Three clues to reading the Chinese economy’s fortune in 2017

As planners set new-year priorities, next year promises even smaller growth

With the end of the year just around the corner, crystal ball-gazing season is upon us when it comes to how the Chinese economy will perform in 2017. The outlook is unlikely to be very appealing.

For this year, economists expect the economy to grow at 6.7 per cent, down from 6.9 per cent in 2015, another slowest annual economic growth rate in a quarter of a century.

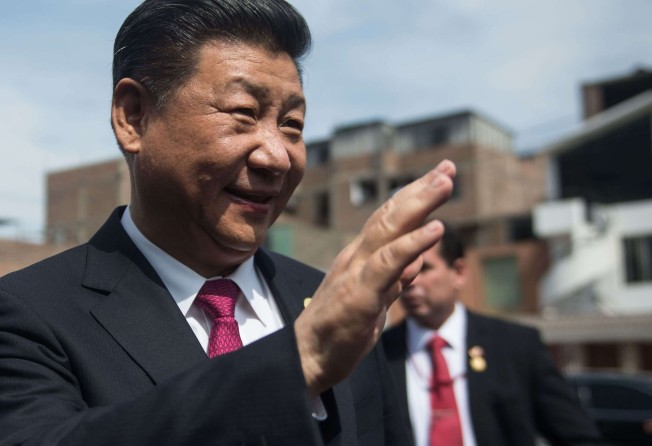

And the worst is yet to come. Many now expect economic momentum to weaken further in 2017 with the growth rate moderating to about 6.5 per cent, perhaps the lowest level the Chinese authorities could tolerate. President Xi Jinping has said China must keep annual average growth of at least 6.5 per cent over the next five years to hit a goal of doubling gross domestic product and per capita income by 2020 from 2010 levels.

Admittedly, since soon after coming to power in late 2012, Xi has preached that the mainland economy has entered “a new normal” where the growth rate would slow to a single digit in the years to come after decades of double-digit growth. And deeper reforms were needed, he said, to move to a consumption-based economy from the reliance on the traditional engines of debt-fuelled investments and exports.

But adjustments to this new normal have not been easy. If predictions are right, the growth trajectory will be L-shaped over the next few years, meaning that – as consumption will not be strong enough to take up the slack – the government will have to rely on state investments to cushion the slowdown. And next year is crucial for the government to find a floor to ensure economic growth doesn’t fall below 6.5 per cent.

The country’s economic planners are expected to hold their annual Central Economic Work Conference in the next few weeks, a closed-door meeting where they discuss and approve policy priorities and key economic growth targets for the year ahead.

Investors read the statement released after each of these meetings keenly, and study the wording for clues on the direction of the world’s second largest economy.

Here are some key words to watch for at the upcoming meeting.

First, the two words “proactive” and “flexible” will continue to guide China’s fiscal and monetary policies as they have done over the past few years. Already, state media has begun to suggest that the government will continue to expand its fiscal deficit and pursue deeper tax cuts to help struggling businesses in traditional industries.

Second, there will be more talk of “reform”. There is little doubt that leaders at the upcoming meeting will pat themselves on the back for achieving a respectable, albeit slower, growth rate against “complex international and domestic situations, and downward pressure” and vow to accelerate the “supply-side reforms” to help generate new growth engines while cutting industrial capacity and property inventories.

But some serious questions remain over the pace and effectiveness of those reforms for the year ahead, after the mixed results so far this year – and because China will enter the final stretch of its own political cycle next year.

At the same meeting last year, the authorities made “supply-side reforms” the main priority for this year, identifying the iron and steel industry and the coal industry as key sectors for sharp cuts in excess capacity.

By July, less than 50 per cent of the targets in those two industries were met, prompting the central government to send inspection teams to force local officials to comply.

And by October, the officials announced confidently that those targets would be met by the end of the year, as about 80 per cent of the targets had been met by the end of September.

But mainland media reported that those figures were manipulated to include those capacities which were long obsolete and should not have been counted.

And officials had forced the cuts indiscriminately through administrative orders, further heightening concerns about the role of the government in the micromanagement of the economy at a time when it has promised to allow market forces to play a decisive role.

More importantly, China has already started the leadership changes from townships to provinces nationwide from this year. These will culminate in changes in most top posts at the Communist Party’s 19th Party Congress scheduled for some time in autumn next year. The massive personnel changes are likely to affect the pace of reforms.

Third, financial risks and yuan. Guarding against financial risks will become a higher priority for next year. Donald Trump’s presidential election win and expectations that the Federal Reserve will raise the interest rate have combined to make the US dollar stronger and exert further depreciation pressure on the yuan.

This has led to massive capital outflows from China, prompting the country’s central bank to intervene heavily in the past few weeks.

Chinese leaders have always maintained that the country’s strong economic fundamentals don’t allow for a sharp fall in yuan, but they are under rising pressure to allow the yuan to depreciate further in smaller doses.

On Tuesday, Yu Yongding, a former adviser to the People’s Bank of China, wrote in official media that the central bank should stop intervening to support the yuan and allow it to depreciate more quickly before Trump’s presidency begins in January.

Wang Xiangwei is the former editor-in-chief of the South China Morning Post. He is now based in Beijing as editorial adviser to the paper