders like Japan’s SoftBank and online giant Yahoo, and a global investment community that had bet on the continued fast-paced development of China’s internet industry.

No internet company can be a champion for five continuous years. It’s a tough business

In a commentary at the time, China's state-run news agency Xinhua said the emergence of Alibaba reflected the “rising power of Chinese business on the world stage”.

The party is over for Alibaba as bludgeoned investors have expressed concerns about its direction amid the company’s lowered sales estimates due to weakening demand in its home market, the slowest revenue growth in three years during the quarter ended June 30, and stock that has fallen below its listing price of US$68.

Alibaba’s share price reached a record high US$119.15 on November 10.

One tell-tale sign about Alibaba’s current plight was its recent decision to embark on a massive US$4 billion share buy-back programme over a two-year period, just within 12 months after its IPO, to ease investors’ concerns.

Ma, the executive chairman at Alibaba, has said that he was used to “unlucky things happening everyday”, but this did not prepare him for the broadside that American news outlet Barron's published this month, which suggested up to a 50 per cent decline in Alibaba’s share price from its current level.

The Barron's story was also critical of Alibaba's investments beyond online retail — including in media, entertainment, logistics and cloud computing — which “seem aimed more at beguiling investors than improving earnings”.

Alibaba is positioned to leverage the next legs of growth in online shopping in China — from lower-tier cities and mobile devices

Alibaba last week slammed the story, claiming the author lacked “understanding of e-commerce and Alibaba’s strengths and strategies”.

Yet fears of a further share slide caused by China’s economic slowdown and the country’s recent stock market crash have rattled the small investors closest to Alibaba, which is headquartered in Hangzhou, capital of the eastern coastal province of Zhejiang.

Chief executive Daniel Zhang Yong, in an internal memo last month, urged Alibaba employees, many of whom own shares in the company, to focus on serving customers and not on the fluctuations of Alibaba’s shares.

“We have faith in the Chinese economy, and … our team and partners,” Zhang said.

A number of analysts are also keeping faith in the company’s strong fundamentals, such as operating China’s largest business-to-consumer and business-to-business e-commerce platforms.

Alicia Yap, the head of China internet research at Barclays, said in a report last week that Alibaba's “user traffic and user engagement levels remain steady and healthy”, despite softness in the domestic market.

In a research note last month, HSBC analysts said: “In our view, Alibaba is positioned to leverage the next legs of growth in online shopping in China — from lower-tier cities and mobile devices.”

According to US-based eMarketer, Alibaba’s share of the US$68.7 billion global mobile advertising market will increase to 6.9 per cent this year, up from 5.1 per cent last year.

Ma, unfazed by temporary setbacks, had pointed out last year that Alibaba was gearing up for a long battle and that the company aimed to be in business for at least 102 years.

Ma reiterated that pragmatic approach at the recent World Economic Forum in Dalian.

“No internet company can be a champion for five continuous years. It’s a tough business,” he said at the event.

Whether Alibaba will be able to build a business that will last more than 100 years is one question investors may not care about right now.