CoverGo’s solution to better manage holders’ insurance policies

Insurance app claims over 1,000 users in Hong Kong have already registered since its launch in February, and now it’s expanding into Malaysia and Taiwan.

Hong Kong ranks among the world’s highest, when it comes to insurance premiums per capita.

But the city is still lacking when it come to insurance technology (so-called “insurtech”) to help make the industry more efficient, says Tomas Holub, the creator of the app CoverGo, who wants to change all that.

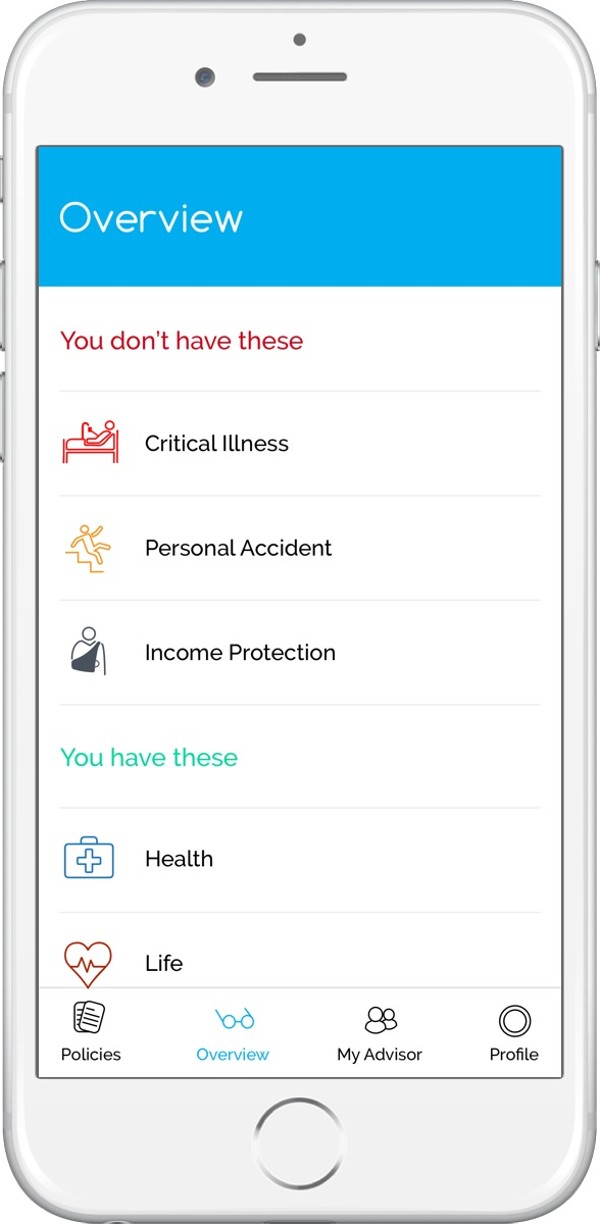

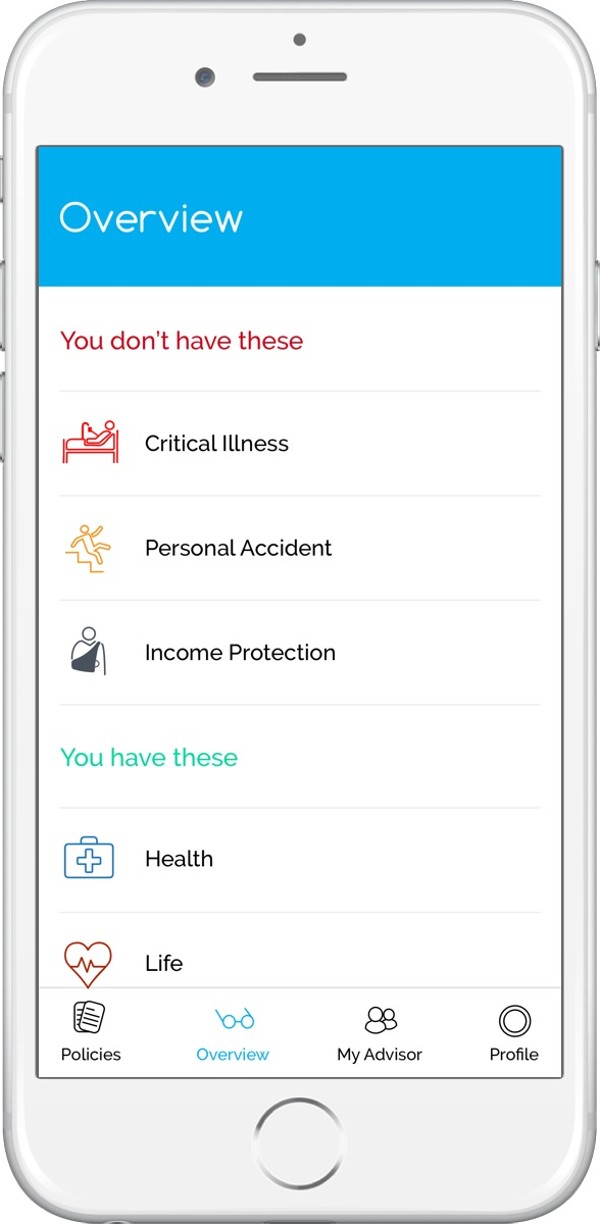

CoverGo allows users to package their existing insurance policies into a “digital insurance wallet”, he says, allowing them to better-manage the policies they own, and highlight areas in which they might lack cover. They can also obtain information about policies they are considering buying.

“Hong Kong’s a natural market. People spend a lot on insurance policies and you don’t have to explain to them why insurance is important,” said Holub, CoverGo’s chief executive and founder.

“It’s a very developed insurance market – but in terms of insurance technology, it is still behind Europe and the US.”

Originally from the Czech Republic, Holub spotted the gap in Hong Kong’s insurtech industry and moved here last year.

He started CoverGo after realising that managing mutli-insurance needs can be a complicated and stressful process for both individuals and companies, following their father’s death two years ago.

He and his brother had to repay Holub Snr’s mortgage, but their insurance claim was rejected as the coverage had lapsed because no one was keeping track of the paperwork.

The personal experience inspired Holub to create CoverGo as a digital alternative to piles of insurance policy paperwork.

He claims over 1,000 users in Hong Kong have already registered with the app since its launch in beta in February.

Financial advisors and agents, for instance, pay subscription fees ranging from HK$100 to HK$200 (US$12.80 to US$25.60), to use CoverGo as a tool to manage their own clients’ policies and map out their needs.

CoverGo has already built up a strong pool of agents, brokers and financial advisors who are using the app, who in turn deal with over 30 insurance firms, as what he calls “an engagement tool”.

The app can also help match users, who do not have an existing advisor, to an ideal fit, Holub said.

While CoverGo’s primary market is still Hong Kong, the start-up is also expanding into Malaysia and Taiwan, both well-established insurance markets.

By next year, Holub then plans to incorporate an artificial intelligence chatbot within the app, allowing users to immediately get automated answers regarding insurance enquiries.

Another feature being planned ot to allow users to take pictures of their claims receipts, and send them directly to their advisor, who can then process them on their behalf.

“Advisors and agents spend half their time processing claims – it is very manual and a major challenge for the industry,” said Holub.

“With chatbot, we hope to help automate those types of task to save time, so that they can focus on tasks that bring greater value, such as new business.”