Can Chinese internet pioneer Sohu finally pull off a comeback after missing the mobile era?

- Sohu’s best year was in 2011 when it posted an annual net profit of US$162.7 million

- The portal reported US$1.88 billion in revenues for 2018, up 1 per cent from the previous year

Years after Sohu.com, once known as one of China’s leading internet portals, fell from grace by missing the mark in some of the hottest realms of the mobile internet age – social media, live broadcasting and short video – it has vowed to make a comeback with new initiatives in videos and more.

Sohu is at the stage of bottoming out and is set for a “comeback”, Sohu founder and CEO Charles Zhang Chaoyang said at a media briefing on Wednesday, detailing plans to launch new self-developed drama series on its streaming site and move into the short video space, according to a report on the Sohu News portal.

But can Sohu pull off a recovery?

Its latest attempt was Huyou, a social app that last month joined the attack on China’s dominant social and messaging app WeChat, but failed to impress users and the industry after it was pulled from app stores only two days after launch.

“Due to the need to improve some features, the Huyou app will be removed in half an hour from app stores for a week”, Zhang wrote in one of three posts announcing the decision last month on Weibo, China’s popular Twitter-like microblogging site run by a rival internet major Sina Corp.

He added that the app, which works like a hybrid of WeChat and Weibo as a social platform, remained accessible to existing users, but some users were quick to move on. “I’ve already uninstalled it,” read the most upvoted comment in response to Zhang’s post.

Sohu did not comment on Zhang's remarks or the company's strategy to achieve a comeback.

Huyou missed its one week deadline for relaunch. It is still “undergoing some improvement”, Zhang said at the media briefing, as reported by Chinese tech media TechWeb.

As one of the earliest internet companies in China, Sohu is now entering a space dominated by Tencent Holdings-operated super app WeChat, which counts more than 1 billion active users and is known as Weixin on the mainland. New social media apps continue to pop up and challenge WeChat’s predominance in the world’s biggest internet population, usually in vain.

“It’s natural for Sohu to make this move because social media is the centre of internet traffic, and that’s why major Chinese internet companies, including Alibaba with its Laiwang app, have made their attempts in this field even though many of them failed in the end,” said Dingding Zhang, former head of Beijing-based research firm Sootoo Institute and now an independent internet industry commentator. Alibaba is the parent company of the South China Morning Post.

The chances for Huyou to break through in the crowded social media market are slim, Zhang said.

“In social media, the cost for users to switch to a new platform is very high, especially when WeChat has covered pretty much everything it can do,” he said. “I don’t think the company thought it through, making Huyou a hodgepodge of all major social products. The chance for it to succeed is less than 1 per cent.”

Hoyou is not Sohu’s first attempt in the social media field. In 2000 Sohu acquired ChinaRen.com, one of the earliest social platforms in China, which met its demise as a new wave of social media services rose.

The company launched its own live-streaming service Qianfan in 2016, when the broadcasting industry was already at its peak with the number of platforms growing to more than 100 but monthly active viewers were in decline, according to market intelligence firm iResearch. Neither of these products became mainstream in their fields.

Social media is a highly competitive space with a slim chance for success, and when Sohu encounters a setback it can only rely on its other businesses such as video and Sogou, the Chinese Pinyin input method editor and a spin-off of Sohu, analyst Zhang said.

In December 1996 Sohu was the first company on the Chinese mainland to connect to the internet via a trunk line after Zhang persuaded officials at Beijing Telecom, a unit of nationwide carrier China Telecom, to put its servers at the headquarters of the fixed-line network operator.

The company was founded by Zhang in the 1990s after he returned to China with a PhD in physics from the Massachusetts Institute of Technology. The Xi’an native, who graduated from the elite Tsinghua University in Beijing, helped a US internet company set up its China operations before he left to start what would be Sohu.

Sohu followed the business model of US internet services pioneer Yahoo by building its own search engine and directory, attracting traffic and selling online advertisements based on page views. By 2000, Sohu was attracting 20 million users who browsed news, searched for information, chatted with friends and sent emails.

Over the years, Sohu has built a matrix of Chinese-language online properties and mobile platforms, which include its main portal, interactive search engine and Chinese input editor Sogou, online games developer and operator Changyou.com, Sohu Video and Sohu News. Yet newcomers popped up in these fields to ride the wave of migration of internet users to the mobile era.

“Sohu’s downturn started when China’s internet migrated from personal computers to mobile in the early 2010s, and it was one of the companies including search giant Baidu that did not make a smooth shift in the industry reshuffle moving from PC to mobile,” analyst Zhang said.

