01:20

Tesla starts delivery of made-in-China cars

BATTERY WARS

Inspired by his grandfather’s passion for airborne personal transport, Akio Toyoda, Toyota’s current president, has not just inherited the world’s largest car company but also his grandfather’s vision – to make cars fly.

Flying cars already exist, but they resemble something more like a helicopter designed by committee rather than a levitating DeLorean. If such machines are ever to go from a curiosity to a commercial success, they must be able to fly a useful distance as well as look desirable – something Toyoda is keenly aware of.

This, in part, is what three years ago started a war between Asia’s battery manufacturers in Japan, China and Korea; to greatly improve the current battery products for electric vehicles (EVs) and explore personal aerial mobility.

Japan lost its pole position as battery developer and supplier around 2017-2018, and has also been lagging in electric car design, self-driving car technology and large commercial drones – the forerunner to flying cars and trucks. Something had to be done to rebuild the industry, and the Japanese government decided it would be best to start with a fundamental component: developing a much better battery.

01:20

Tesla starts delivery of made-in-China cars

THESE ARE NOT THE BATTERIES YOU ARE LOOKING FOR

Electric vehicles have been around since the late 1800s, and rose to great popularity by the early 1900s when nearly 40 per cent of automobiles driven in the United States were powered by electricity. The rest were powered by steam and noisy, smelly gasoline. Sales peaked in 1910 as gasoline-powered cars improved in efficiency and range, which helped them rise to the prominence they have today.

The development of lithium-ion (Li-Ion) batteries in the 1980s, commercialised by the Japanese firms Sony and Asahi Kasei, made possible electric cars that could rival petrol driven cars for distance, but they were still bulky. Weird-looking electric cars accommodating huge battery banks were often seen as concept cars at motor shows, but were never something you would want to be seen in, even if you could buy one. It took Elon Musk and Tesla to fix that.

As part of Musk’s core strategy with Tesla, once battery storage density went up sufficiently, battery packs could be buried in the floor of a vehicle and newly designed, powerful, compact and simple drivetrains allowed for decent space inside the car. This gave designers the opportunity to swap goofy looks for sleek lines, and short-range travel for something approaching consumer expectations. This is why the rebel sports saloon Tesla Model S does not look out of place alongside an Aston Martin Rapide or Maserati Quattroporte, and the insane acceleration possible in all of them attracts similar-minded saloon car buyers.

If Toyoda is ever to see a car levitate from one of his factories, Toyota’s strategic investment in battery development and the funding of airborne car start-ups will need to pay off. The first part of that, the battery investment, is about to be realised as Toyota Motor is poised to reveal a monumental transition in energy storage for personal mobility by being the first company sell a car to powered by solid-state batteries with a prototype to be unveiled in 2021.

This will be a game changer for electric car development.

