Genting Hong Kong’s demise leaves Malaysian banks – and its government – facing US$600 million question

- Finger pointing in parliament as opposition leader Anwar Ibrahim raises spectre of the Bumiputra Malaysia Finance scandal of the 1980s

- With Najib Razak and finance minister Tengku Zafrul Abdul Aziz also wading in, the issue has become a political hot potato ahead of Johor’s upcoming snap election

The troubles at soon-to-fold cruise operator Genting Hong Kong have emerged as an issue of contention in Malaysia’s tumultuous politics, with the opposition and government sparring over whether its liquidation will hurt local banks that had lent it hundreds of millions of dollars.

The opposition leader Anwar Ibrahim last week queried finance minister Tengku Zafrul Abdul Aziz on a report by The Straits Times that said Maybank, RHB Bank and CIMB were among the “chief unsecured creditors” of the firm, with a combined exposure of US$600 million.

The Singaporean daily quoted an unnamed senior banker from one of the three banks as saying that Genting Hong Kong’s troubles were going to be “painful, particularly after most banks had a good [financial year] in 2021”.

The report said other creditors involved included Singapore-listed Oversea-Chinese Banking Corp, BNP Paribas and Credit Agricole.

With the Malaysian government’s status as the biggest shareholder of the three local banks – through the investment vehicle Permodalan Nasional Berhad – Anwar queried how a “gambling company” was able to obtain unsecured loans from the lenders.

The veteran politician, a former finance minister, raised the spectre of the Bumiputra Malaysia Finance scandal of the 1980s, in which a state-backed lender suffered billions of ringgit in losses after providing loans to companies with vague track records.

In response, the finance minister on Saturday fired back, saying Genting Hong Kong had also secured loans from foreign banks.

“Is Datuk Seri insinuating that all these foreign banks have also been negligent in lending to Genting Hong Kong?,” the finance minister wrote on Facebook on Saturday, using Anwar’s honorific title.

“Decisions to give loans are not determined by the finance minister, the Ministry of Finance, or [the banks’] shareholders but by the banks themselves,” he said. “Every bank has its own due diligence process and credit assessment by their respective credit committees, to assess the borrowers’ ability to repay the loans.”

Finger pointing

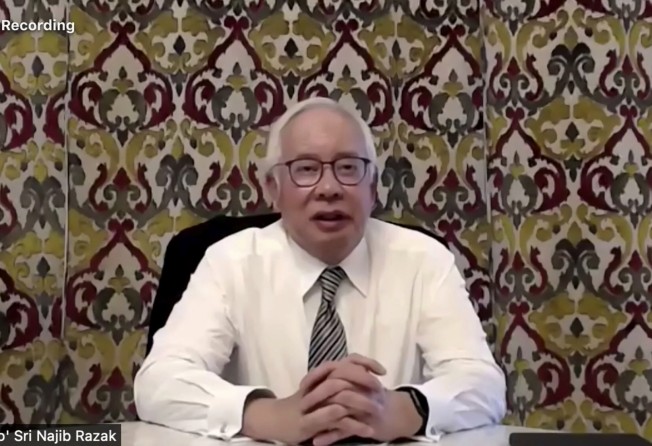

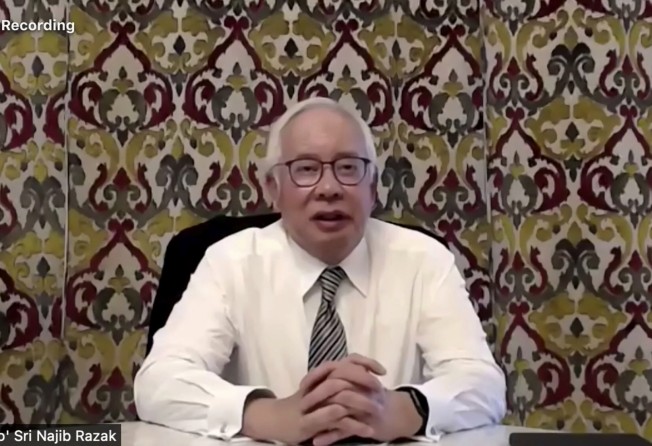

Also wading in was Najib Razak, the scandal-haunted former prime minister who concurrently served as finance minister during his stint in power from 2009-2018.

