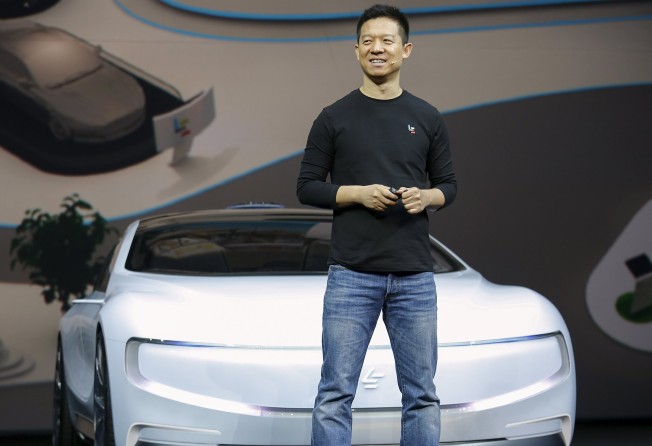

LeEco founder Jia Yueting ordered back to China to sort out subsidiary’s financial troubles

The China Securities Regulatory Commission has stepped up efforts to show it is serious about protecting investors on the mainland. Leshi, the debt-saddled video-streaming unit of LeEco, is listed on the Shenzhen Stock Exchange.

China’s stock regulator issued an order late on Monday for LeEco founder Jia Yueting to return to the country before the end of this year to deal with the financial woes of his company’s Shenzhen-listed subsidiary.

The China Securities Regulatory Commission (CSRC) said Jia has yet to show up and deliver on his promise to provide interest-free loans to debt-mired Leshi Internet Information & Technology Corp, despite repeated calls from the regulator.

The CSRC has been pushing for Jia’s return since September.

“The debt has yet to be paid back,” the agency said in a statement. “It has severely hurt the interest of the listed company and investors and has had an extremely adverse social impact.”

Jia made his fortune at Leshi with an online video-streaming service similar to Netflix, but he borrowed heavily against his shares in the company to expand into new ventures, including smartphones and electronics.

In July, Jia ceded his positions as chairman and board member at Leshi to focus on privately held conglomerate LeEco’s electric car start-up Faraday Future. This venture, which Jia had envisioned to one day challenge Tesla, has also been struggling to raise capital.

A Leshi representative declined to comment on the CSRC statement.

Faraday did not respond to calls and emails for comment. It was not clear where Jia is, though Faraday has operations in the United States.

The CSRC may not have the authority to force Jia back to China, but it has been stepping up efforts to show it is serious about protecting investors in the country’s fledgling stock market. The regulator has imposed steep financial penalties on alleged market manipulators this year.

In March, it ordered one individual to pay penalties of 3.47 billion yuan (US$529 million) for violations on disclosures and manipulation, and another to pay 1.17 billion yuan in two cases of manipulation.

“China is stepping up efforts in securities supervision, and the CSRC can’t let its credibility be challenged by a case like this one,” said Dong Zhiyi, a Shanghai-based attorney with Yida Law Firm. “I’ve never heard of CSRC issuing such a statement asking for a shareholder’s return.”

In November, billionaire property magnate Sun Hongbin provided US$270 million in loans to LeEco’s online video-streaming subsidiary and television unit Leshi Zhixin through his Tianjin-based Sunac China Holdings.

That marked the second major funding made by Sunac to support embattled LeEco this year, after making a 15 billion investment in January to bail out fellow Shanxi province entrepreneur Jia and his LeEco group of companies.

In a statement issued by Leshi in October, it said Jia had promised in 2015 to make two interest-free loans payable in 10 years or more worth a combined 5.7 billion yuan, while his sister Jia Yuefang had agreed to make loans valued at 1.7 billion yuan.

Trading in Leshi shares has been halted since April.