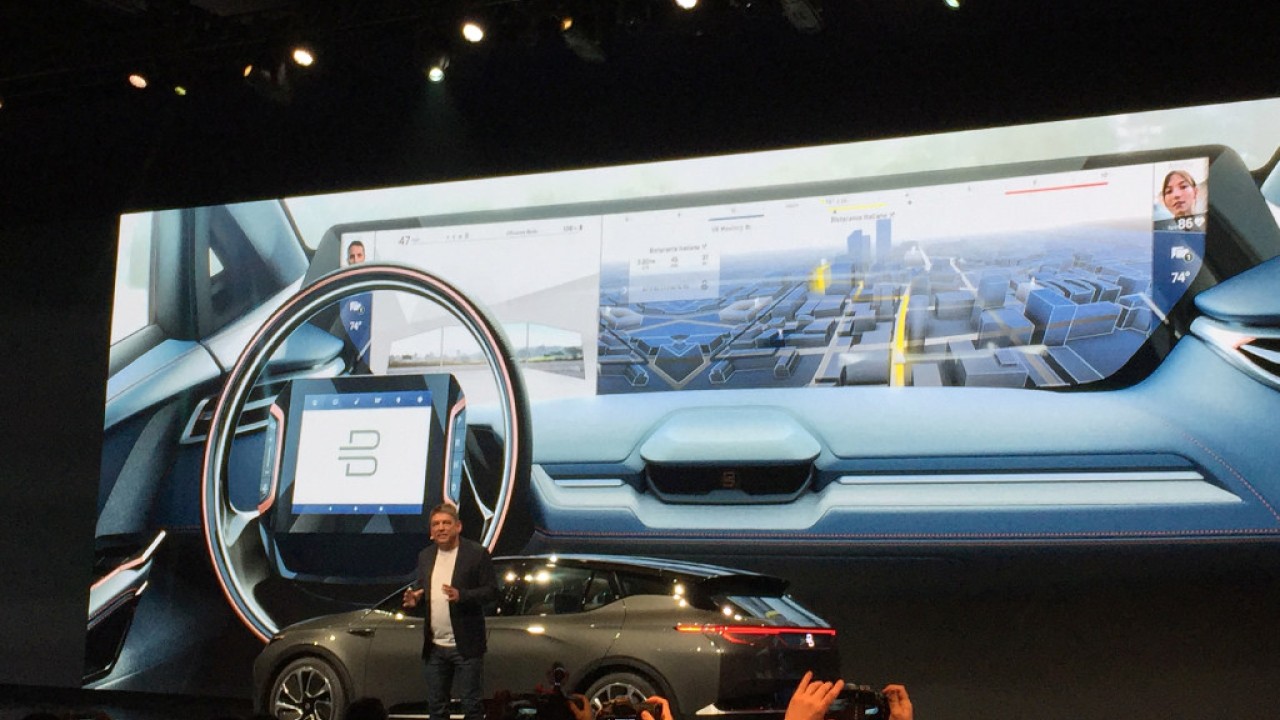

01:03

China-backed Byton woos CES with electric car that's almost half the price of a Tesla

“OH YEAH, WATCH THIS!”… “WATCH WHAT?”

Li-Ion batteries with liquid electrolytes have become ubiquitous in the modern world, powering everything from my laptop to that Tesla I drool over. Moving to Li-Ion batteries with a solid electrolyte has benefits that are easy to understand, even if the chemistry isn’t: multiples more power stored in a cell that charges in the fraction of the time of the batteries we use today. The fact that they won’t swell up and burst into flames is also a good selling point.

The constituents of solid-state Li-Ion batteries are largely the same as the liquid batteries we use today, so there will not be a sudden shift away from lithium as the major raw material. Lithium prices have been in a long, slow decline over the past three years and the introduction of this new technology may finally soak up the oversupply and cause prices to rise again.

With increased power density, range anxiety for electric car owners as the power fades just when you need it will be a thing of the past. And it will also provide additional juice for additional power hungry air-conditioning and heating in extreme climates.

THE ALLIANCE

Before the launch of Tesla’s pretty roadster in 2008, Japanese automakers saw the changing winds in the industry and made alliances with battery manufacturers to ensure supply. Tesla also joined forces with Panasonic to produce batteries. Nissan looked to NEC to supply batteries for its EVs, and with Sony, TDK and Asahi Kasei the technology leaders in the mid-2000s, the pieces were in place for Japanese companies to supply the electric car industry globally.

However, the Japanese dominance slipped in the following decade as Chinese and Korean firms ramped up production of Li-Ion batteries. By 2018, China alone had 60 manufacturers supplying Li-Ion cells, and they were on target to meet 70 per cent of the world’s demand. Firms such as Renault, VW, BYD, Hyundai and Audi – the bestselling electric car brands outside Tesla, Nissan or Mitsubishi – avoided the Japanese.

The Japanese government decided to reverse this trend and spearheaded an initiative by its New Energy and Industrial Technology Development Organization (NEDO) which includes Toyota, Nissan and Honda. The car makers, along with 20 manufacturers of batteries and chemicals including Panasonic, GS Yuasa and Asahi Kasei, closed ranks to reassert Japanese dominance in EV batteries though the accelerated development of solid-state technology.

01:25

Shocking moment Tesla Model S explodes in a Chinese car park

USING THE FORCE

Now that solid-state batteries allow for a 500km trip on a single charge, can recharge in 10 minutes, and have none of the safety concerns that plagued BYD and Tesla in their early years, the global development and adoption of EVs is likely to accelerate as rapidly as Tesla’s curvy new roadster.

Further down the supply chain, this will have knock-on impacts for auto material suppliers, the chemical companies that will make the solid electrolytes, and the mining firms that supply lithium.

Demand for lithium is likely to rise, as will demand for other metals, in particular copper which is extensively used in electric and self-driving cars. The Japanese government is promoting a new US$19 billion fund for investment in decarbonising technologies, and there will also be government help in sourcing lithium in the near term.

More countries are likely to jump on the carbon-neutral bandwagon, and have a higher chance of actually achieving it. High-capacity solid-state batteries will make it easier to store energy generated by renewable sources, so the talk of switching electric grids to alternative energy will no longer just be political lip service.

And as for those flying cars? We were supposed to see some at the Tokyo Olympics this year thanks to Toyota’s investment, but it never happened with the games postponed. But with start-ups popping up around Asia, and some early flying taxi demonstrations out of China as well as the partnership between Aston Martin and Rolls-Royce to develop a low-altitude aerospace business, the Japanese are going to have to step on it there too.

Neil Newman is a thematic portfolio strategist focused on pan-Asian equity markets