Sohu was the first internet portal operator in China to introduce popular American television programmes, such as The Ellen DeGeneres Show and House of Cards. Today, however, the domestic market for streaming video is dominated by Nasdaq-listed iQiyi, Alibaba subsidiary Youku Tudou and Tencent Video, all of which deliver many of the country’s most-watched TV programmes.

In online news, Jinri Toutiao, an app operated by Beijing-based Bytedance, has built a following of hundreds of millions of users by pushing content tailored to individual preferences, which is done through recommendation algorithms powered by artificial intelligence.

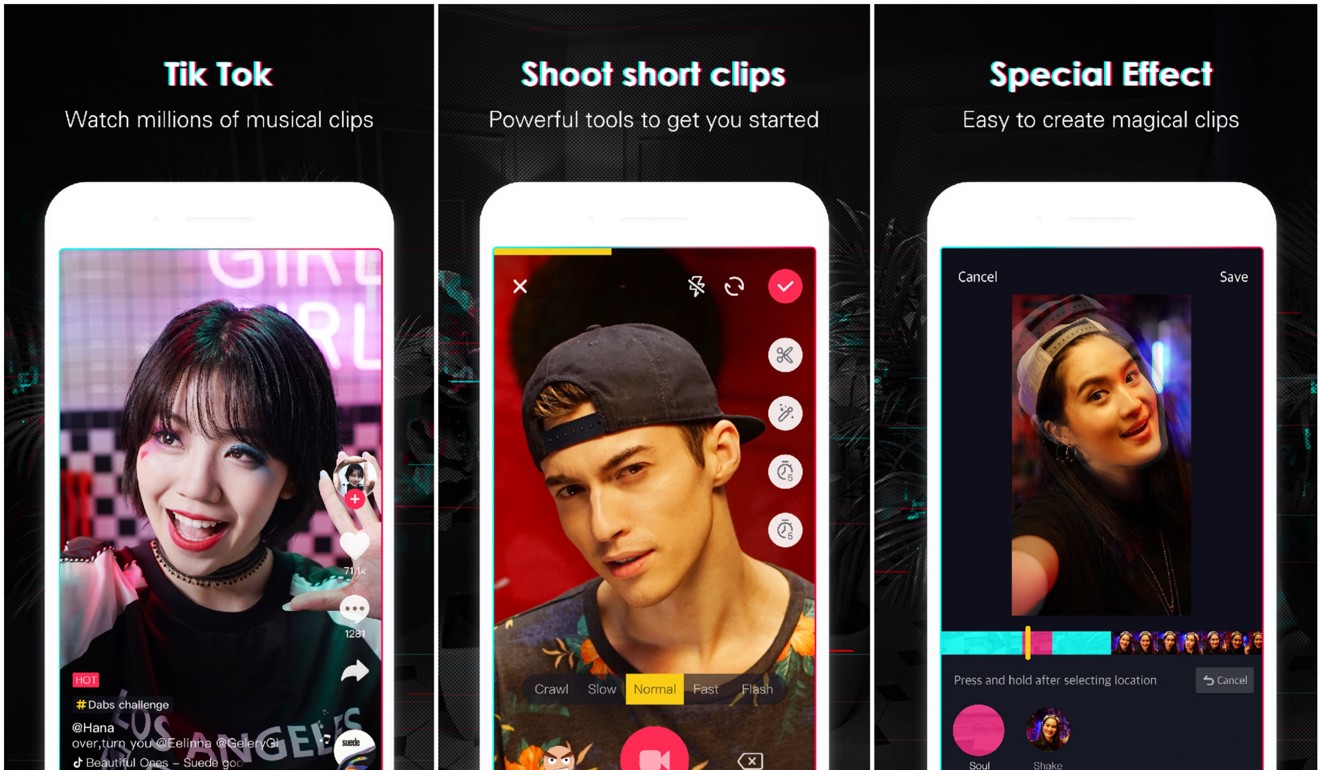

Bytedance’s Douyin app, known as Tik Tok outside mainland China, has captured plenty of attention with its 15-second user-generated videos. Reports have put Bytedance’s valuation at a potential US$45 billion in an initial public offering.

Sohu’s best year was in 2011 when it posted an annual net profit of US$162.7 million. The company has failed to post a profit since 2012, as users and advertisers shifted to a new class of internet service providers like Tencent. Today Hong Kong-listed Tencent’s market value is 800 times bigger than that of Sohu.

Sohu reported US$1.88 billion in revenues for the year 2018, up 1 per cent from the previous year, as its advertising business felt the impact from China’s economic slowdown.

Sohu’s Zhang said profitability is still a theme for the company through better capital management and monetisation of its current products. “We will see the losses to narrow quarter by quarter, and we’re running swiftly towards profitability,” he told the press on Wednesday.