For more insights into China tech, sign up for our tech newsletters, subscribe to our award-winning Inside China Tech podcast, and download the comprehensive 2019 China Internet Report. Also roam China Tech City, an award-winning interactive digital map at our sister site Abacus.

China stockpiles US chips amid fears of worsening trade relations

- Chinese imports of US computer chips risen strongly in the past three years, as the risk of a “silicon curtain” descending looms over tech firms

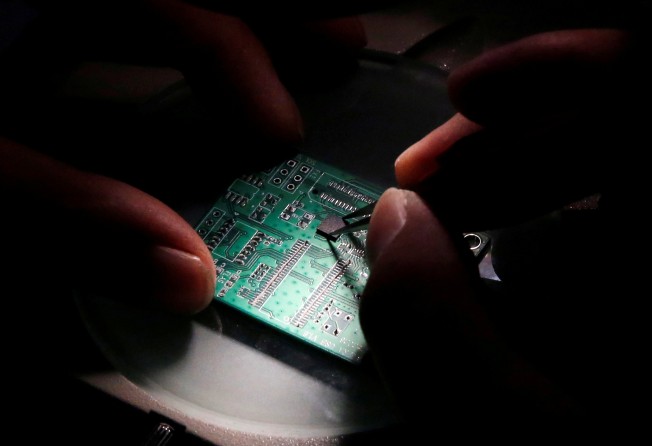

China is stockpiling US computer chips, a sign that tech companies there are preparing for worsening trade relations that could lead to being cut off from American technology.

Chinese imports of American semiconductors, integrated circuits and the equipment to make them have risen strongly in the past three years, analysis of the latest official data shows, despite overall purchases from the US declining dramatically since 2018 amid the trade war. Imports of chips and related machinery from the US were almost US$1.7 billion in August, the most since at least the start of 2017, and were close to that again in October.

As US President Donald Trump’s tariff war with China morphs into a more general confrontation over future technology, the risk of a “silicon curtain” descending is real for many Chinese firms who are not yet able to source hi-tech components domestically.

“It’s politically intolerable to China that the US has an at-will ability to turn off major companies like ZTE and Fujian Jinhua, as well as being able to deal major operational blows to Huawei,” said Dan Wang, a technology analyst at Gavekal Dragonomics in Beijing. “So the government and the companies are trying to be more technologically independent.”

China has invested billions in an attempt to develop a domestic semiconductor industry. But it still lags in key areas such as high-performance microprocessors and graphics chips.

The US blacklisting of Chinese companies including Huawei Technologies is one factor driving the surge in imports, given the need to stockpile. The emergence of home-grown smartphone brands such as Huawei and Oppo as well as a rapid adoption of cloud computing is also helping propel the import of high-performance silicon.

Huawei has built up inventory from around 2018 and continued to do so in 2019 in anticipation of losing access to US tech. The firm is at the centre of the tension between the US and China over whether its telecommunications and networking equipment poses a security threat.

Surveillance company Hangzhou Hikvision Digital Technology is another, one of eight Chinese technology companies facing restrictions over accusations they were involved in human rights violations in Xinjiang. The company said in October that it had stockpiled enough key parts to keep operations going for some time.

In October the government formally created a new US$29 billion state-backed fund to invest in the semiconductor industry, advancing its goal of reducing dependence on US technology. State-backed Tsinghua Unigroup is the nation’s top chip maker and one of the local giants leading the charge. Its most ambitious project is a US$22 billion dollar plant in Wuhan that was funded from the first fund in 2014.

Investment in the sector slowed in 2019 after the blacklisting of Fujian Jinhua Integrated Circuit basically shut down one of the country’s fastest-growing fledgling chip makers. Imports of chip-making equipment are down somewhat on the heights in 2018, when total purchases jumped to over US$26 billion from 2017’s US$16.4 billion, but China is still importing almost US$2 billion dollars a month from the top five suppliers.