Homelink, China’s biggest property agent, closes 87 branches in Beijing as buying curbs bite

Transactions handled by the agency tumbled 77 per cent in April amid tight restrictions on mortgage lending and sales of ‘commercial flats’

China’s largest property agency, Homelink, confirmed on Tuesday that it has closed 87 branches in Beijing, underscoring the depth of the city’s real estate market woes after unprecedented government tightening.

The company, which recently attracted China Vanke as an investor, said in a statement that it had shut the outlets after a fourth straight week of falling business in the wake of the harshest purchase restrictions in the capital’s history. Previous reports said Homelink would shut down 300 stores across Beijing. The agent did not say how many more stores it plans to close.

“Our stores’ business has dropped about 70 per cent since the curb, as we can’t sell [commercial] apartments now,” said Zhang Meng, a Homelink agent in Beijing, referring to flats in buildings that were originally designated for commercial use. “Now we handle nearby ordinary homes, which other stores also do. Competition is fierce and no single home was sold through my hands.”

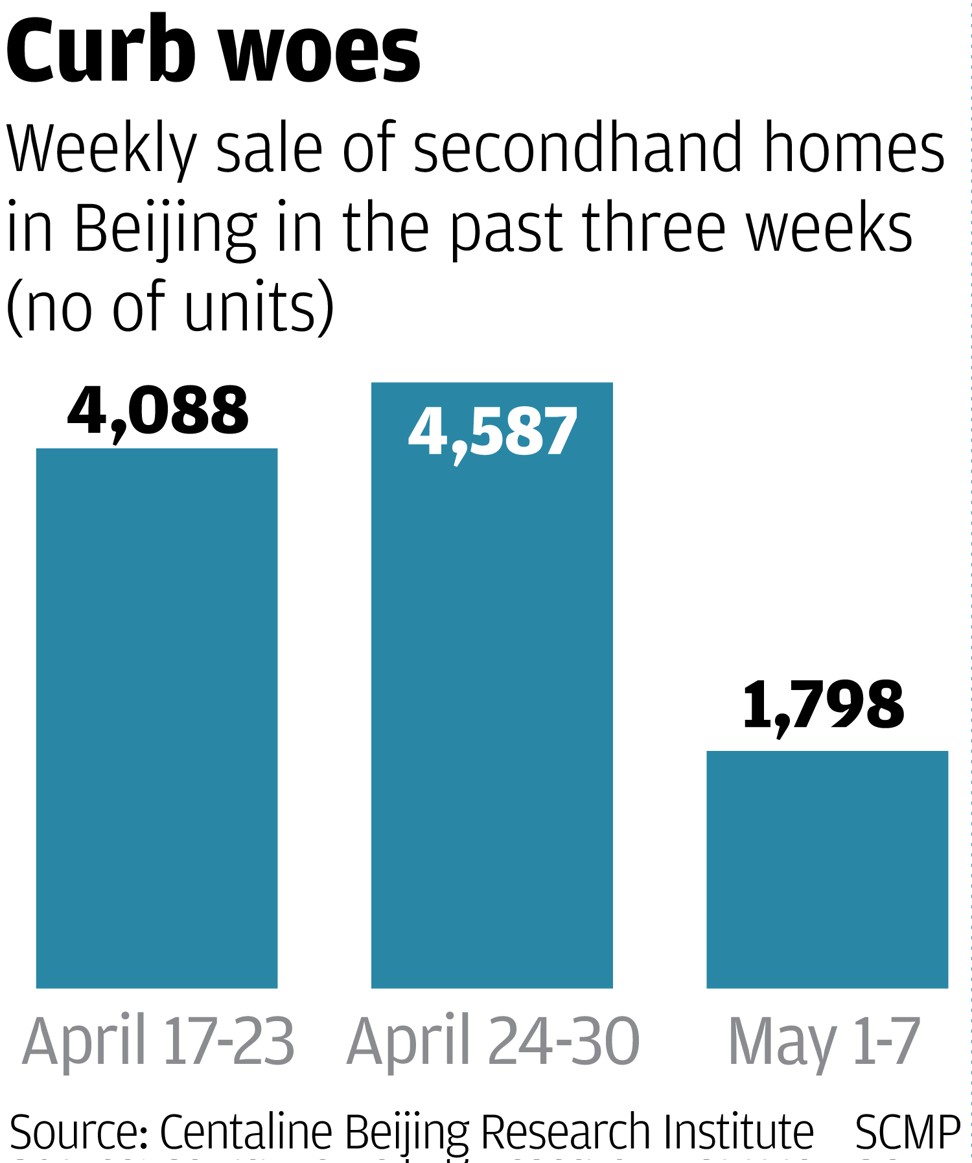

Beijing has launched a spate of curbs targeting sales of new homes, pre-owned homes and so-called ‘commercial apartments’ since March 17. The intensity of the restrictions surprised even industry insiders.

Second-time buyers of most homes in the city now have to pay a minimum of 80 per cent of the property’s value out of their own pockets, while buyers with any mortgage history – even having paid off their debts – no longer enjoy the “first-time buyers” status they were previously granted.

Nine days later, the local government banned the sale of apartments built on land meant for office or retail use to individuals, and ordered agents to stop listing them. The converted units had become an increasingly popular product catering to buyers who found themselves barred by the previous restrictions.

‘School district homes’, another previously red-hot product that saw prices double in just six months because of their proximity to prestigious schools, were dealt a heavy blow when governments announced new rules that made automatic eligibility for school admission through ownership uncertain.

The government crackdown on commercial flats hit Homelink hard, as it banned agents from listing them either for sale or lease. Homelink said it had closed 44 of its outlets for that reason alone.

Beijing Pixel, the largest commercial apartment project in the city, saw all 20 of its agents’ outlets closed, with some converted into convenient stores.

Today’s confirmation of the closures comes just three weeks after China Vanke announced it would pay 3 billion yuan (US$435.6 million) for an undisclosed stake in Homelink, betting on the huge growth potential of China’s pre-owned home market. The Post reported earlier that the valuation for the company may be excessively high as investors ignore inherent risks in the sector.

The downturn has also hit Shanghai. New home sales in April fell 8.8 per cent from a month prior, and sales of secondary homes slumped 20.6 per cent, according to Homelink data. Turnover there was the lowest since 2012.

Vanke, the mainland’s second-largest homebuilder, saw contracted sales growth slow sharply to 17.5 per cent in April, from 89 per cent expansion in the previous month. Vanke has a national presence that caters to the mass market, so its monthly sales are closely followed as a barometer of the market.

Transactions were dampened by the looming prospect, starting from May 1, of banks in Beijing cancelling their discounted lending rate for first-time homebuyers, and raising the mortgage rate for second-home buyers to 20 per cent above the benchmark.

Major banks in Guangzhou also dropped the preferential rate for first-time buyers. The pessimistic outlook has dented stock prices of most developers, with the Shenzhen Stock Exchange properties index losing 9 per cent in the past month.