Rebutting online commentary that he said had pinned blame on him for the provision of the loans, Najib too said he played no part in the decision-making process.

He suggested Finance Minister Zafrul, the chief executive of Maybank Investment Bank from 2010 to 2013, would have better answers as he was the loan’s lead arranger.

The political sniping comes as regional investors continue to digest the implications of Genting Hong Kong’s imminent demise.

The firm is majority owned by the Malaysian billionaire Lim Kok Thay, whose sprawling Genting empire comprises casinos in Singapore, Malaysia, Las Vegas as well as ventures in plantation, real estate and energy.

Lim is the second son of the Genting group’s founder Lim Goh Tong, and founded Genting Hong Kong in 1993 as a means to diversify from the company’s initial leisure and gambling focus.

Genting Group and its unit Genting Malaysia in 2016 fully disposed of their stakes in Genting Hong Kong, and the cruise operator is currently 76 per cent owned by Lim.

Genting Group, Genting Malaysia and Genting Singapore have no cross shareholding except for Lim being a common stakeholder in all four.

On January 18, Genting Hong Kong said it was appointing provisional liquidators after exhausting “all reasonable efforts” to negotiate with its creditors and stakeholders.

Lim over the weekend said the decision to liquidate the company was driven by the newly installed German government’s decision to walk away from a previously signed pact to provide a US$620 million credit line to Genting’s ship building unit.

Officials in the government of Chancellor Olaf Scholz – who succeeded Angela Merkel in December – in turn blamed Genting for the saga, saying the firm turned down a loan of 600 million euros (US$670 million) on condition of providing an additional 60 million euros plus guarantees.

Azmi Hasan, a senior fellow at the Nusantara Academy for Strategic Research think tank, said opposition leader Anwar’s concerns were valid. He suggested the issue had the potential of snowballing and emerging as a political hot potato ahead of an upcoming snap election in the state of Johor.

“Genting is synonymous with the gambling industry and for banks with links to the government issuing loans without collaterals to a company in such nature of a business can be a very sensitive issue in Malaysia especially to the Muslim voters,” Azmi said.

“Whether the anger or frustration will be directed at these banks only or to the federal government during the state election is something that needs to be observed because there is no indication on how the campaign will take place and how the opposition will ‘use’ this particular issue.”

Professor Edmund Terence Gomez, a political economics professor at the Faculty of Economics and Administration at the University of Malaya, said his focus was on the longer term structural issues surrounding the unsecured loan issuance to Genting Hong Kong.

He questioned the need for the government-linked banks – controlled ultimately by the government through stakes held via pension funds and other savings institutions – to grant unsecured loans in the first place.

A key question was whether the Genting brand’s “well-connected” status in the country affected the Malaysian banks’ due diligence processes, Gomez said.

Maybank, one of the three banks named by The Straits Times, said last week that it had “a rigorous asset quality monitoring process, whereby vulnerable borrowers are identified and managed accordingly from the onset of any potential asset quality weakness”.

“Maybank would like to state that our current net credit charge of guidance for loan provisioning remains unchanged and we can confirm that our financial position remains strong,” the bank said.

Zafrul’s cabinet colleague Azmin Ali – minister for international trade and industry – has also pushed back against suggestions that the situation surrounding Maybank could affect the country’s financial health.

“So far, based on the statement given by Maybank, it has no impact on our liquidity and I think [the central bank and the Ministry of Finance] will take some measure to ensure that the liquidity in the country will remain strong,” Azmin said last Thursday.

Additional reporting by Bloomberg