China-Australia trade: Uptick in Chinese investments Down Under but US, Singapore funds piling in too

- ‘The last couple years have taught us that Australia-China trade is less affected by political tension than perhaps previously realised,’ says analyst

- The US has the highest number of investment approvals, with Singapore in second place, and China coming in fourth

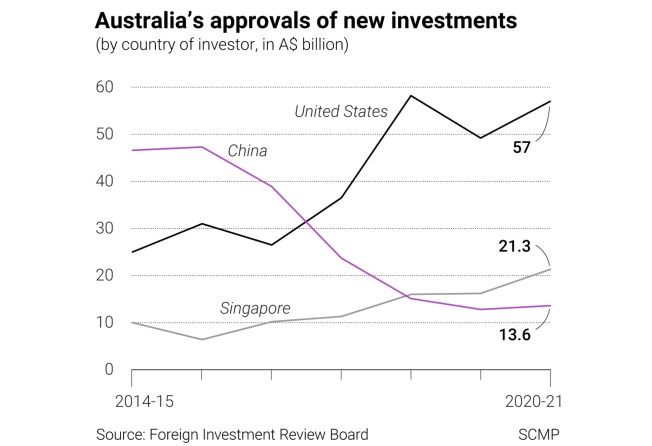

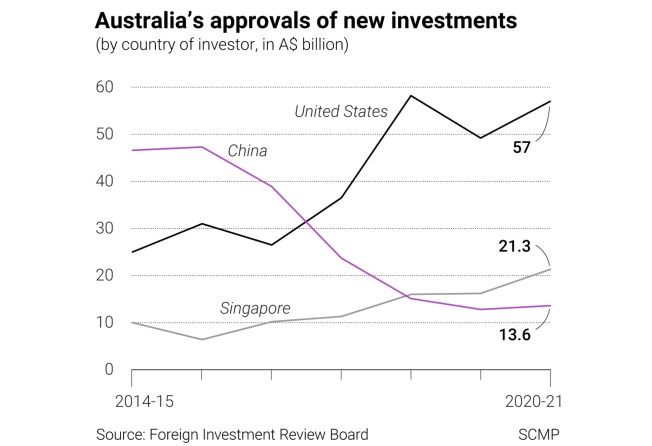

Chinese investments in Australia have risen slightly despite a years-long slowdown and deteriorating bilateral relations between the two countries, while yearly approvals of US investments Down Under continue to rise, nearly doubling from five years ago, new data shows.

In 2020/21, the US had the highest number of investment approvals by Canberra, a position once occupied by China.

Singapore has quietly overtaken China in securing investment approvals in Australia and was in second place – with A$21.3 billion approved – with China in fourth place.

Nearly A$14 billion of that figure from Singapore was for property, reflecting “significant growth in the value of proposed investment for Singaporean investors in the real estate sector”, the Australian Foreign Investment Review Board said.

The Board’s data shows Canberra approved A$13.6 billion (US$10 billion) in investments from China in the financial year ending June 2021, a slight uptick from A$12.8 billion the previous year.

While the figures pale in comparison to the A$47.3 billion approved during the height of Chinese investments in Australia around 2015/16, the fall in Chinese businesses’ interest in investing in Australia appears to have stabilised in 2020/21.

Chinese investment approvals began falling around 2015/16 mainly because of Canberra’s financial restrictions on property purchases, its tightening of foreign investment laws and China’s control of capital outflow.

“The last couple years have taught us that Australia-China trade is less affected by political tension than perhaps previously realised,” said James Laurenceson, Director of the Australia-China Relations Institute at the University of Technology Sydney.

“The economic drivers that caused businesses and households to want to engage in the first place haven’t disappeared.”

He said investment was sensitive to geopolitical factors but “these new numbers show that Australia’s overall risk profile and the returns on offer still tick the box for many Chinese investors”, including in agriculture, finance, manufacturing, mining and real estate.

That said, “some assets like critical infrastructure are now off the table”.

In terms of total existing investments (rather than new money going in), the US remains Australia’s top foreign investor followed by the UK, according to the Australian trade department.

The US’s direct ownership of Australian assets is about A$1 trillion (US$746 billion), and the figure for the UK is around A$700 billion. Chinese investments sit in ninth position in this category, at about A$80 billion. Singapore ranks higher than China as a foreign investor, with nearly A$120 billion in investments.

Whether some funds flow through intermediaries like Singapore or Hong Kong, generally the investment board traces through the layers of ownership to determine the original source of investment.

Approvals do not necessarily mirror actual investments, although they do reflect the appetite of investment from investor countries.

For example, while US investment approvals have increased over the years, actual investments fell in 2019 and 2020 due to issues including a pandemic-driven downturn in global investment and more competitive US tax settings, said Stephen Kirchner, United States Studies Centre’s director of international economy.

The same can be said for Chinese investments. The latest annual assessment of actual Chinese deals by KPMG and the University of Sydney showed Chinese investments fell nearly 27 per cent in 2020 taking “Chinese direct investments in Australia back to pre-mining boom investment levels of 2007”.

For new approvals in 2020/21, nearly half of the Chinese interests in Australia were in the real estate sector, particularly commercial property. The rest of the approvals were spread fairly evenly across sectors such as finance and insurance, mining, and agriculture.

Chinese interest in residential real estate has waned over the years after Canberra cracked down through the likes of higher taxes and application fees.

The cooling deepened after China called time on capital outflow putting a stop on the transfer of cash from mainland China into property in Australia.

The slowdown in Chinese interests continued amid recent sweeping reforms to Australia’s foreign investment laws and direct moves by Canberra to block some transactions. These included attempts by Chinese buyers to purchase Australia’s massive Kidman cattle empire and New South Wales electricity provider, Ausgrid – the nation’s biggest energy grid – around 2015 and 2016.

Since January last year, Australia’s reforms introduced “national security” tests to business and land acquisitions by foreign investors and also allowed the government to review transactions that previously did not require approval.

In 2020, there was also speculation in Australia and China that some of these reforms targeted Chinese investors, prompting Beijing to caution Canberra to be “fair and non-discriminatory”.

For newly-approved US investments in Australia in 2020/21, most were for commercial real estate and services although the investment board did not provide details on the type of services.

Additionally, Australia has approved major transactions for American investors, approval previously denied to Chinese ones.

Late last year, Canberra approved American private equity giant Kohlberg Kravis Roberts and the Ontario Teachers’ pension fund’s A$5.2 billion purchase of Spark Infrastructure, which owns about 50 per cent of Victoria state’s electricity distribution operators Powercor and CitiPower. But China’s earlier attempt to buy Ausgrid, for example, was denied.

Canberra also granted US investment firm Blackstone’s purchase of the nation’s largest gaming and entertainment group Crown Resorts last month.